2022-8-10 17:51 |

The crypto market is slowly recovering, and Ethereum (ETH) seems to be at the fore of the current rally. The second largest crypto asset by market cap has soared by surprising margins in the past week, with no visible signs of slowing down. This has birthed a lot of opinions from analysts about the asset’s subsequent direction, especially with the Merge gradually becoming a reality.

ETH up by over 50% in 30 daysLast month, the entire financial space looked out for the CPI data report from the Federal Reserve. The policy publication has shown historical potency of influencing any financial markets swayed by macroeconomic conditions.

The CPI report, as revealed on July 13, showed that there was a 9.1% increase in the inflation rate since last year. The data was shocking and devastating – investors expected the markets to plunge further, but that wasn’t the case for digital assets, especially ETH.

Upon the disclosure, ETH slumped below the $1000 mark before slightly rebounding to close the day at $1,113. The price of ETH has since then surged past $1,800 despite the unfavourable macroeconomic conditions. ETH has rallied by over 50% in 30 days, effecting over $600 million in Delta 1 short contracts liquidations.

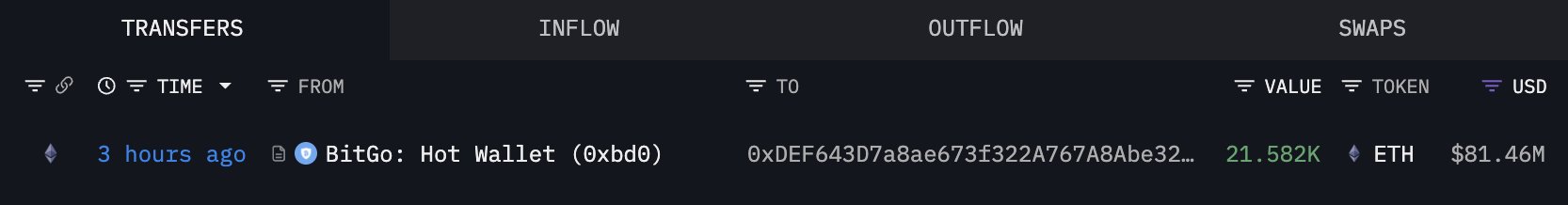

As The Merge draws closer, investors have pocketed some ETH, awaiting further upsurgeA few days ago, data from crypto analytics platform, CryptoQuant, indicated that a whale purchased about $1.7B in ETH futures contracts in only an hour, but this did not cause significant adverse effects on positions. The trading volume in the derivatives market had subsequently risen sharply, with long positions increasing as ETH stages a comeback. These metrics indicate that the asset’s rally was accelerating. The asset saw a slight drop to retest the $1,500 level before rising to $1,610 hours later.

The majority of the crypto markets are dependent on how Bitcoin (BTC) fares. The same applies to ETH despite outperforming the digital gold in the past week. Another major factor influencing ETH’s current rally is news of the events surrounding the much-anticipated Merge.

Also, following the Gray Glacier update and the successful merge of the Sepolia testnet, the Goerli testnet merge is expected to follow suit before the full mainnet Merge slated for September. The Goerli testnet merge is likely to occur on August 11. The build-up to this event has seen a lot of whales and investors load up on ETH as they expect a further upsurge.

ETH’s 24H trade volume went from $14.7 billion on July 18 to $20.3 billion as of press time. Market cap has also surged to $223 billion from the $133 billion recorded a month ago. The asset currently trades at $1,828.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|