2021-11-5 03:06 |

Ethereum is taking the first tentative steps towards being fully deflationary after it notched seven consecutive days of negative issuance.The burn feature introduced by the London upgrade had a role to play in the recent trend.It is expected that the network’s transition to Ethereum 2.0 will fully introduce deflationary attributes to the network.

Ethereum is making significant strides in the quest to be fully deflationary after recording the first week of deflationary issuance. While this may not be a recurring trend, for now, it is a small glimpse into the future of what is to come for the network.

Seven Days StraightAmid impressive price performances and increasing demand, Ethereum notches 7 consecutive days of deflationary issuance. This means that within the time frame, more Ethereum has been destroyed than has been created from mining.

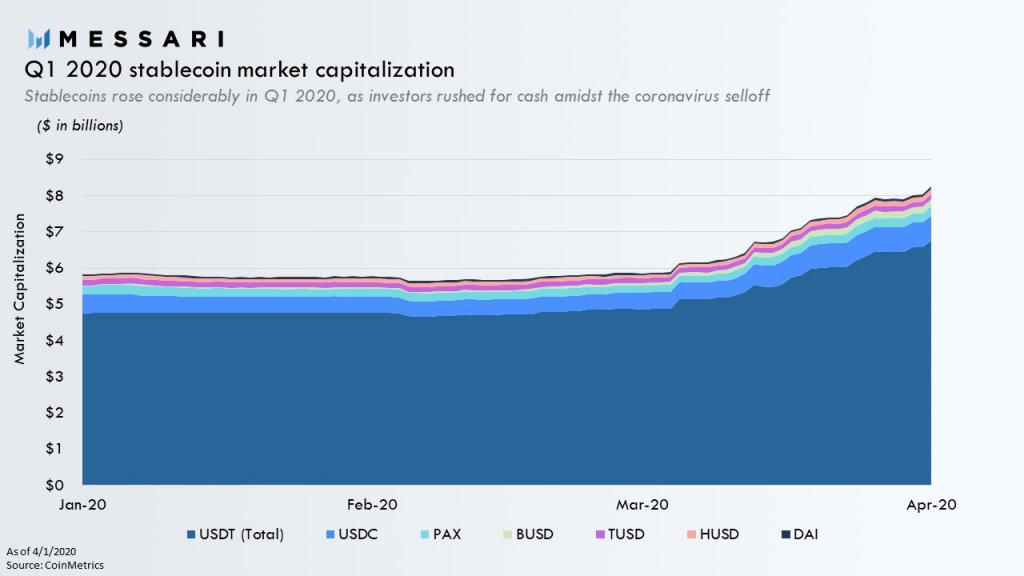

The building blocks to introduce deflation were laid by the London hard fork through the introduction of a burning mechanism. Since implementation, over $3 billion worth of Ethereum has been burned and data from Ultrasound Money reveals that 15,000 ETH is being burnt daily which is valued at around $60 million given the current prices. On the other hand, analytics from WatchTheBurn shows the difference between burn rate and net issuance to be minus 8,000 ETH at press time.

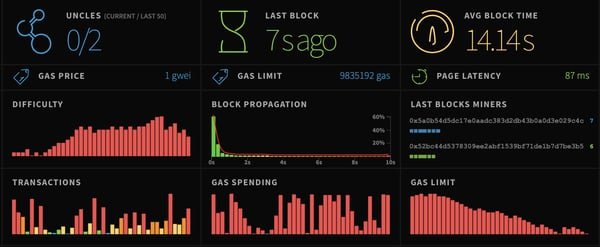

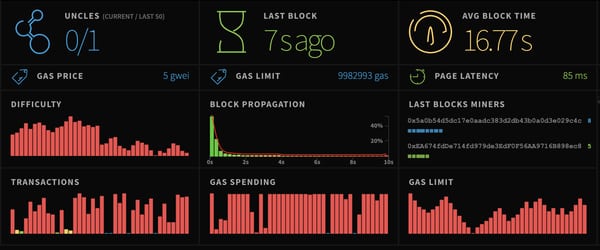

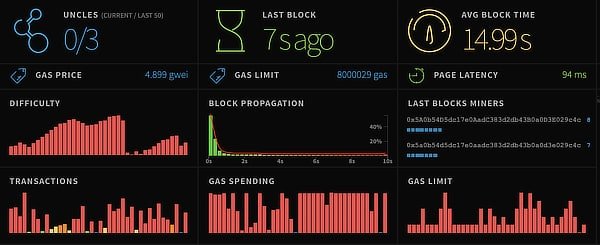

Gas prices may also have a role to play in the recent trend for the asset. Recent weeks have seen gas prices surge drastically to the point that average transaction costs on the network were over $50.

“Due to the current PoW issuance (4.5%), a deflationary ETH was not something that was expected to happen until The Merge,” says Anthony Sassano, co-founder of EthHub on The Daily Gwei. The transition to ETH 2.0 is billed for 2022 but still, this is a rare glimpse into the future of the asset.

Ethereum continued its fine form from October, soaring to reach a new all-time high of $4,638. The market cap for the second-largest cryptocurrency is at $536 billion while 24-hour transaction volume soared by 23.08% to settle at $18 billion.

The FutureWhen Ethereum 2.0 becomes a thing, it will introduce something more than just deflationary pressure. Analytics firm Ultrasound predicts that after the transition is completed, Ethereum’s supply may be reduced by 2% a year.

Right now, Ethereum does not have a supply cap and its circulating supply is at 118,187,792 ETH, unlike Bitcoin that has a supply cap of 21,000,000. Already, things are in full gear for the attainment of Ethereum 2.0. The Altair upgrade has been successfully launched but before that, the convergence of the dev team in Greece increased optimism levels for a seamless transition.

Ethereum 2.0 will also introduce the switch from Proof-of-Work To Proof-of-Stake which will greatly reduce the energy consumption levels of the network. It is widely expected that gas fees will be significantly reduced as part of the array of features coming to the network.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|