2023-4-15 19:06 |

Things to know:

– Ethereum’s Shanghai upgrade is live, allowing validators to withdraw their staked ETH.

– Retrieving your staked ETH through Ledger Live with Lido or Kiln apps is not immediate. You will be able to unstake them around May 2023.

– For Ledger Enterprise clients, the Shanghai upgrade will provide new incentives for institutions and corporates to stake their Ethereum assets as they will be able to unlock and withdraw their rewards, which significantly de-risk them as an investment.

The Merge, a successful software upgrade that took place in September 2022, shifted the Ethereum protocol from a proof-of-work to a proof-of-stake blockchain. This upgrade was the initial phase of the five stages of Ethereum’s development, as outlined by Vitalik Buterin, including “The Merge,” “The Surge,” “The Verge,” “The Purge,” and “The Splurge.”

If you want to explore Ethereum’s scaling roadmap, read this article where Charles Guillemet, CTO of Ledger, provides critical insights into the future of Ethereum.

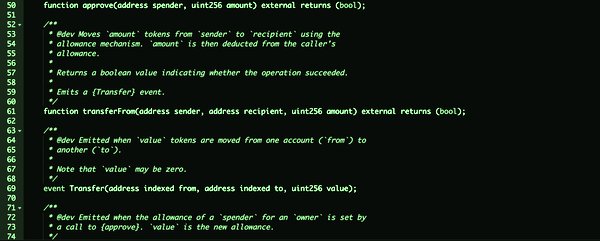

What Is The Shanghai Upgrade?Ethereum’s Shanghai upgrade is a hard fork. This software upgrade implements EIP-4895, allowing validators to withdraw their staked ETH. So far, the staked coins remain blocked on the protocol, meaning users couldn’t retrieve their rewards.

As the upgrade is now live, validators can:

Unlock and withdraw their staking rewards. Unstake ETH and gain access to their entire balance. Earn rewards that will be distributed automatically. Re-stake to sign back up and start earning more rewards.The Shanghai upgrade also includes three other improvement proposals that tackle high gas fees, slow transaction processing time, and the overall performance of the network.

For Charles Guillemet, CTO at Ledger, “The Shanghai upgrade marks the completion of the blockchain migration to Proof of Stake, as well as a significant milestone in the evolution of Ethereum. This upgrade will bring more liquidity to the market and encourage those who were previously hesitant to stake their ETH due to uncertainties around locking time. It also highlights the Ethereum community’s remarkable ability to update its protocol seamlessly.”

Read our Ledger Academy article to learn more about the implications of this significant upgrade.

Shanghai Upgrade: what does it mean for Ledger Live users? Staking with Lido through Ledger Live:While the upgrade is live, Ledger Live Lido users will only be able to withdraw their staked ETH from their Ledger Live app around May 2023. stETH holders will be able to unstake their stETH and in return receive ETH at a 1:1 ratio.

Withdrawals will be handled through the following Request and Claim process:

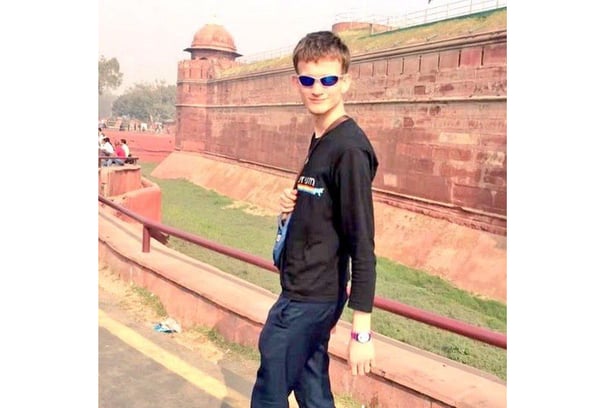

Request: A user locks stETH as a withdrawal request. Fulfillment: The protocol sources ETH to fulfill the withdrawal request, locks the ETH, burns the locked stETH, and marks the withdrawal request as claimable. Claim: The user claims their ETH. Staking with Kiln through Ledger Live:Just like with Lido users, Kiln users on Ledger Live will also be able to withdraw their staked ETH around May 2023 by following these simple steps:

Unlock and connect their Ledger device to the Ledger Live app. Navigate to the Discover section. Select Kiln. Go to the Rewards tab and select the validator(s). Click Unstake. Review and verify the transaction using their Ledger device.Once the validator goes through the exit and withdrawal queues, you can return to the Rewards tab, click the Withdraw button and claim your ETH.

Shanghai Upgrade: what does it mean for Ledger Enterprise clients?For Ledger Enterprise clients, the Shanghai upgrade will provide new incentives for institutions and corporates to stake their Ethereum assets as they will be able to unlock and withdraw their rewards which significantly de-risk them as an investment. Unlocking rewards can also open new financial opportunities with the possibility to compound rewards though pool staking.

For Alex Zinder, Head of Ledger Enterprise, “with the coming clarity on the timing of the update, there is no better time than now to add ETH staking to your institutional yield strategy. Ledger is seeing great demand for ETH staking from its retail users, so, if you want to bring secure and compliant ETH staking to your retail audience, contact Ledger Enterprise.”

By staking your digital assets with Ledger Enterprise, you can access a seamless, secure, all-in-one digital asset management platform, a fully customizable governance framework, real digital ownership, and 100% auditable and regulatory-friendly reporting.

Learn more about how to stake with Ledger Enterprise here.

origin »Bitcoin price in Telegram @btc_price_every_hour

Live Stars (LIVE) на Currencies.ru

|

|