2024-12-18 18:01 |

Big whales are making waves in the Ethereum ocean. Whale wallets—those holding over 100,000 Ether—now control a staggering 57% of all ETH in existence, according to recent data from Santiment.

Source: Santiment

While the whales are stacking up more Ether, smaller investors seem to be losing ground. Wallets containing between 10 and 100,000 Ether have dwindled to 33.46%, their lowest point in history. On the other end of the spectrum, wallets with under 100 Ether now hold only 9.19% of the total supply—a figure not seen in nearly four years.

“wallets with 100-100K hold their lowest ratio of supply in history, 33.46%. And sub-100 ETH wallets hold a near 4-year low of 9.19%,” said Santiment.

Santiment sees the current trend as a potential bullish indicator. Historically, when major stakeholders accumulate significant amounts of cryptocurrency, the market often responds with upward momentum. Ethereum’s nine-year trajectory supports this observation, with whale accumulation frequently preceding notable price increases.

“It is still generally a bullish long-term signal when a coin’s most prominent key stakeholders continue accumulating… especially when it’s a 9 year-old asset with whales holding their highest ever portion of coins,” said Santiment.

Ethereum Activity Surges: 130,200 New AddressesAccording to Santiment, December brought more than just whale news. The daily average of new Ethereum addresses surpassed 130,200, marking an eight-month high. This surge in new addresses indicates growing interest and participation in the Ethereum ecosystem, even as large holders dominate supply.

Source: Santiment

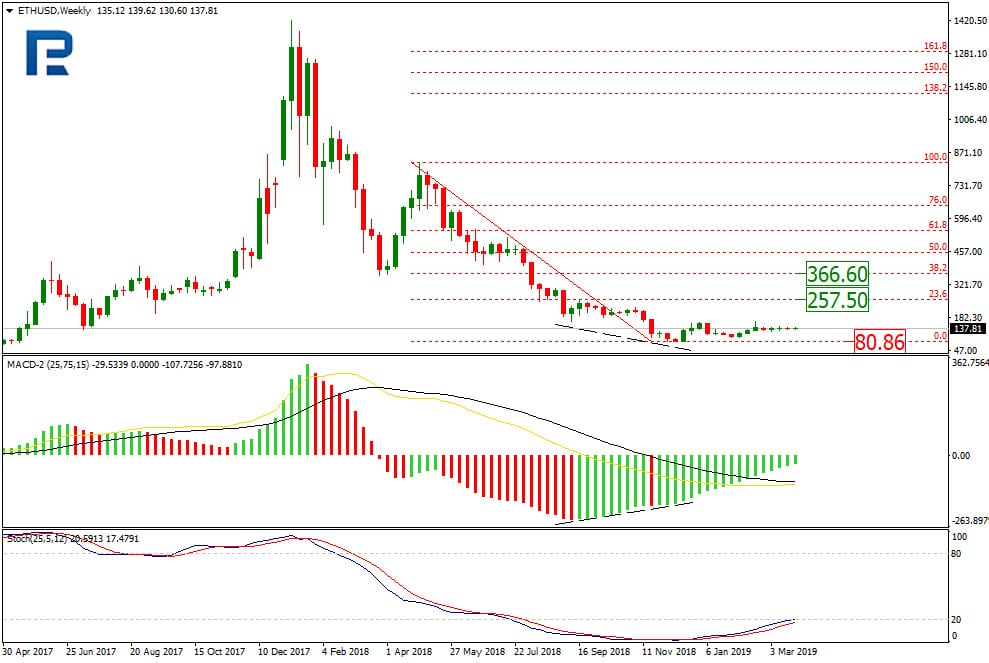

On December 7, Ether’s price reclaimed $4,000 for the first time since March. According to Brave New Coin’s Ethereum Liquid Index, ETH hit $4,016, closing in on levels not seen since its all-time high of $4,891 on November 16, 2021. While it’s still 17% off that peak, optimism is bubbling up among analysts who believe ETH could hit new highs by early 2025.

Ali Martinez, a leading crypto analyst, pointed out that whales have been accumulating more Ether since prices broke above $3,330. This accumulation could be a sign that smart money expects significant gains in the coming months.

Source: Ali Martinez on X

Bitcoin’s Rally Ignites Crypto Market OptimismBitcoin’s recent rally to $107,800 on December 16 has fueled bullish sentiment across the crypto market. This new all-time high is dominating crypto discussions, but its impact on altcoins like Ethereum cannot be ignored. Santiment’s social sentiment tracker reveals that Bitcoin’s performance is driving broader market optimism.

Source: Santiment

Bitcoin’s rise has also renewed focus on other trending projects. VANA and MOCA have garnered attention, with VANA making headlines for its listing on Binance’s Launchpool and MOCA jumping 95% in a week after being listed on major South Korean exchanges.

Despite Bitcoin’s dominance, Ethereum remains a top contender for major gains. If ETH can stay above critical price levels like $3,800, it could break out into a full-fledged bull run.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ether Zero (ETZ) на Currencies.ru

|

|