2019-6-20 14:22 |

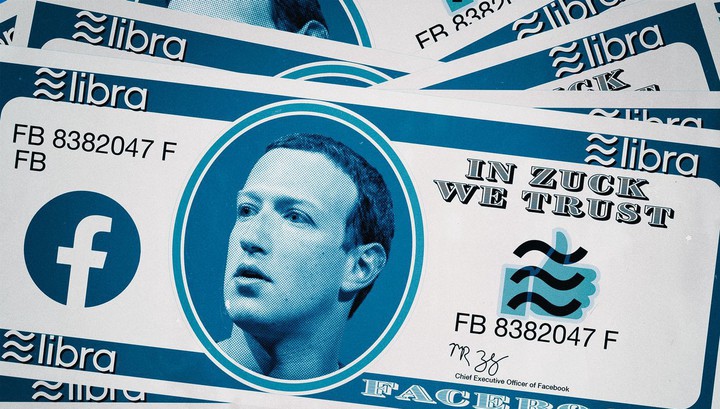

That didn’t take long – from India, to the US and Europe, regulators are pushing back against Facebook’s Libra cryptocurrency plans.

Within a heartbeat of the Libra cryptocurrency announcement, the world’s regulators began signalling: hey not so fast Zuck.

It’s one thing to tell the world about a global money launch, but quite another to get it out of the door.

Facebook’s problems are not so much in its particular brand of blockchain (or not blockchain) so much as the considerable roadblock presented in the form of the global financial regulators and central banks.

But you also get the feeling that the financial authorities are behind the curve on crypto and we are at a wake-up call moment.

Financial Action Task Force coming after Facebook’s Libra and all crypto

After much chatter about how to regulate crypto on Friday (21 June) the G7’s Financial Action Task Force (FATF) will present its full recommendations for regulating “virtual asset service providers” (VASPs).

The rules have all been finalised with the exception of the part about requiring Vasps to record the identity of senders and receivers of cryptoasset, which it was consulting on.

Presumably the bank-wire type rules will be included in the published recommendations on Friday, despite the objections of those lobbying on behalf of the crypto industry.

That being so, the new rules could be a particularly onerous and expensive to comply with for crypto firms, especially regarding transactions involving so-called privacy coins such as Monero (XMR), Dash (DASH), Verge (VXG) and Zcash (ZEC) but also with “ordinary” pseudonymous coins such as bitcoin.

It all comes to a head on 28 June at the G20 meeting in Osaka, Japan, when the financial regulators will have their own gathering running alongside that of the political leaders.

There could be some market-impacting news coming out of those deliberations.

But let’s get to the responses from the financial powers that be to Facebook’s Libra.

US Senate Banking Committee and House Financial Services Committee to both hold Libra hearings

In the US Facebook’s are turned out to be a red rag to a bull.

First out of the blocks was the chair of the House Financial Services Committee, Rep. Maxine Waters who said her body would conduct hearings on the social media giant’s plans. She called on Facebook to immediately cease any further work on the project.

“With the announcement that it plans to create a cryptocurrency, Facebook is continuing its unchecked expansion and extending its reach into the lives of its users. The cryptocurrency market currently lacks a clear regulatory framework to provide strong protections for investors, consumers, and the economy,” Waters said in a written statement.

Activity on the US Capitol didn’t stop there.

The Senate Banking Committee has let it be known that it will begin a hearing on Libra starting on 16 July.

According to Reuters, the committee had asked Facebook for details about the project in May.

Jerome Powell high expectation on “safety and soundness” for Facebook’s Libra

And yesterday the chair the of US Federal Reserve Jerome Powell was asked about Libra in his press conference following the sharing of thoughts on interest rates and other matters that came out of the two-day policy meeting.

Asked if cryptocurrencies might impact monetary policy, Powell said “we are a long way from that”. He noted that Facebook had done “quite broad rounds around the world with regulators, supervisors and lots of people to discuss their plans and that certainly includes us.”

He see the benefits of the that could have “large application” but has high expectations from a safety and soundness and regulatory standpoint”. In his remarks he was saying he was echoing what Bank of England governor Mark Carney had already said, which we will come to shortly.

Staying with the US, hostility to crypto in Congress was in evidence last month when Rep. Brad Sherman said bitcoin and other crypto should be banned.

His reasoning is that crypto could undermine the dollar and therefore the economic power of the US: “An awful lot of our international power stems from the fact that the dollar is the standard unit of international finance and transactions… it is the announced purpose of the supporters of cryptocurrencies to take that power away from us.”

Bank of England’s Carney demands “highest standards” for Libra

Over at the Bank of England, governor Carney, told the FT that regulators will need to be all over Libra like a rash.

Although he is “an open minded” about the project and sees the benefit of its promised “free and instant” payments. He said the authorities will need to look at it “very closely”.

Precisely because it would be likely to be on an exponential adoption is Carney’s implied thinking, it will need to be “subject to the highest standards of regulation”.

In a shot across Mark Zuckerberg’s bow, he said a launch would not be greeted with an “open door” by regulators.

Carney said the Bank of England will be working with the G7 group of leading industrial nations, the Bank of International Settlements, sometimes referred to as the bank of the central banks and the Financial Stability Board, which Carney chaired shared until last year .

French finance minister lashes out against Libra

Staying in Europe, French finance minister Bruno Le Maire is calling for central banks to look into Facebook’s plans, warning that it could become a “sovereign currency” and that this “must not happen”, he said in an interview aired by Europe1 radio. Read more on this in the EWN reports here.

German European Parliament members warns on Facebook “shadow bank”

German European Parliament member Markus Ferber said Facebook’s Libra “set off alarm bels for regulators” and he worried that Facebook could in effect become a “shadow bank”.

Ferber sits on the parliament’s important Economic and Monetary Affairs committee.

Staying in continental Europe, Europe’s privacy chief, Giovanni Buttarelli the European Data Protection Supervisor told Business Insider that “any further concentration of personal data poses additional risks to the rights and freedoms of individuals — so the proposed launch of a digital coin (cryptocurrency) by Facebook will require careful scrutiny from several enforcement bodies, including data protection authorities”.

The European Union has the toughest privacy rules among the major economic blocs, enshrined in the General Data Protection Regulation (GDPR).

India says no to Facebook LibraElsewhere things are looking too good either.

India, which Bloomberg reported last year was a key target for Facebook’s crypto ambitions with its high number of unbanked individuals, is not playing ball.

The usually well-informed Indian business news outlet The Economic Times, reported: Libra, the cryptocurrency to be unveiled by Facebook next year, will not be available in India, according to a person directly in the know, as current regulations do not permit use of the banking network for blockchain currency transactions.

Mark Zuckerberg explicitly mentioned the 1.2 billion unbanked people around the globe as the core initial target audience.

The unnamed person in the report is quoting saying: “Facebook has not filed any application with RBI (Reserve Bank of India) for its cryptocurrency in India.”

However there has been no response from the Indian central bank and a Facebook spokesperson told ET “We expect Calibra to work on WhatApp and be available globally’”

Facebook is going to need to go on a hiring spree for lobbyists for each of the jurisdictions it is looking to bring the service to.

Do you think Facebook’s Libra will get off the ground or be killed at birth by regulators? Leave a comment

The post Facebook Libra Regulatory Pushback Building in India, US and Europe appeared first on Ethereum World News.

origin »Bitcoin price in Telegram @btc_price_every_hour

Libra Credit (LBA) на Currencies.ru

|

|