2024-12-4 20:00 |

For the first time since its approval, Ethereum exchange-traded funds (ETFs) have recorded monthly inflows surpassing $1 billion, signaling a significant rise in institutional interest. This milestone coincides with ETH’s price climbing to $3,700, raising expectations for further gains in the near future.

With institutional demand poised to bring long-term stability, the substantial inflows suggest that Ethereum is becoming a preferred asset for diversified portfolios. How will this affect ETH’s price?

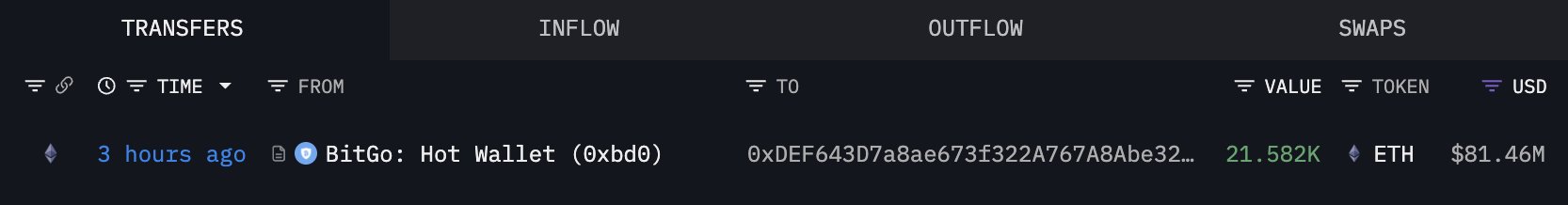

Ethereum Sees Improved Institutional InterestIn September, Ethereum ETFs faced a tough month with net outflows of -22,678 ETH, indicating weak investor demand. However, October saw a dramatic rebound, with 218,878 ETH in inflows, showing a surge in investor interest.

November continued the positive momentum, with Glassnode reporting a significant jump to 288,733 Ethereum ETF monthly inflows — the highest since the ETF’s approval in July. With ETH trading above $3,700, this surge translates to a remarkable $1.06 billion, marking a key milestone for the altcoin.

This influx of capital signifies a bullish outlook for Ethereum. Just as Bitcoin’s price soared to new all-time highs following consistent inflows in the billions, Ethereum could be poised for a potential price rally in the short term, echoing the same pattern.

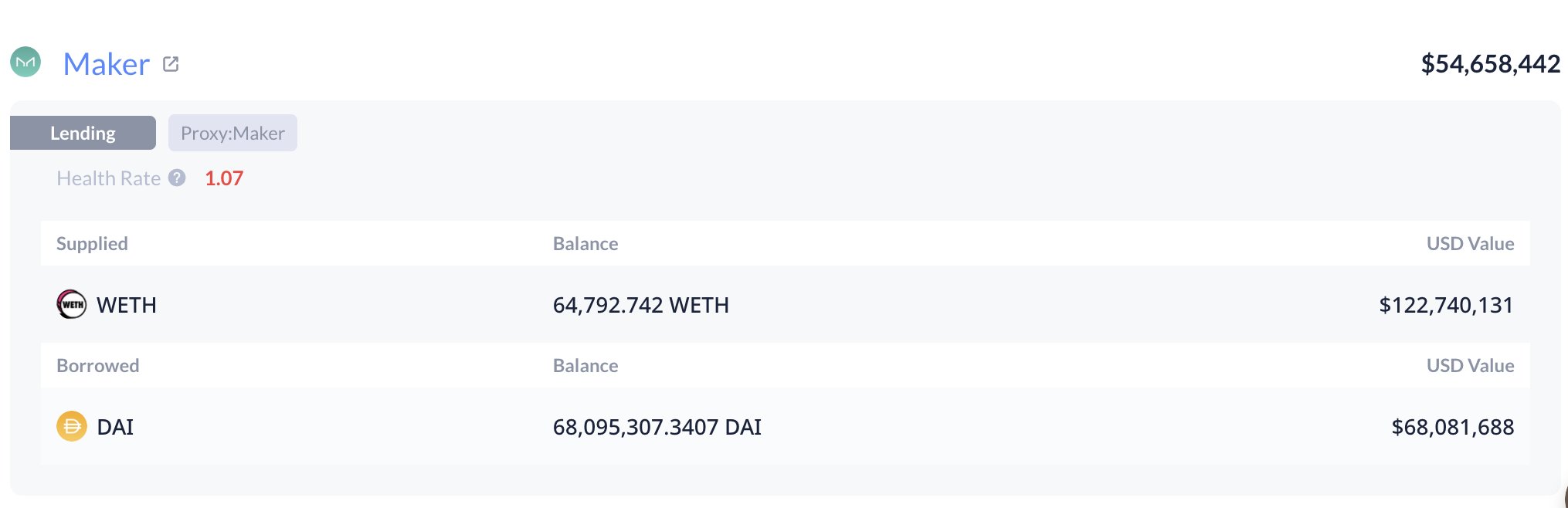

Ethereum ETF Monthly Netflows. Source: GlassnodeFurthermore, the Historical In/Out of Money (HIOM) also supports this outlook. The HIOM metric tracks the variation in holders’ profits over time, revealing the percentage of addresses that would have made or lost money if they had sold at any given point.

It also highlights which side holds the momentum — buyers or sellers — offering critical insights into market sentiment. Typically, a decrease in the number of addresses in the money discourages potential buyers from accumulating, indicating a bearish outlook.

However, in Ethereum’s case, the ratio of profitable holders has risen. This increase suggests that more participants could be incentivized to buy the altcoin or invest in the ETF. If this trend continues, it could drive ETH’s value higher.

Ethereum Historical In/Out of Money. Source: IntoTheBlock ETH Price Prediction: Hike to $6,000 This Cycle?On the weekly chart, Ethereum is mirroring a previous pattern, with its price peaking at $4,891 in November 2021. Prior to that, a significant correction occurred between February and March 2020.

A similar pattern unfolded from May to November this year, and with a bullish reversal already underway, Ethereum appears ready to challenge its all-time high.

Ethereum Weekly Analysis. Source: TradingViewIf this trend holds, ETH could surge toward $6,000 within a few months. However, this bullish outlook hinges on continued institutional and retail demand. Should Ethereum ETF monthly inflows falter, this prediction may not come to fruition

The post Ethereum ETF Monthly Inflows Surge Past $1 Billion: Impact on ETH Price appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

EthereumFog (ETF) на Currencies.ru

|

|