2020-6-1 04:00 |

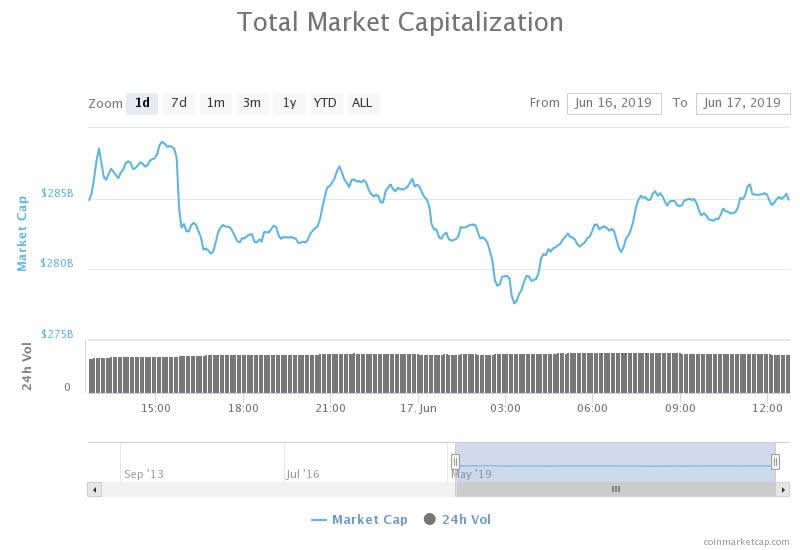

Ethereum made its third attempt to set new local highs against its Bitcoin trading pair in 2020 yesterday. This movement has shown signs of being fleeting, however, as the crypto has lost some of its momentum. Although the cryptocurrency is flashing some subtle signs of near-term weakness, it is important to note that one data metric points to the cryptocurrency seeing a notable upswing in the days and weeks ahead. This possibility is elucidated by the cryptocurrency’s options skews turning negative, suggesting that traders believe it is primed to see upside volatility. Ethereum Retraces from Recent Highs as the Cryptocurrency Makes Third Attempt at New Highs Ethereum is currently trading up marginally at its current price of $235. This marks a notable rebound from recent lows of $205 that were set earlier this past week when the crypto was caught within a prolonged consolidation phase around $200. ETH’s recent volatility has largely come about independent of that seen by Bitcoin and most other major altcoins. Because the crypto is actually showing signs of leading the market, how it trends in the hours ahead could be one of the determining factors for where the aggregated market goes next. This latest uptrend did allow ETH to gain some serious ground against its Bitcoin trading pair. On Thursday of this last week, the cryptocurrency’s BTC price dived to lows of 0.022. After tapping this level, it incurred a massive amount of buying pressure that catalyzed this recent movement. Over the three days following this dip, ETH rallied to highs of nearly 0.026 BTC. This marked the third attempted breakout the crypto has seen against its Bitcoin trading pair this year – a pattern that Skew spoke about in a recent tweet while showing ETH’s price as a percentage relative to that of Bitcoin. “ETH / BTC: third breakout attempt this year,” Skew noted while pointing to the chart seen below. Image Courtesy of Skew This Pattern Signals That ETH Will Soon See Immense Volatility Although Ethereum now appears to be entering a consolidation phase in the $230 region, it doesn’t appear that this will last for too much longer. Skew also explained that the cryptocurrency’s options skew – which is an indicator of the volatility spread between options contracts with different expiry dates – has dived as of late. This indicates that the cryptocurrency is bound to see some immense volatility in the near-term. Because the options skew is negative, it is possible that this will lead to an upside movement. “Negative skew indicates risk of volatility now seen to be on the upside,” Skew explained in a recent tweet. Image Courtesy of Skew If Ethereum rallies higher in the near-term, it is possible that this will help guide the entire cryptocurrency market higher. Featured image from Shutterstock. origin »

Bitcoin price in Telegram @btc_price_every_hour

Time New Bank (TNB) на Currencies.ru

|

|