2018-12-18 23:21 |

Ethereum’s 94% Loss This Year, Which Some Analysts Believe Is Justified

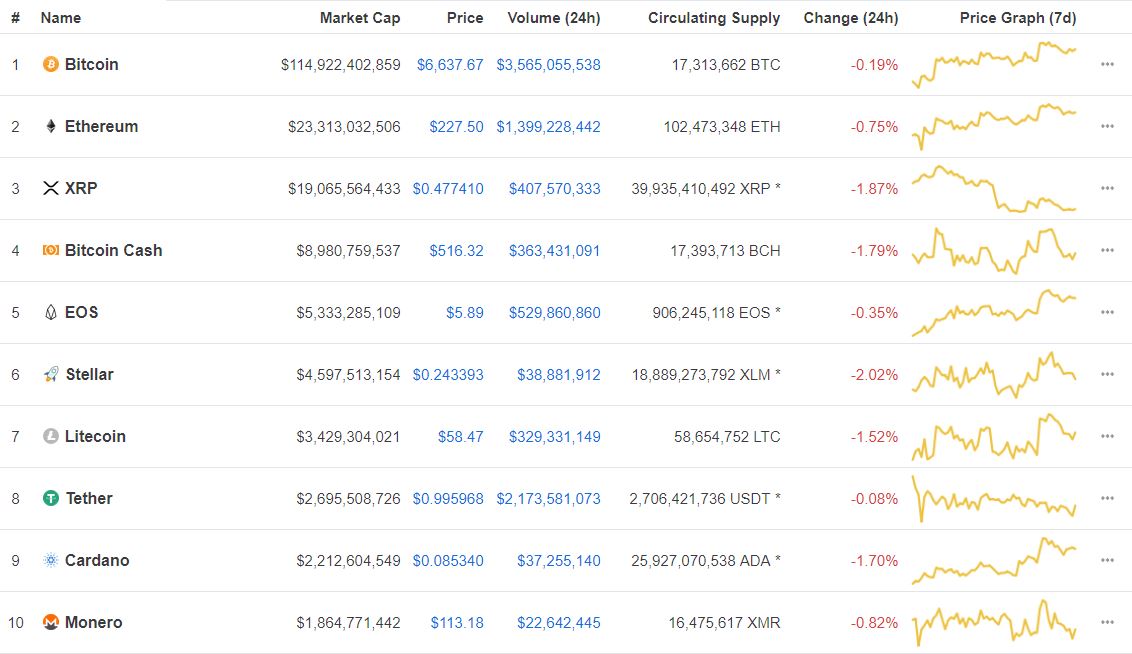

The cryptocurrency market has seen a relatively bad year, though every asset dealt with it differently. Bitcoin had some of the least amount of damages, amounting to 83% in losses, which is still fairly steep. However, for being one of the top three crypto assets by market cap, Ethereum’s 94% loss is substantial. Its performance has bumped it below Ripple’s XRP token, and many analysts believe that this downward path is justifiable.

Ethereum became a hot commodity in the beginning of 2017, leading investors to create an investment thesis around ETH. Between the success of ICOs and Ethereum’s ability to make them possible, they became the go-to platform for token sales. Ether’s value rose with the popularity of ICOs, and decentralized apps (dApps) became a major part of the crypto community as well.

Towards the end of 2017, it looks like Ethereum was comfortable, and investors continued to use it as a basis for startups. However, as soon as 2018 came, the startups and dApps created under Ethereum took a tumble, and Ethereum was highly criticized for the glitches and lack of scalability in their network. Regulatory agencies started going after ICOs as false promises were exposed, leading to attention from the U.S. Securities and Exchange Commission.

Essentially, as it is clear to see now, Ethereum hasn’t lived up to its hype, and hasn’t managed to reach the expectations that the entire market had for it. A 14-part Twitter threat was recently posted by Alex Kruger, a crypto-friendly market analyst, explaining the current predicament of the Ethereum Network.

Overall, Kruger has been largely cynical to altcoins anyway. In Ethereum’s case, he doesn’t hold back, saying that the only two purposes of it in the first place is to launch ICOs and create dApps. As for Ethereum’s demise, Kruger notes,

“What happened is simple to understand. ICO promoters caught the fragrance of easy money and embarked on an unbridled money printing race, by coming up with the most ridiculous ideas they could muster. Both the general public and venture funds gobbled these ideas enthusiastically.”

Even the projects that came to fruition without any scent of fraud on them haven’t been that successful. The users on these dApps are minimal, at best, and their lack of use is what drove Ethereum to lack of interest. Though Kruger’s rant was mostly over by the final comment, readers replied that he didn’t understand. To that, he replied,

“That is absolutely nonsense. Price was not supposed to crash 94%. Let’s not forget that until recently many were saying ‘there’s no bubble.’ This is how technology adoption looks like.”

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) íà Currencies.ru

|

|