2020-8-20 06:00 |

Most readers are likely aware of Yam Finance, an Ethereum-based decentralized finance project that took the industry by storm last week. Announced just earlier this month by five developers in the space, the project, whose native token is YAM, exploded out of the gate.

Within the span of a few hours, YAM grew to a market capitalization in the millions. Also, the value of cryptocurrencies locked in the Yam Finance protocol reached hundreds of millions. At its peak, there was more than $650 million worth of Ethereum, Maker, Compound, Synthetix, and other altcoins allocated to Yam smart contracts.

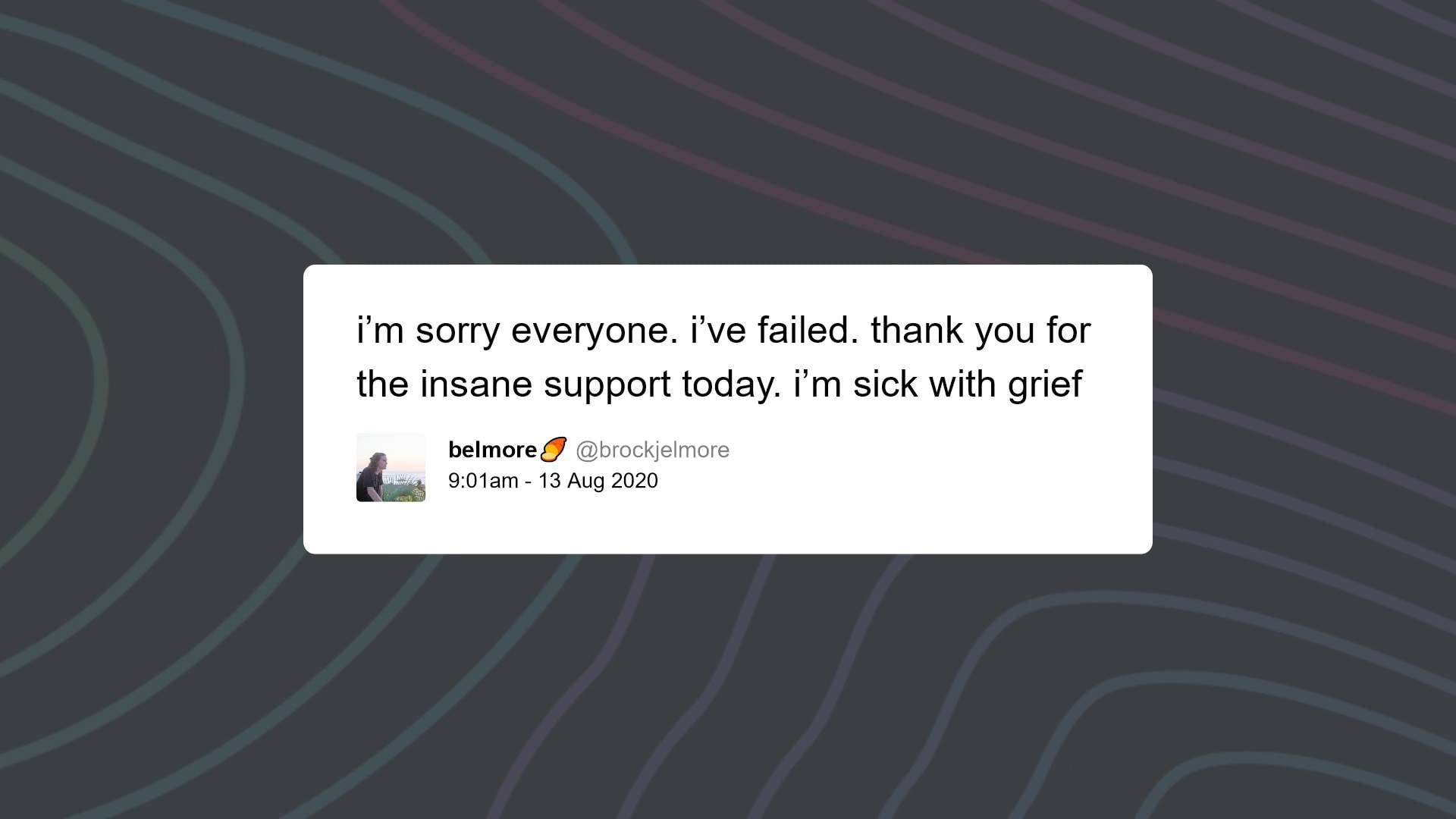

But just two days after it launched, Yam imploded due to an issue with a core contract mechanism. The $650 million worth of assets locked in the contracts was safe, but there was a bug that made YAM basically worthless.

The bug also ensured that approximately $500,000-750,000 worth of yCRV was lost to the ether.

Related Reading: Crypto Tidbits: MicroStrategy’s $250m Bitcoin Purchase, Ethereum DeFi Boom, BitMEX KYC Ethereum’s Yam Finance Protocol Is Being RevivedDespite some cynics claiming that YAM was a total failure, the community wanted to revive the protocol after it crashed in spectacular fashion.

Just a day or two after Yam underwent its initial implosion, the developers of the project said that they were looking into relaunching the project without bugs (hopefully):

“The community has clearly been supportive of a YAM relaunch with proper auditing, and it has been engaged and helpful in generating ideas regarding how to proceed. This engagement is exactly what we hoped YAM to achieve, and we believe the best solution is to get power to this community as simply and efficiently as possible. Once this is achieved, YAM holders will be able to continue to decide the path of the protocol.”

According to a blog post published on August 19th, the project will be undergoing a migration starting now:

“Following a successful audit of the migration contract from Peckshield, which can be viewed here, we are proceeding with the YAMv1 to YAMv2 migration process. The audit process found only issues of “Low” or “Informational” severity, all of which have been addressed.”

It is unclear if Yam Finance, with new code under its belt, will garner the support it saw last week.

Related Reading: Is BTC Really In a Bull Market? Here’s Why Analysts Think BTC Isn’t Countless CopycatsYAM has seen countless copycats since its implosion last week.

There are projects like Pasta, Based, and Shrimp that have attempted to replicate the premise and ethos of Yam.

Yam’s re-launch, though, may depress these assets as capital and interest flows back into the “OG” protocol.

Related Reading: Crypto Tidbits: Goldman Stablecoin, Dave Portnoy Wants BTC, DeFi Boom Featured Image from Shutterstock Price tags: ethusd, ethbtc, yamusd, yambtc Charts from TradingView.com Ethereum DeFi's Hottest Project YAM is Being Revived After Implosion origin »Bitcoin price in Telegram @btc_price_every_hour

Hive Project (HVN) íà Currencies.ru

|

|