2021-9-24 14:20 |

The portfolio will track major assets in the DeFi ecosystem, including Ethereum (ETH), Uniswap (UNI), aave (AAVE), and Chainlink (LINK)

eToro, a leading investment and trading platform headquartered in the UK, has announced a new investment product tracking top crypto assets in the decentralised finance (DeFi) sector.

According to eToro, investors seeking investment opportunities in several leading DeFi projects now have a chance to do so using the DeFi Portfolio product.

eToro added in the news release:

"Both smart contract blockchains and a selection of leading protocols are included in the portfolio, giving you exposure to every corner of DeFi — from Uniswap to Yearn and beyond."

Specifically, investors will get exposure to a single product sampling 11 projects. It includes major cryptos such as ETH, LINK, UNI and AAVE.

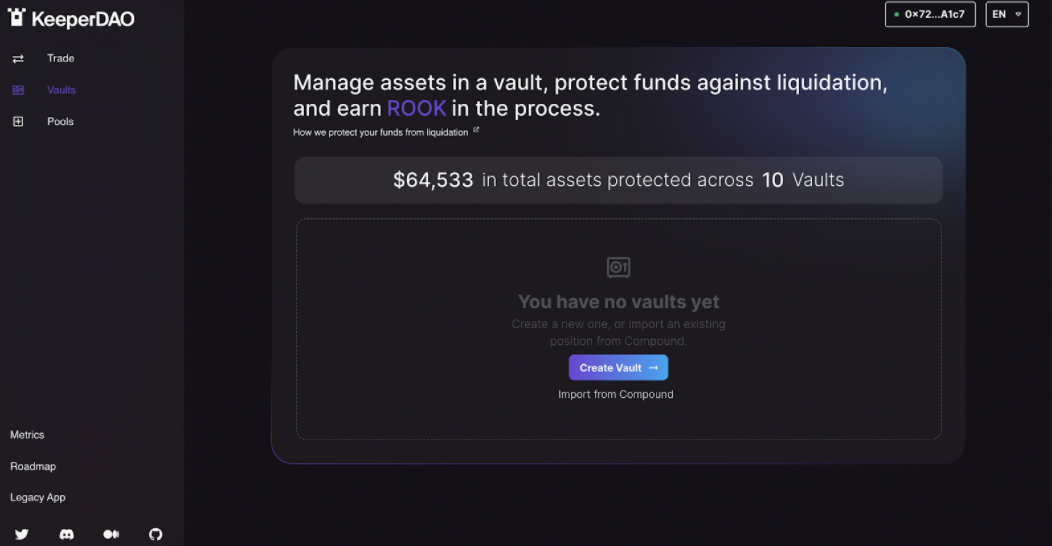

Other assets in the mix are Yearn.finance (YFI), Compound (COMP), Decentraland (MANA), Basic Attention Token (BAT), Maker (MKR), Polygon (MATIC) and Algorand (ALGO).

Dani Brinker, eToro's head of portfolio investments, said in a statement that the emergency of the DeFi space has opened up a new opportunity for investors. However, the sector is seeing an explosion of new projects every other day, a scenario that might prove challenging to new investors seeking to pick out gems.

He thus summed up eToro's role as one of helping investors select and spread risk. He noted:

"By packaging up a selection of crypto assets in a DeFi CopyPortfolio, we're doing the heavy lifting and enabling our customers to gain exposure and spread the risk across a variety of cryptos."

Access to the product starts at $1,000, with investors able to view relevant tools and charts highlighting the product's performance.

The post eToro launches Portfolio with exposure to major DeFi assets appeared first on Coin Journal.

origin »Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) на Currencies.ru

|

|