2025-12-31 14:30 |

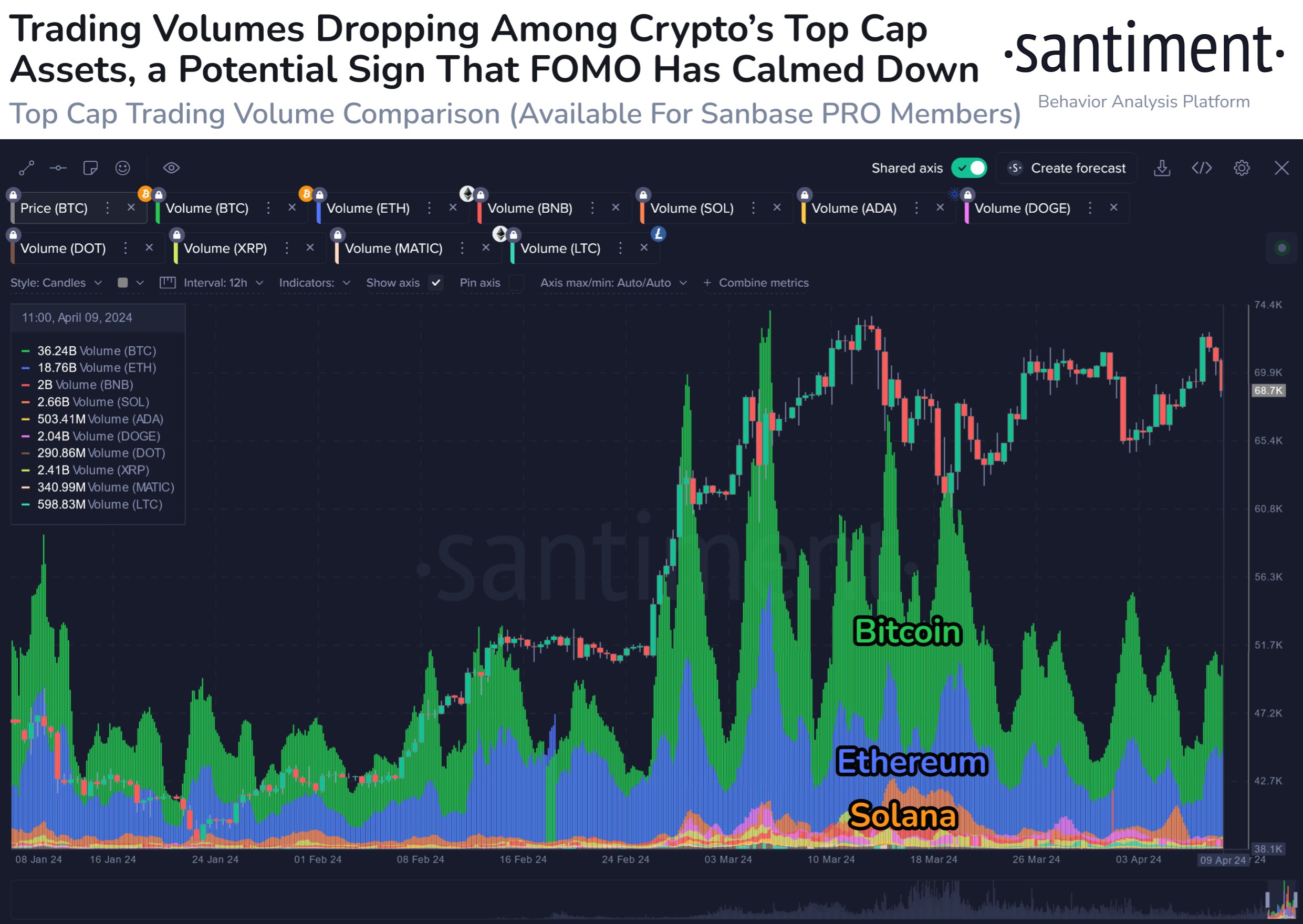

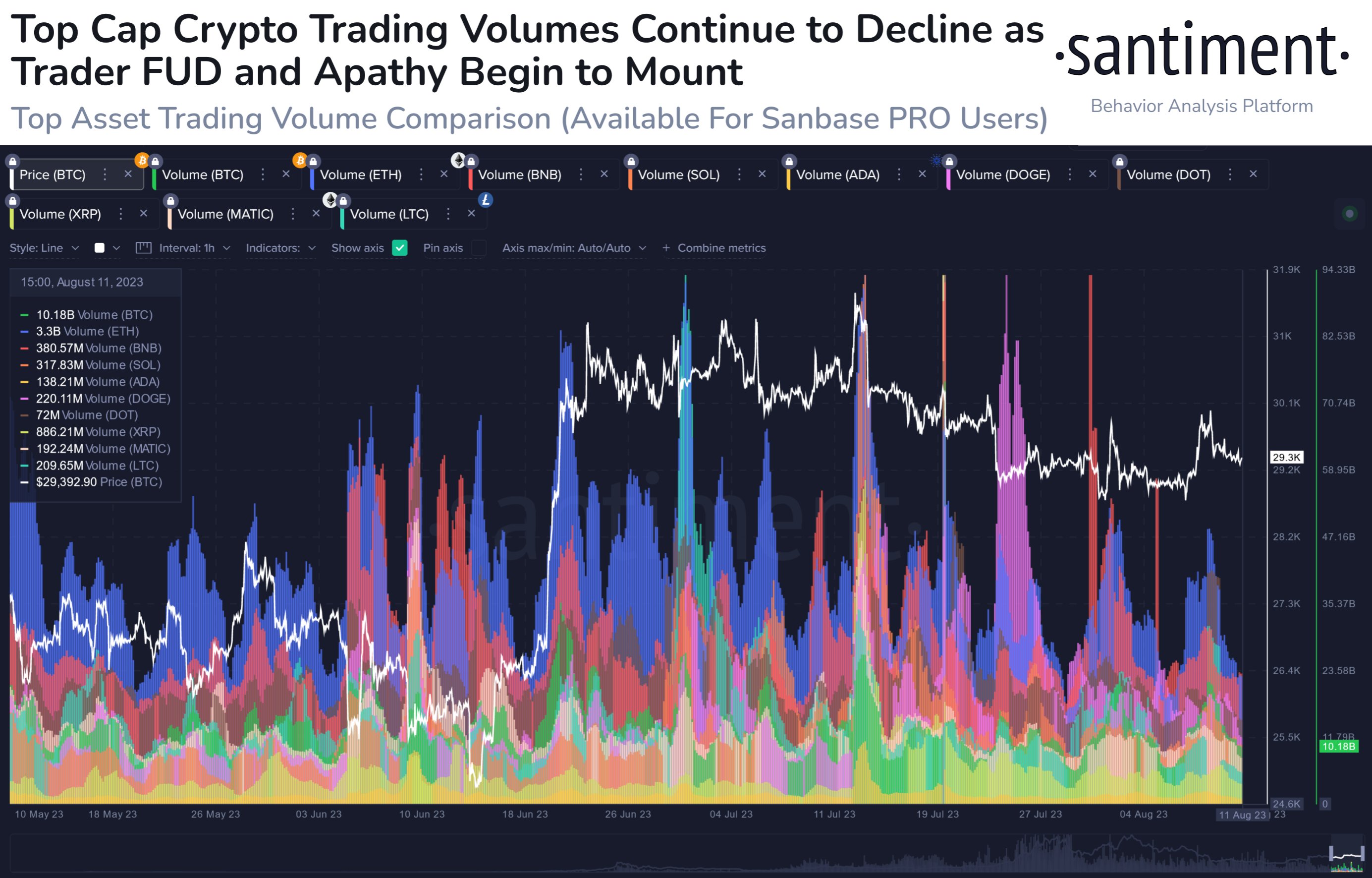

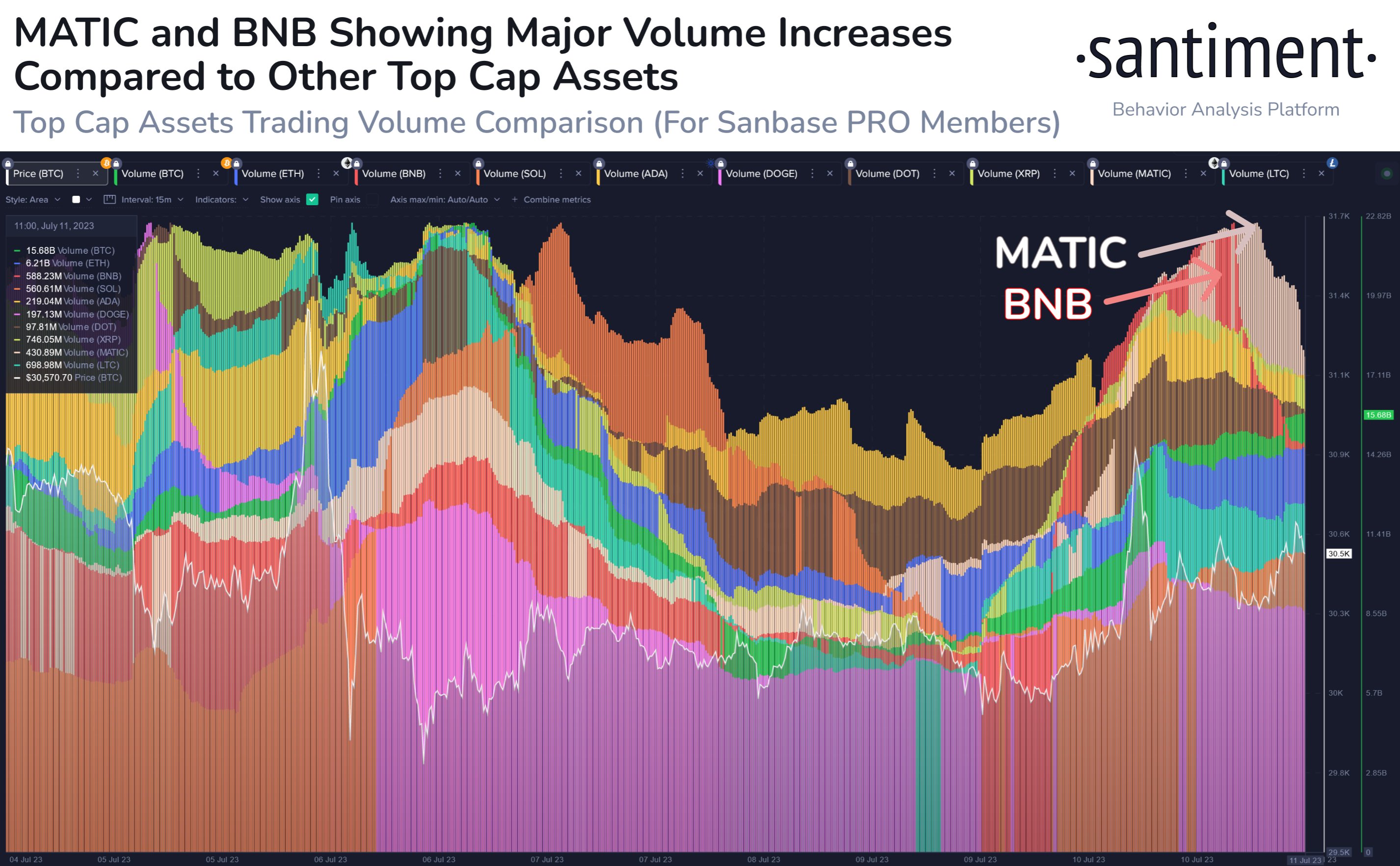

A new Santiment post is pointing to something traders can feel without even checking a chart: activity has gone quiet. According to Santiment’s tweet and the Sanbase chart attached, weekly trading volume across top-cap coins has slipped to year-low levels during the second half of December, with the current 2-week stretch ranking as the weakest since the same period last year.

The chart tracks the past year of weekly trading volume across major assets, with Bitcoin and Ethereum standing out the most on the visual. Bitcoin’s volume (the large green area) surged during the mid-year and early Q4 swings, then faded hard as December progressed. Ethereum’s volume (the large blue trace) follows the same story, but the drop into late December looks even more pronounced relative to earlier peaks.

Source: X/@santimentfeedWhat makes the comparison interesting is the side-by-side framing of December 2024 versus December 2025. Last year, volumes dipped during the holidays, but there was still visible movement across Ethereum and large altcoins. This year’s right-side cluster looks flatter and thinner, and the smaller lines for assets like Solana, Cardano, Dogecoin, XRP, and others sit much closer to the baseline. In plain terms, the market is still open, but participation looks missing.

That matters because volume is the fuel that makes breakouts and breakdowns “stick.” When volume dries up, price can drift sideways for longer than expected, and moves that do happen can look random. Thin liquidity also means sudden spikes can appear out of nowhere, but they often fade quickly because there isn’t enough follow-through.

Read also: The Revenue Flippening Is Here: Solana (SOL) Set to Pass Ethereum (ETH)

What this could mean for early JanuaryThe most normal outcome is a volume rebound in the first full trading week of January as desks come back online and positioning resets. If Bitcoin wakes up first, altcoin volume usually follows with a lag, but only if BTC provides a clean directional move. If Bitcoin stays range-bound, the chart’s “stall” behavior can easily extend into early January as traders wait for a catalyst.

A more volatile scenario is also possible: low liquidity can turn a single impulse move into a sharp wick, especially if leverage is crowded. If that happens, the first clue usually shows up in volume before the trend shows up in price.

Either way, Santiment’s main signal is simple. Into year-end, Ethereum and large-cap altcoins are trading with half-speed participation. For the market to feel alive again in January, volume has to return first.

Read also: ChatGPT Predicts the Hedera (HBAR) Price in January

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

The post Ethereum, Cardano, and Altcoin Volume Dries Up as Crypto Markets Stall Into Year-End appeared first on CaptainAltcoin.

origin »Bitcoin price in Telegram @btc_price_every_hour

Volume Network (VOL) на Currencies.ru

|

|