2026-2-11 16:00 |

For years, the crypto industry has treated liquidity as a finite resource that projects must compete for through incentives and marketing. This approach has created fragmentation across networks, with the same assets requiring separate liquidity pools on different chains. Georges Chouchani, founder of Euclid Protocol, believes the industry has been solving the wrong problem.

In this exclusive interview, Chouchani explains how Euclid is building infrastructure that generates and optimizes liquidity rather than simply moving it between networks. With a recent $3.5 million raise from strategic investors, the protocol is preparing for its mainnet launch and token generation event.

Q: Liquidity has been a problem in crypto for years. What made you think the industry was solving it the wrong way?

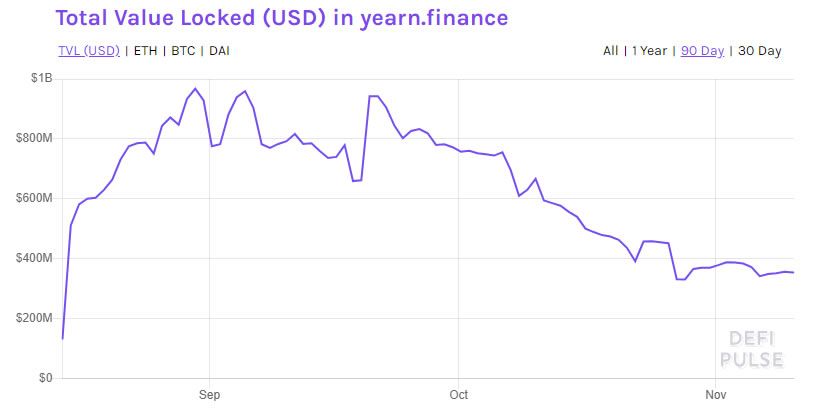

A: I don’t think it’s about solving it the wrong way, but with the existing tech at that time, it was treated as a finite resource that applications and chains compete to grab through incentives and huge marketing spends. This is what we always term the “Zero Sum Game”. This hurt the industry by focusing on short-term tactics to acquire this liquidity, which is, by itself, mercenary (follows the highest returns). Protocols could not focus on the bigger picture or spend on improving their product and attracting long-term users. 90% of protocols fail due to a lack of liquidity available to tap into. With our tech, this changes.

Q: Most solutions today focus on moving liquidity between networks. Why did you believe generating and optimizing liquidity was the more durable approach?

A: Bridges and solutions to move liquidity between networks make this liquidity less efficient because the moved liquidity is no longer the “same” as the original asset and liquidity it originally was on the origin chain. This is why we see pools for ETH and WETH (wrapped ETH) as completely different; this means instead of having one efficient pool for ETH, it’s broken down into tens of pools across different protocols and chains. This means it will never be enough to onboard retail liquidity to decentralized protocols.

With Euclid, we allow this liquidity to be accessible from any network and protocol, removing the need to move, wrap and fragment assets. This means protocols no longer spend millions on incentives for short-term access to liquidity and focus on their business model and initial product.

Q: You describe Euclid as a unified liquidity layer. In simple terms, how is that different from what most projects call “unified liquidity”?

A: Unified Liquidity is usually a term used by a protocol to explain that you can use an asset on any chain directly without directly bridging, or you can easily move assets between chains. Although a great solution for fragmentation, it does not tap into liquidity available in markets (where assets can be bought and sold), since the liquidity still exists inherently on different protocols or networks (by liquidity, we mean how much you can sell without a big impact on the amount you receive, or the best quote).

When we say a unified liquidity layer, we mean where markets are unified and accessible from 50+ networks. Before Euclid, if there is a $1M pool on 10 chains, you can only trade against $1M in liquidity, although $10M of liquidity actually exists.

We can think of aggregators in the traditional sense as brokers that help traders settle a trade easily by finding the best path and taking a small fee for the effort. But the path still depends on the most liquid market for the trade.

Euclid, however, you can think of it as the New York Stock Exchange, where all brokers trade across the world, as it is the most liquid venue to access. This is what our infrastructure offers. The goal is to power thousands of protocols, traders, and market makers by offering 24/7 highly liquid markets across any network. A goal so far thought impossible.

Q: Instead of finding prices from other markets, Euclid sets prices itself using an AMM and its own orderbook. Why was that an important choice?

A: Finding prices from other markets defeats our original goal of unifying liquidity. We would become like any aggregator out there. We do not want to find the best price in the market for users; we want to be the best price in the market. It is not an important choice for us; it is the only way to do it. We all build on decentralized markets because we want to get rid of middlemen that charge fees and have access to privileged information that can be directly given to the user.

Our infrastructure allows products and protocols to offer direct access to markets, investment opportunities, and more liquidity to users directly without bridges, aggregators, solvers, or whatever you want to call them, in a way that is both time and cost-efficient as well as more secure long-term.

Q: Euclid allows one liquidity pool to work across more than 50 networks. What does that change for teams that usually manage liquidity chain by chain?

A: Assuming a lending protocol that plans to go multichain across 50 networks, it requires liquidations and hence markets to liquidate assets on these 50 networks, else they need to rebalance or bridge assets to where it’s liquid enough. Also, liquidity fragmented across these 50 networks will mean that there is less liquidity in one pool, hence less optimized prices, more slippage and hence tighter spreads and worse liquidations for users, making the whole user experience and business model worse.

With Euclid, we take care of the liquidity and offer you the best markets for the protocol to liquidate and trade from anywhere. No need to rebalance assets on the backend, hedge, or bridge. The protocol can spend more time and money on building a better protocol as well as generating more revenue to invest in it long-term.

This is a game-changer for anyone looking to build and deploy decentralized protocols.

Q: A lot of Euclid’s efficiency happens behind the scenes. What kinds of costs or complexity does it remove for users and protocols?

A: I could talk on and on about this. What we offer is more than a better quote when you buy Bitcoin; our infrastructure allows the efficiencies to show in all areas of the user experience using an integrated protocol.

First of all, interacting with assets on different chains or having a multichain portfolio is as easy as using Binance; you don’t have to worry about gas management, bridging, or asset rebalance. Although a few dollars here and there don’t seem like a big improvement, this saves the protocols millions every year that they can reinvest in the product and user experience.

$1M in volume a year for an average trader could lose over $10,000 to capital inefficiencies in fragmented markets. Over 1,000 traders, this is $10M in lost capital to the users and protocol. These numbers scale fast and are the “wasted energy” of Web3 that could be put to good use instead. This is one of the major reasons the NYSE was created and became the biggest market for people, brokers, and institutions to trade on a daily basis.

Q: Euclid is sometimes grouped with interoperability or chain abstraction projects. Why do you think that comparison misses the point?

A: Our infrastructure DOES improve interoperability and offer better chain abstraction, but it is definitely not what we are building. Unified markets onchain does make building multichain protocols or offering it to users much easier, but this is an effect of what we are building and not our main goal.

The mess that chain abstraction and interoperability are solving exists because fragmentation exists across networks. Euclid solves this for liquidity. Liquidity no longer is fragmented and it trickles down directly to the user experience.

Today, protocols tackling chain abstraction require fillers or solvers in the backend to complete a user intent instantly, which is expensive and is the main reason behind capital inefficiency. If these protocols use Euclid instead (which they will be very soon), they won’t need middlemen of any kind to fill user intents, and will provide a much more seamless user experience to users.

Q: Euclid recently raised $3.5 million from strategic investors. What was hardest about raising funds for an infrastructure project like this in the current market?

A: Although the market is harder than ever to raise in and liquidity is drying up, the main benefit is that only investors who are close and passionate about our vision decided to participate, which shapes us as long-term believers and supporters of the protocol and what we do. We’ve received support from strategic partners with whom we will work long-term to achieve our vision, and we are really grateful for this.

I also believe that today it is clearer than ever that infrastructure that permanently solves fragmentation and offers efficient markets is needed more than ever. As they say, you can predict the future of tomorrow by what is funded today.

Q: Several of the investors and partners are closely tied to the broader ecosystem. How do these relationships shape what Euclid is building next?

A: Capital is just one part of what we look for in investors. The access to integrate Euclid and put it on the map is what we are looking for. We are more confident than ever that our product fits in the ecosystem, but introductions are needed to start the flywheel as well.

It also creates the feedback loop of understanding what our partners need and their biggest problems, so we can make sure that our product solves this for them and keep iterating and updating our infrastructure to match the demand out there.

Q: As Euclid moves toward mainnet and a token, how are you thinking about the token’s role within the system rather than as a standalone asset?

A: The token is a value-accruing asset that aligns the entire ecosystem’s incentives. Every trade directly and indirectly accrues value to the holders, as well as it allows the protocol to use this token to incentivize more integrations (hence volume) and liquidity for even more efficient markets, and hence even more demand on trades, creating what we call the liquidity flywheel.

It will also offer governance rights to its stakers to participate in voting on future incentives, fee structures, and next iterations of the product.

The post Euclid Protocol’s Georges Chouchani on Making Liquidity Work Across All Blockchains appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Liquidity Network (LQD) на Currencies.ru

|

|