2023-5-16 19:02 |

Key takeaways

The EU finance ministers have unanimously approved the MiCA cryptocurrency regulation.

The regulation could boost crypto adoption and usage in Europe.

AltSignals could be a big winner as more retail and institutional traders could enter the crypto market.

The cryptocurrency market has evolved over the last decade, and many feel that there is more development in store. Following the Bull Run of 2021, regulatory agencies globally have been working to roll out favourable regulations that would ensure consumer protection and promote innovation in the industry.

One of the most important crypto regulations, MiCA, has been approved by finance ministers across Europe. This implies that the regulatory framework could soon be adopted across the continent.

Could this latest development lead to the massive adoption of cryptocurrencies, and what does this mean for trading-focused tokens like AltSignals?

EU finance ministers finally approve MiCAEuropean Union finance ministers vote unanimously to adopt Europe’s Markets in Crypto-Assets regulation.

MiCA sets clear regulatory guidelines and requirements for using digital currencies and related services and activities across the EU. The legislation covers various areas, including cryptocurrencies, digital assets, stablecoins, and utility tokens.

Once the bill is passed into law, MiCA is expected to take effect before the end of 2023 or in 2024.

What Does this mean for the cryptocurrency market?The adoption of MiCA in Europe could serve as an excellent boost for the cryptocurrency industry in Europe and even beyond.

Market experts believe that clear regulations would make it easier for industry players to know how to provide services and open the market up to more investors.

Jeremy Allaire, CEO of USDC stablecoin issuer Circle, stated earlier this year that he is optimistic that MiCA will create the conditions for a thriving competitive market in the EU.

The cryptocurrency market is worth over $1 trillion at the moment, down by more than 60% from the all-time high of $3 trillion recorded in November 2023.

With the adoption of MiCA, cryptocurrency adoption in Europe could increase over the coming years and, subsequently, the total capitalisation of the market.

What is AltSignals?One of the cryptocurrencies that could benefit from this latest development is AltSignals. AltSignals is a trading platform designed to provide trading signals for stocks, forex, indices, cryptocurrencies, and CFDs.

The project is still in its presale stage, and the developers have raised nearly 70% of the funds needed to improve their services. AltSignals will be using some of the funds to develop ActualizeAI, a solution that could make it easier for more people to enter the cryptocurrency trading scene.

AltSignal’s ActualizeAI will be fully automated and work 24/7, just like the cryptocurrency market. With this solution, traders can easily determine entry points in the market, execute more accurate trades, and deploy proper risk management strategies.

The AltSignals platform is powered by the ASI token. Token holders would be granted access to various services offered by AltSignals.

Visit the official AltSignals website to learn more about their presale.

How does MiCA adoption affect AltSignals?AltSignals could be a big beneficiary of MiCA in Europe thanks to its position as a niche-focused project.

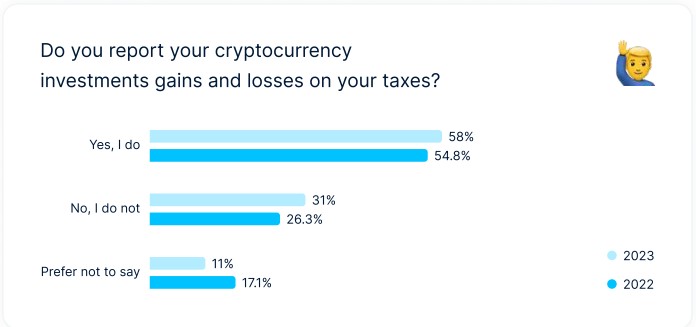

The lack of clear regulation is one of the reasons some investors, especially institutional investors and traders, are yet to enter the cryptocurrency market.

With MiCA, there would be regulatory clarity in Europe, and more individual and institutional investors and traders could troop into the market. If or when that happens, tools such as AltSignals could play a huge role in ensuring cryptocurrency adoption.

Retail and institutional traders can leverage AltSignals to trade various cryptocurrencies. They could also use the solution to trade other asset classes like forex, commodities and stocks.

The adoption AltSignals could see ASI’s value surge over the next few years. At the moment, AltSignals is still in its presale stage, and ASI is sold for $0.015 per token. The team has raised more than $740k so far and looks likely to hit the $1 million goal soon.

As a coin with utility, ASI could be one of the biggest winners, especially as the cryptocurrency market could be on the verge of another bull cycle.,

Are cryptocurrencies good investments?The results recorded by millions of investors over the past decade already answer this question.

Since the launch of Bitcoin in 2009, no other asset class has outperformed cryptocurrencies. The ROI recorded by cryptocurrencies far outweighs those recorded by stocks and commodities over the past decade.

Cryptocurrencies like Bitcoin, Ether, Solana, Polygon, Dogecoin, and Shiba Inu, have given early investors thousands of percentages in ROI.

Keep in mind that we mentioned early investors, as they usually purchase cryptocurrencies when their prices as still low. ASI could also follow this path thanks to its utility as a trading-focused token.

Is now a good time to buy AltSignals?This could be a good time to buy promising cryptocurrency projects like AltSignals. If the developers deliver on their promises, AltSignals could have huge adoption within the cryptocurrency trading community.

The launch of ActualizeAI could help boost AltSignals’ adoption rate, especially amongst crypto traders. If that happens, buying ASI could be an excellent investment, as the utility of the token will increase over time.

The post EU finance ministers approve MiCA crypto regulation: should you buy AltSignals now? appeared first on CoinJournal.

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) íà Currencies.ru

|

|