2026-1-1 19:55 |

The Ethereum blockchain recorded its strongest operational year in history in 2025, processing record transaction volumes and securing the vast majority of the DeFi market.

However, the crypto asset that powers the network failed to mirror that growth, posting double-digit losses for the year.

According to CryptoSlate's data, ETH is trading down 10% year-to-date at under $3000. Its performance against Bitcoin, the flagship digital asset, has also lagged, with the ETH/BTC ratio falling 6% since the start of the year.

This divergence highlights a fundamental shift in the economics of the world’s most widely used commercial blockchain.

Ethereum Daily Transactions (Source: YChart)While network utility has soared, technical upgrades designed to lower costs for users have significantly reduced the revenue flowing to the core network, decoupling the price of Ether from the activity on its rails.

The $100 million lossOne of the most significant factor in Ethereum’s financial profile this year was the collapse of “rent” paid by Layer-2 networks.

These networks, which bundle transactions together to save costs before settling them on the main Ethereum blockchain, previously served as a major source of fee revenue.

In 2024, Layer-2 networks generated $277 million in total revenue. Of that amount, they paid approximately $113 million—or 41%—to the Ethereum mainnet to process data and secure the network.

In 2025, that revenue model inverted. According to Growthepie data, the total revenue for Layer-2 networks fell 53% to $129.17 million as fees were lowered for end users.

However, the cost paid to the Ethereum mainnet plummeted even further. Layer-2 networks paid around $10 million to Ethereum for security in 2025, representing less than 10% of their total revenue.

Related Reading Ethereum transaction fees hit record low as Layer-2 networks siphon activity May 10, 2024 · Oluwapelumi AdejumoThe remaining $119 million was retained as profit by the Layer-2 operators.

Ethereum Layer 2 Networks Revenue (Source: Grow The Pie)Effectively, this meant Ethereum sacrificed more than $100 million in guaranteed fee revenue this year to secure its long-term survival.

This decline stems from the “Dencun” upgrade implemented last year. The update successfully lowered transaction fees, effectively subsidizing the ecosystem’s growth by reducing the income Ethereum collects from the “Layer-2” networks built on top of it.

This allowed the network to process higher volumes of traffic without clogging the main blockchain or spiking fees.

While the technical implementation succeeded in making Ethereum cheaper and faster, it removed a key driver of demand for the ETH token.

In previous years, high network usage resulted in high fees, a portion of which were “burned” thereby reducing supply and supporting the price.

With fees hitting record lows in 2025, the deflationary pressure on the token supply has weakened significantly. As a result, Ethereum's inflation rate has increased by 0.204% since the merge event in September 2022.

Related Reading Ethereum inflation soars amid Dencun changes—less than 100k ETH away from pre-Merge levels Nov 22, 2024 · Oluwapelumi Adejumo Coinbase network dominates profit shareThe rearrangement of Ethereum’s economics has created a consolidated market for scaling solutions, with one dominant player capturing the majority of the sector’s earnings.

Base, the Layer-2 network developed by the publicly traded US exchange Coinbase, generated more than $75 million in revenue in 2025. This figure represents nearly 60% of the entire Layer-2 sector’s revenue for the year.

Base’s financial performance far outpaced its decentralized rivals. Arbitrum, which held a significant market lead in prior years, generated approximately $25 million in revenue, taking second place.

Other competitors saw lower values. The Polygon network generated $5 million in revenue, while Consensys-backed Linea brought in $3.94 million. Optimism, another early leader in the scaling sector, earned approximately $3.83 million.

This concentration of revenue marks a departure from 2024, when the market was more evenly distributed. In the previous year, Arbitrum generated $42 million, Linea generated $36.6 million, and Scroll generated $35 million.

The rise of Base suggests that distribution channels and user experience have become the deciding factors in the scaling wars.

By integrating the network directly into its exchange products, Coinbase has successfully funneled retail activity onto its own rails.

Consequently, a significant portion of the value generated by the Ethereum ecosystem now accrues to the balance sheet of a distinct corporate entity rather than the broader network participants.

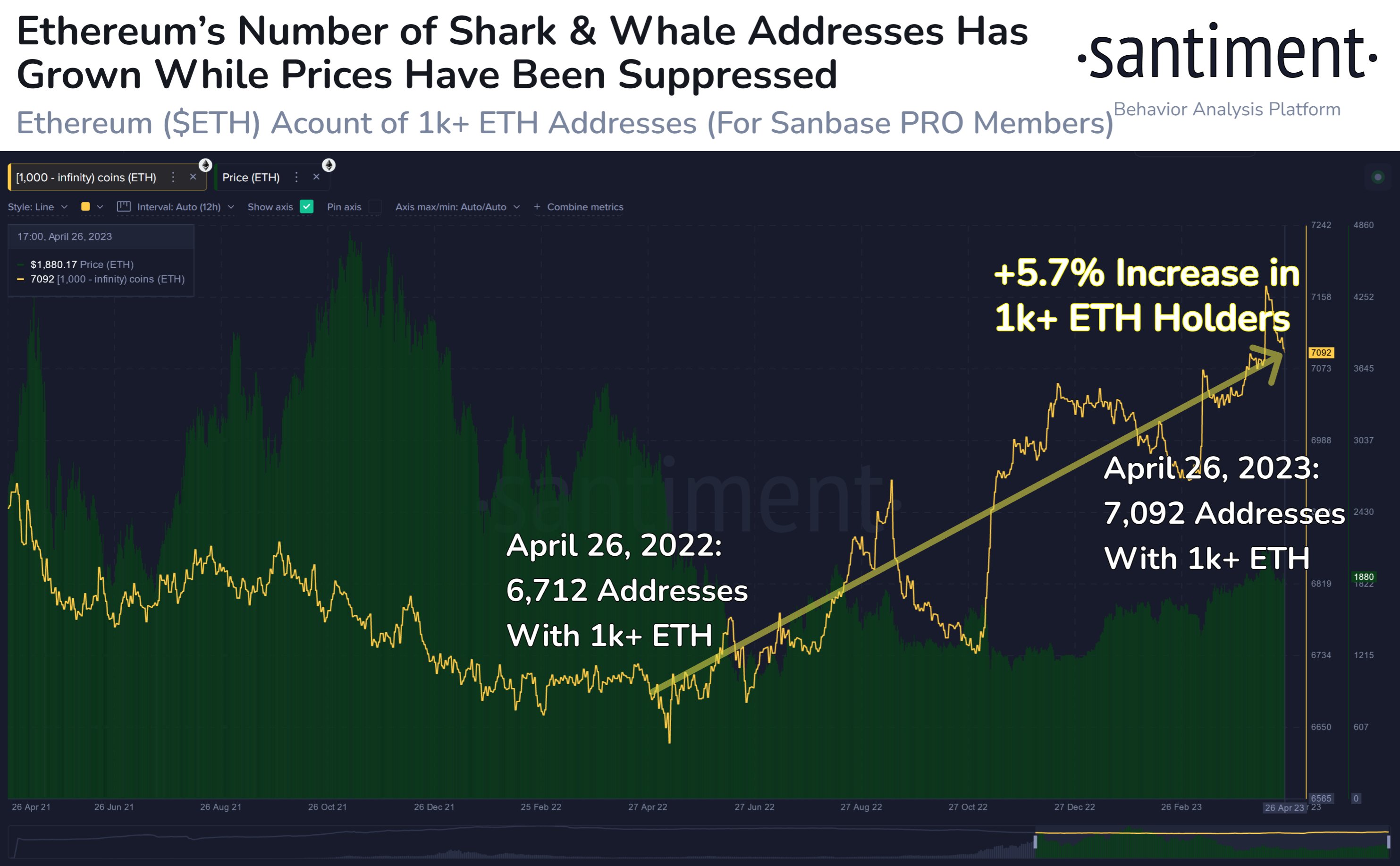

Market share hits multi-year highDespite ETH's price performance, institutional adoption of the Ethereum network continues to be accelerating.

Available data indicates that investors are not leaving the ecosystem for faster or cheaper alternative blockchains, a trend that defined the 2022 bear market.

For context, Ethereum’s dominance of the DeFi sector expanded throughout 2024 and 2025. The blockchain network's mainnet now secures approximately 64% of the total value locked (TVL) in DeFi applications, up from a cycle low of roughly 45% in 2022.

Leon Waidmann, the head of research at Onchain HQ, posited that the Ethereum ecosystem’s market share rises above 70% when assets held on Layer-2 networks like Base, Arbitrum, and Optimism, are included.

Etherem DeFi Dominance (Source: DeFiLlama)This consolidation suggests a “flight to quality” among large capital allocators.

As the industry matures, institutions are prioritizing Ethereum’s security and legal clarity over the speculative upside of newer, more volatile blockchains.

The network has effectively become the settlement layer for the industry, even as the specific mechanism for capturing value from that activity remains under pressure.

At the same time, analysts note that the ecosystem's stability stands in contrast to previous market cycles.

Transaction volumes are accelerating into the year-end without the “blow-off top” speculation typically seen during peaks, suggesting the growth is driven by fundamental usage rather than short-term trading frenzies.

Investors weigh utility against valueNonetheless, the widening gap between Ethereum’s operational success and its market valuation presents a complex outlook for investors heading into 2026.

The 10% year-to-date decline in ETH's price reflects uncertainty regarding the token’s role in this new low-fee environment.

With the mainnet effectively subsidizing the Layer-2 networks, the direct correlation between increased transaction volume and increased token price has been disrupted.

Related Reading Ethereum layer-2 solutions Linea and Polygon stumble with outages and finality delays Sep 10, 2025 · Oluwapelumi AdejumoMarket observers point out that while the ecosystem is healthier than ever, the financial benefits are currently siloed in the application and scaling layers.

However, the network supporters argue that this is a necessary transition phase. They argue that Ethereum has secured its position as the global standard for blockchain settlement by reducing costs and increasing capacity.

According to them, this moat that will eventually drive long-term value to the token with BitMine Chair Tom Lee believing the asset could rise above $5000 next year.

The post Ethereum lost over $100 million in fees this year, and one corporate giant kept the profit appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

New Year Bull (NYB) на Currencies.ru

|

|