2018-11-13 17:35 |

Latest Ethereum News

Despite deep losses, 2018 marks an important milestone for blockchain and cryptocurrencies. It is the year of institutional experimentation with many remaining explicit about their intention to try out different blockchain solutions while some venture into digital asset custodial services.

Of course, the entry of Fidelity Investment is a game changer but still others are racing and declaring their intention to be part of the larger infrastructure that will see Ethereum and other cryptos absorbed by investment firms because of their depth and low volatility. Besides CoinBase application and approval by the NYDFS, Binance is also expanding and want to have a global outreach before providing specific solutions from professional as well as institutional level investors.

Already, their trading interface is intuitive and complex enough to cater for professional traders. Aside from their high security levels and deep liquidity—it is the largest exchange by trading volume, the exchange is running their operations on a proven and time-tested platform.

They now plan to introduce sub-accounts and with a tiered fee discount trading program under a maker/take model that suit the high-volume trades of institutions. To this end, the exchange is now ramping up support for corporate account management processes while leveraging their flexible API systems where limits—deposits and withdrawals can be set.

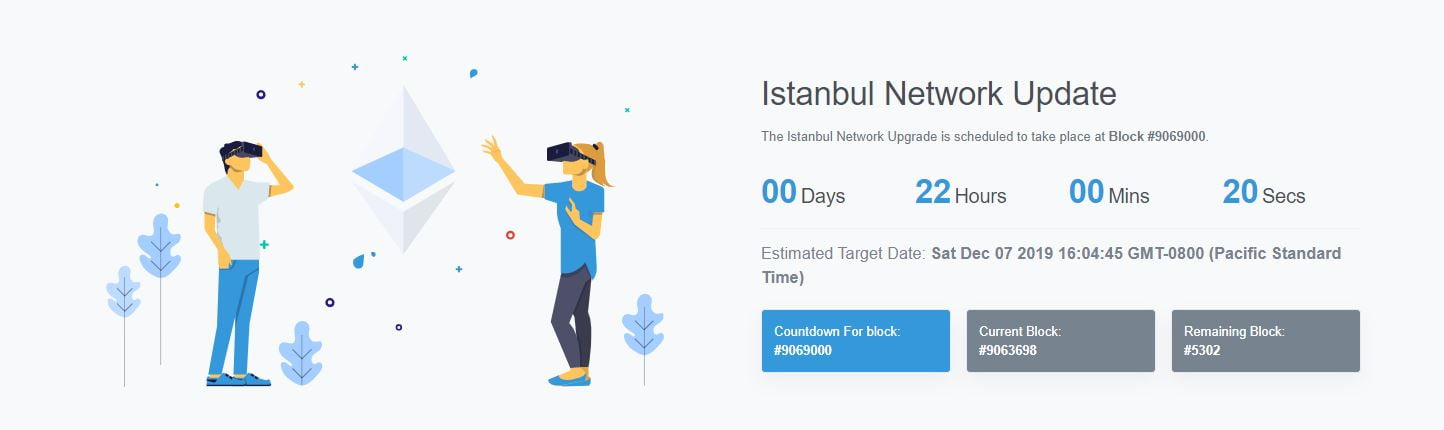

Ethereum (ETH) Price Analysis ETH/USD Weekly ChartStill, ETH/USD is registering marginal gains in lower time frames while movements in higher time frames are constrained within tight ranges.

As a matter of fact, gains in the last seven days are less than one percent and relatively flat in the last day. Considering the lack of movement, our last ETH/USD trade plan is valid now that bulls didn’t build enough momentum to reverse early August losses.

Then, the high-volume bear bar triggered a wave of sell pressure and in a classic bear bar breakout, prices are yet to recover and ETH/USD is trading within a $110 range with supports at $160—or Sep lows.

Unless otherwise, sellers are in charge and every high should theoretically be another selling opportunity but since prices are down +80 percent from 2017 highs, a conservative trade plan demands patience with trade execution only when bears drive prices below $200 and later $160.

ETH/USD Daily ChartOverly, bears are in charge and as such, two bars are of important in our analysis: Sep 5 bear breakout bar and confirming Oct 11 bar. Everything else constant, it’s clear that sellers are in charge from an effort versus results point of view and from how bars are arranged.

Therefore, because of this, risk-off, aggressive type of traders can execute trades at spot with stops at $225—or Nov 7 highs with first target at $190 and later $160.

On the reverse side conservative traders should take a neutral stand until prices surge above $250 or dip below $160 in a trend confirming move that could see ETH/USD test $75.

*All Charts Courtesy of Trading View

Disclaimer: Views and opinions expressed are those of the author and aren’t investment advice. Trading of any form involves risk and so do your due diligence before making a trading decision.

origin »Bitcoin price in Telegram @btc_price_every_hour

High Performance Blockchain (HPB) на Currencies.ru

|

|