2021-10-28 13:35 |

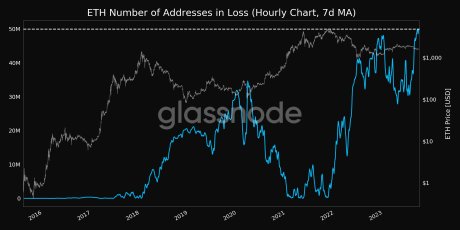

Ethereum slumped below $4,000 earlier yesterday amid market-wide pullback as long-term holders took profits, but a confluence of wildly-bullish factors suggests the bulls are about to roar.

Ether Primed For A Surge To $5KMike McGlone, a senior commodity analyst at Bloomberg Intelligence, harbors the opinion that Ethereum is right in the middle of the digitization of finance and money, which lays a strong foundation for further price spikes.

The growing popularity of both decentralized finance (DeFi) and NFTs have helped Ethereum to reaffirm market dominance. Ethereum is arguably the most popular blockchain in the crypto universe to use smart contracts which eliminates the need for centralized institutions like banks.

Additionally, ether is a commodity that is experiencing a supply crunch while the demand grows by leaps and bounds.

It is worth mentioning that the supply of ETH tokens has been shrinking ever since the blockchain’s London hard fork in August. In particular, the Ethereum Improvement Proposal 1559 introduced burning ETH that was previously paid to miners as rewards for validating transactions. The end result is that, with every new block created, some ETH is removed from circulation forever — essentially putting the brakes on the inflation rate and bolstering the price.

McGlone also believes Ethereum is well “rested and corrected” and riding the digitization wave. Just a week ago, the world’s second-most valuable cryptocurrency established a new all-time high above $4,366. ETH has, however, retraced since then and is changing hands at $4,165.45 at the time of publication, with 1.07 percent losses over the past 24 hours.

ETHUSD Chart by TradingViewThe combination of the indicators pointed out by the Bloomberg strategist paints a bullish picture for Ethereum’s future. Although the asset remains slackly in the bear territory at the moment, it seems to be just a matter of time before ETH enters its next rally.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|