2019-1-10 17:29 |

Ripple announced on January 8 the addition of 13 new financial institutions to the company’s much-talked-about blockchain remittance system, RippleNet.

More than 200 Customers Now on RippleNetNamely, Euro Exim Bank, SendFriend, JNFX, FTCS, Ahli Bank of Kuwait, Transpaygo, BFC Bahrain, ConnectPay, GMT, WorldCom Finance, Olympia Trust Company, Pontual/USEND, and Rendimento become the latest organizations of the network, joining the other 200 existing customers that are already using RippleNet.

While every participant on RippleNet will benefit from the network’s low cost, fast, and transparent remittance settlement, JNFX, SendFriend, Transpaygo, FTCS, and Euro Exim Bank will also utilize the XRP On-Demand Liquidity feature.

XRP for liquidity is Ripple’s innovative solution that enables fast cross-border payments and eliminates cumbersome processes in the traditional banking system.

Until now, banks had to set up nostro accounts in foreign currencies and allocate large sums of money, in order to send payments to other countries.

RippleNet allows customers to source on-demand liquidity and to execute transactions using cryptocurrencies like XRP, while originators and beneficiaries send and receive payments in their local currencies, respectively.

Brad Garlinghouse, CEO of Ripple, said:

“In 2018, nearly 100 financial institutions joined RippleNet, and we’re now signing two—sometimes three—new customers per week. We also saw a 350 percent increase last year in customers sending live payments, and we’re beginning to see more customers flip the switch and leverage XRP for on-demand liquidity. At the end of the day, our goal is to make sure our customers can provide excellent, efficient cross-border payments experiences for their customers, wherever they are in the world.”

The First Bank to Openly Endorse XRP and RipplePerhaps, the most notable development comes from the fact that Euro Exim Bank becomes the first bank to publicly announce its support to XRP.

The St. Lucia based bank was initially introduced to RippleNet during Ripple’s Swell conference last October.

It will implement the xRapid API to its infrastructure to automate the complicated cross-border payment process, in an attempt that aims to optimize and substitute traditional remittance systems like SWIFT.

According to Ripple, the RippleNet network can effectively reduce the costs of a traditional wire transfer by 70% and transactions in XRP can be executed in 3-5 seconds, compared to SWIFT payments that can take up to 3 days.

Kaushik Punjani, Director, Euro Exim Bank, stated:

“As a leader in trade finance solutions for global corporates and fintechs, we are uniquely placed to offer new payment channels and ways to source liquidity. Our customers—whether big corporates or individual remitters—have historically been restricted from obtaining suitable funds or settling transactions in a cost efficient and timely manner. Working collaboratively with Ripple and selected counterparts, we have designed, tested and are implementing both xCurrent and xRapid in record time, and we look forward to the benefits these will bring our customers.”

With customers in over 80 countries worldwide, Euro Exim Bank hopes that RippleNet will serve as a frictionless system for near-instant payments, removing costly intermediaries involved in the existing systems.

RippleNet will free financial institutions from having to keep their funds locked in foreign accounts and, therefore, they will be protected from the volatility risks involved with foreign currencies.

This would enhance the institution’s credibility towards its customers and improve the control over its deposits.

Euro Exim Bank’s representatives are particularly excited with the idea of a transparent distributed ledger from which the organization will significantly benefit, as they have previously identified several communication and traceability flaws in SWIFT payments.

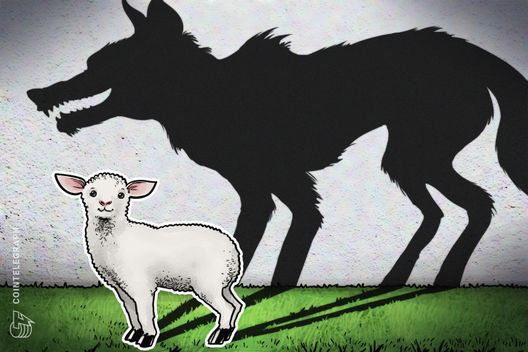

RippleNet – A No-Brainer Solution for Banks or Maybe Not?While the advantages for financial institutions migrating their operations to RippleNet are tremendous, numerous factors still raise question marks and prevent Ripple from wide adoption.

For example, minimizing costs in cross-border payments would also mean that intermediary banks would be circumvented, losing a large chunk of their revenue. Hence, it is possible that banks won’t be motivated to support a change that doesn’t favor their interests.

Moreover, Ripple has previously been accused of not being decentralized as it operates as a traditional company and a large amount of XRP tokens are held by the company.

Several XRP investors went to file lawsuits against Ripple, claiming that the latter was a profit-oriented organization that promotes its corporate products and controls the supply of the XRP token.

They believe that XRP, therefore, is not a democratized digital currency and its price movements were manipulated and artificially inflated.

Nonetheless, Ripple remains the project that brings blockchain technology closer to real-life applications than anyone else.

XRP will be the cryptocurrency that will fuel the most operations on RippleNet and such developments can only be seen as promising for its price appreciation.

XRP deserves to be on the top 3 of all cryptocurrencies based on its adoption, regardless of its linkage to Ripple.

Euro Exim Bank Endorses XRP as Ripple Announces New Customers was originally found on Cryptocurrency News | Blockchain News | Bitcoin News | blokt.com.

origin »Bitcoin price in Telegram @btc_price_every_hour

Time New Bank (TNB) на Currencies.ru

|

|