2019-3-12 11:50 |

CoinSpeaker

Facebook Coin Could Bring $19 Billion Additional Revenue, Believes Barclays

Facebook is reportedly developing a cryptocurrency that could be part of a multibillion-dollar revenue opportunity, Barclays internet analyst Ross Sandler said in a note to clients Monday.

Sandler forecasted as much as $19 billion in additional revenue by 2021 from “Facebook Coin.” Conservatively, the firm sees a base-case of an incremental $3 billion in revenue from a successful cryptocurrency implementation. He said:

“Merely establishing this revenue stream starts to change the story for Facebook shares in our view.”

In his forecast, Sandler pointed out that the crypto-based revenue option is something “sorely needed at this stage of the company’s narrative,” stressing that any advertising-free revenue streams are likely to be well-perceived by Facebook’s shareholders.

The vision of a customized separate currency within the platform is not new. We already wrote of how Facebook plans to use its crypto token for in-app payments across its suite of applications. The Facebook Coin will be a stablecoin pegged to three different fiat currencies.

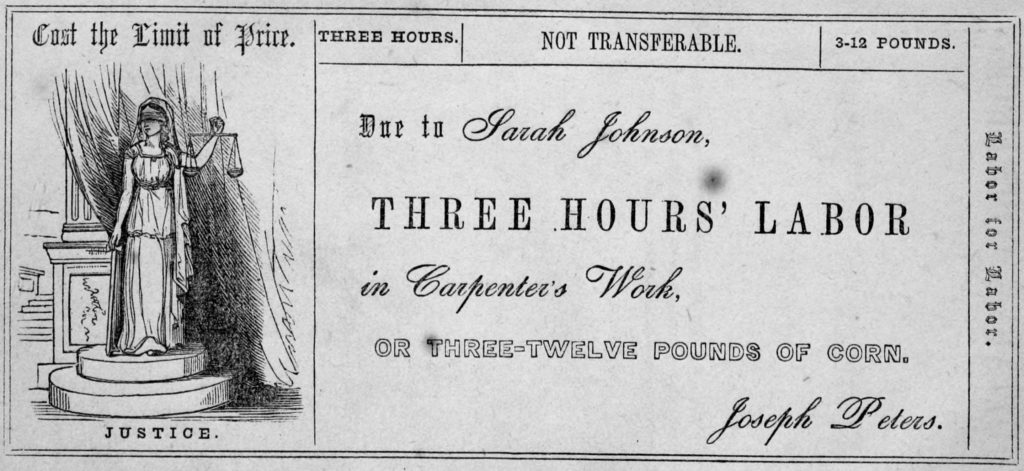

The Barclays analyst recalled Facebook’s original payment project that was similar to what cryptocurrencies are today. Developed by California-based firm The Menlo Park in 2010, “Facebook credits” represented a virtual currency that allowed users to pre-pay those credits using domestic currencies and then use them for in-app-purchases.

Almost a decade down the line, Facebook today has more than 1.7 billion active users. Its subsidiary WhatsApp has 1.5 billion users. Hence, the metrics today are in favor of Facebook. If it ever releases its own cryptocurrency, it already has a user base of 1.5 billion to create a crypto-community. Furthermore, the favorable niche built by the cryptocurrency market makes it easier to implement and enact Blockchain on its platform.

Sandler added that Facebook will bear the brunt of interchange costs between fiat currencies and its possible new cryptocurrency, which could cut into the profitability of the business.

Citing analysis from Barclays, Sandler stated that the first version of “Facebook Coin” may be a single purpose coin for micro-payments and domestic peer-to-peer (p2p) money transfer, which is considered “very similar to the original credits from 2010.” He added:

“Facebook coin may simply be looking to process micro-transactions and re-invigorate the original business model that was in place in 2010-2012 under Facebook Credits. However, the scope of the project could be much larger, especially considering David Marcus, former CEO of PayPal, is heading up the project.”

Binance CEO Welcomes Facebook Coin as Adoption-Furthering ToolsChangpeng Zhao, the CEO of the cryptocurrency exchange Binance, deviated from the larger cryptocurrency community and welcomed the large institutions curating their own digital assets. In a recent tweet, CZ stated that JPM Coin and the Facebook coin will further the adoption drive for the collective industry.

Prior to his affirmation, the Binance CEO did admit that his opinion on such a contentious matter would be “unpopular”. According to him, banks and tech-giants like JP Morgan and Facebook can do as they wish as long as their intentions are not harmful. He also added that any form of cryptocurrency adoption would be beneficial for the larger community.

Unpopular opinion: JPM/FB coins.

In a decentralized world, anyone can do as they please (within limits, so long as they don't hurt others). The more people adopt #crypto, the better.

Adoption is #adoption. Welcome!

How well will they do? Well, let's wait and see. https://t.co/ke3wYhsexI

— CZ Binance (@cz_binance) March 9, 2019

Facebook Stock UpgradedFacebook stock jumped Monday after a Wall Street analyst upgraded its shares to buy and raised his price target, saying concerns about waning user engagement have softened.

Nomura analyst Mark Kelley upgraded Facebook to buy from neutral and raised his price target to 215 from 172. That’s a premium of about 24% from where Facebook stock currently trades.

Facebook stock rose 1.5% to close at 172.07 on the stock market today.

Nomura’s reasons for recommending Facebook provide pretty much the mirror image of why so many investors were selling the stock last year.

As Nomura explains in its report, Facebook is transitioning its business to emphasize Stories faster than the analyst had initially expected. Stories is a feature that is basically a Snapchat-killer, emphasizing short-duration, ephemeral photo and video posts that can be altered with “filters,” much like on Snapchat.

Several analysts, including Forrester’s Thomas Husson, foresee Facebook creating a new business model with private messaging, leading to secure transactions. Almost all of Facebook’s $56 billion in revenue last year came from advertising sold on news feeds and other public posts.

Facebook Coin Could Bring $19 Billion Additional Revenue, Believes Barclays

origin »Bitcoin price in Telegram @btc_price_every_hour

Coin(O) (CNO) íà Currencies.ru

|

|