2021-9-6 18:25 |

Ethereum was deflationary on September 3 as more ETH was burned than issued. This marks the first time Etheruem issuance turns negative after the EIP-1559 proposal, which added an element of deflation to the second-largest cryptocurrency by market cap.

On September 3, around 13,485 ETH were issued, while over 13,838 ETH were burned. Consequently, the net emission was around -353 ETH tokens.

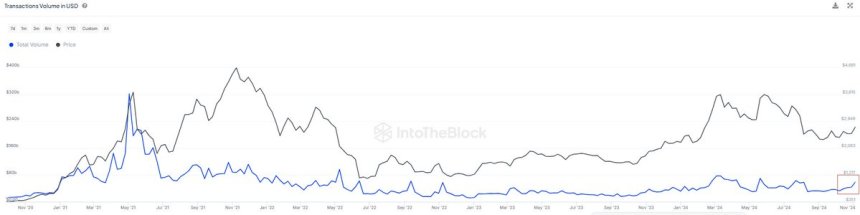

The unprecedented hype around NFTs is considered the main reason behind the deflationary day. Starting in late July, the market for non-fungible tokens saw a flood of attention. By August, the market processed over $3 billion worth of transactions, reaching a considerable new milestone.

While September 3 marks the only day Ethereum has been deflationary, there has been a considerable drop in the total number of ETH tokens issued following the EIP-1559 launch. Ethereum miners collected around 91,000 ETH as part of their mining revenue in July. However, that figure descended to approximately 61,000 ETH by August — representing a decline of 30% in ETH issuance.

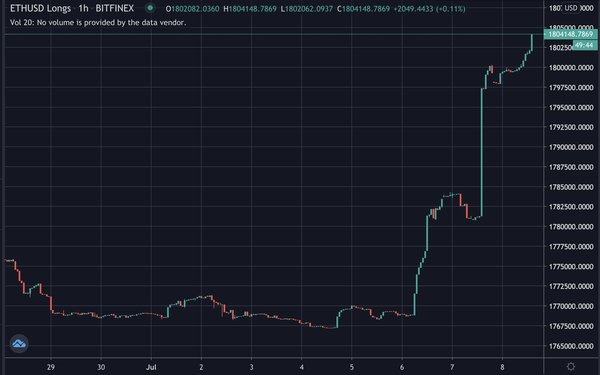

When Would Ethereum Become Deflationary?The long-awaited EIP-1559 proposal, which eventually launched on August 5, redesigned Ethereum’s fee mechanism. As part of the proposal, a portion of the ETH gas fee, dubbed “base fee,” is burned every time the network is used.

The amount of ETH being burned is directly related to how much the network is used. At times of high network congestion, the ETH issuance can turn negative, as this is the case with the deflationary day on September 3.

However, it is worth mentioning that EIP-1559 doesn’t make Ethereum a deflationary asset by default. Instead, the upgrade substantially reduces the amount of ETH being issued. Since going live on August 5, EIP-1559 has burned more than 213244 ETH, worth over $840 million at current prices.

As of now, around 5 ETH is burned every minute, while over 8 ETH is being created. Removing the 5 burned ETH, around 3 ETH is issued every minute. At this rate, over 4,000 ETH is issued daily.

Nevertheless, Ethereum would not become a deflationary asset until it completely transitions from PoW mechanism to PoS. This is the final stage of the Ethereum 2.0 upgrade, which is slated to launch in 2022. “Eth2 researchers are working on ways to accelerate the merge. It will probably happen earlier than expected. More soon,” the Ethereum website states.

origin »Bitcoin price in Telegram @btc_price_every_hour

Chronobank (TIME) на Currencies.ru

|

|