2023-11-14 13:00 |

BlackRock and NASDAQ have outlined why the SEC needs to approve the investment company’s new spot Ethereum exchange-traded fund (ETF) filing. According to the filing with the SEC, approval of a Spot ETH ETP would represent a major win for the protection of U.S. investors in the crypto asset space.

If approved, the iShares Ethereum Trust would allow regular investors to trade Ether, the world’s second-largest cryptocurrency by market cap, as easily as stocks can be traded.

BlackRock And NASDAQ Lobbies SEC To Allow Spot ETH ETFsBlackRock, the world’s largest asset manager, recently applied to the SEC to launch an Ethereum exchange-traded fund (ETF) linked to the spot price of Ethereum. BlackRock wasn’t the first investment company to make this type of application, as hedge fund Ark Invest already filed for a Spot Ethereum ETF in September. However, the news of BlackRock’s filing sent Ethereum surging more than 11% in less than 24 hours. As a result, ETH broke over the strong $2,000 resistance level for the first time in seven months.

BlackRock’s Spot ETF is called the “iShares Ethereum Trust” and is sponsored by Ishares Delaware Trust Sponsor LLC, a subsidiary of Blackrock Inc. Coinbase, the largest crypto exchange in the US, acts as the custodian for the Trust’s ether holdings, which are to be traded on the NASDAQ exchange.

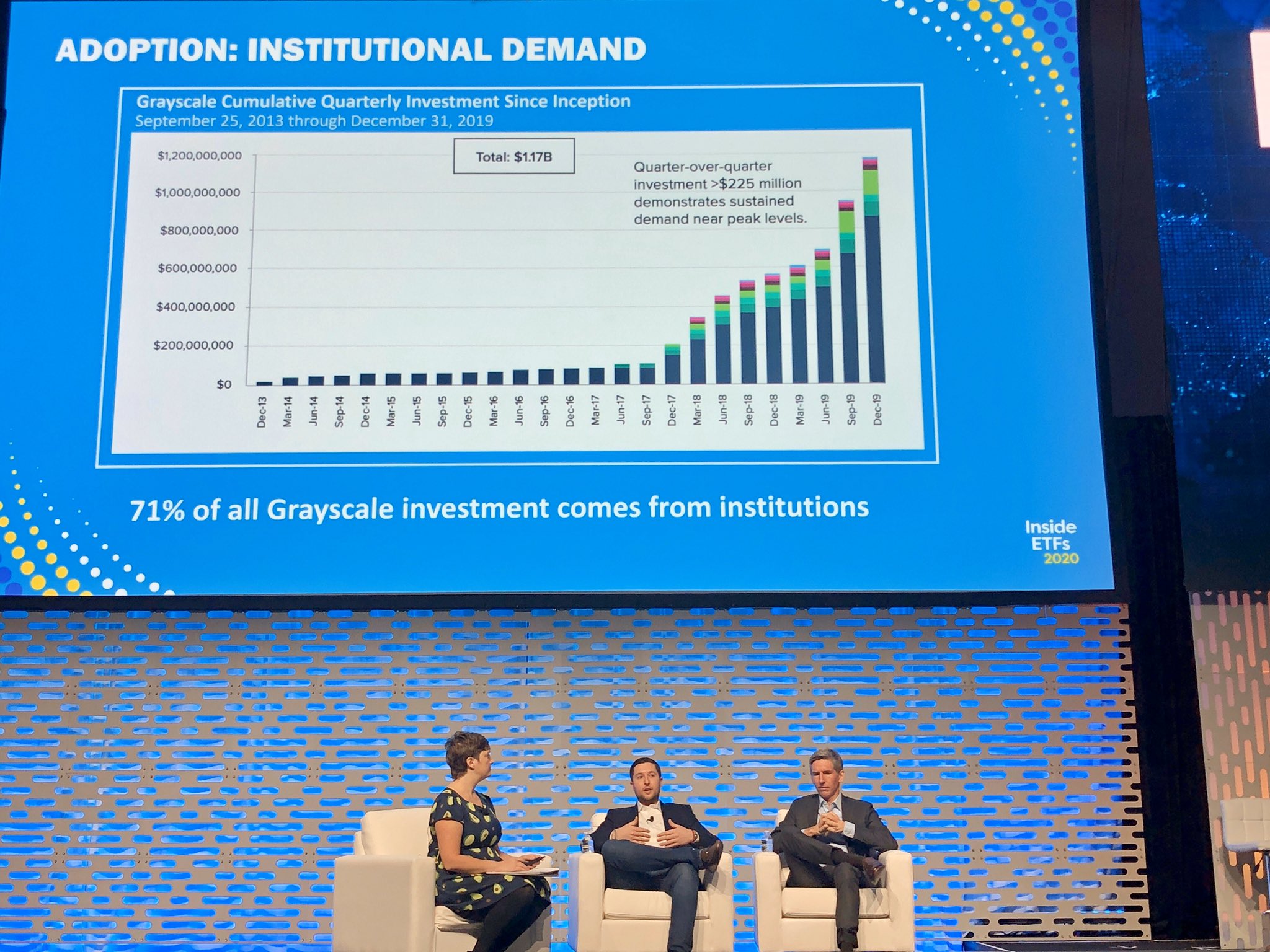

In its SEC filing, NASDAQ asked for a proposed rule change in order for it to list and trade shares of the ETF. According to the filing, US investors, for the most part, have lacked a US-regulated way to gain exposure to Ethereum investments. It also argues that most of the current methods are risky and subject to high trading fees and volatile discounts.

For example, an investor who purchased the largest OTC ETH Fund in January 2021 and held the position at the end of 2022 would have had a 30% loss due to the change in the premium/discount, even if the price of ETH did not change. However, a spot ETH ETP like the proposed iShares Ethereum Trust ETF would better protect investors against the risk of losses through fraud and high premiums.

“To this point, approval of a Spot ETH ETP would represent a major win for the protection of U.S. investors in the cryptoasset space,” the filing said.

Potential Impact On Ethereum Price If The ETF Is ApprovedDespite spot crypto ETFs being available in other countries, including Germany, France, and Canada, the SEC has been hesitant to greenlight a crypto ETF in the US, and 12 Bitcoin spot ETFs are currently waiting for approval.

A US Spot Ethereum ETF would significantly boost interest and confidence in Ethereum and ultimately drive the asset to new highs. The hype leading up to the approval may also push the asset to a new yearly high.

ETH is up by more than 60% this year and has outperformed BTC in the past few days. It is currently trading at $2,060 and analysts believe a bullish cross over $2,150 would signal the end of the bear market for ETH.

origin »Bitcoin price in Telegram @btc_price_every_hour

Cryptospot Token (SPOT) на Currencies.ru

|

|