2024-12-5 01:46 |

The United States government recently transferred 19,800 Bitcoin (BTC) worth approximately $1.92 billion to a Coinbase Prime wallet. This sparked fears of a potential sale around crypto circles, with traders on high alert. The assets moved to Coinbase constitute part of the Silk Road seizures.

In 2022, the United States Department of Justice (DOJ) seized over 50,000 BTC obtained from the Silk Road dark web.

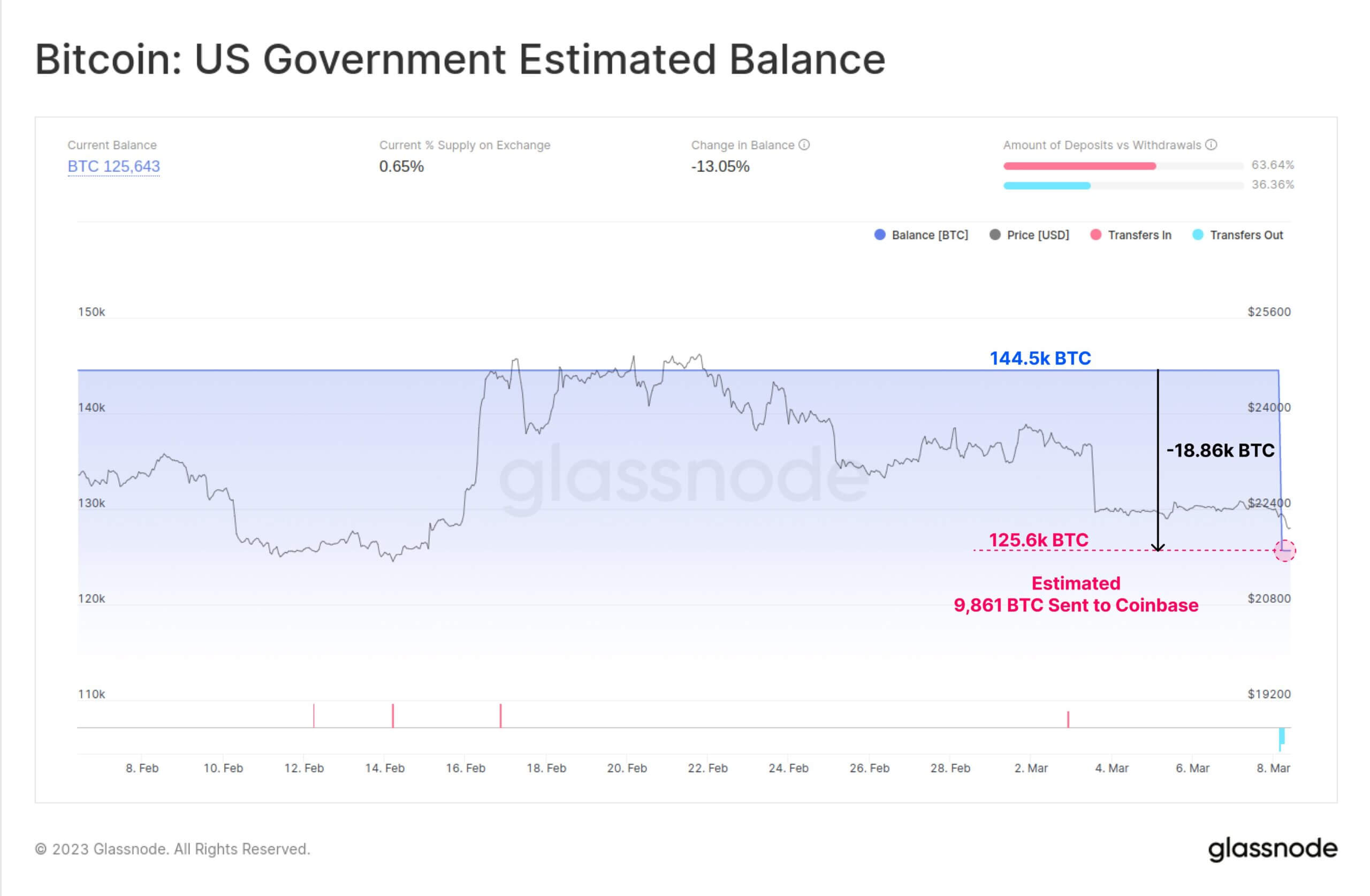

On-chain Analysts Flag TransfersData from on-chain crypto from Arkham Intelligence showed the transfer split into two wallets. The government moved $969 million to the first wallet, while $949 million was sent to the second address. The government’s wallet now holds 188,303 BTC, which is currently worth $18.2 billion.

The transfer sparked sell-off concerns among market participants. This is because asset movement to centralized exchanges often signals a potential sale while transfers to other custodians point to a long-term holding strategy. A similar situation occurred in July which led to a a market plunge. Specifically, the US government sold 29,799 BTC and the asset’s price plunged 24% as a result.

“A transfer of such a large amount of Bitcoin to an exchange, especially Coinbase Prime, often signals an intent to sell or distribute. This can create bearish sentiment as market participants anticipate increased supply. When the U.S. Government sold 29,799 BTC on July 29, 2024, the market experienced a sharp price drop, with Bitcoin losing over 24% in value. Such large-scale government sales typically create significant selling pressure,” crypto analyst Amr Taha noted.

Bitcoin Price FallsThe impact of the US government transfers has been felt in the market, as they wiped off efforts at a price recovery. Bitcoin’s price plunged 2.3% to trade at $95,568 as traders continue to monitor the situation. The market leader influences the wider market and might re-ignite, leading to a rally in altcoins.

This was seen in the last meme coin frenzy, as prices moved after huge inflows to BTC. Meme coins are largely influenced by community rallies on social media spaces, among other things. In the last 24 hours, top meme coins have also recorded outflows like Bitcoin; however, new assets posted much larger outflows.

origin »Bitcoin price in Telegram @btc_price_every_hour

eToro United States Dollar (USDEX) на Currencies.ru

|

|