2020-9-6 14:44 |

The price of Ether (ETH), the native currency of the Ethereum blockchain network, sharply dropped by 27% in five days. Yet, the amount of ETH locked in decentralized finance (DeFi) suggests a medium-term bullish trend.

The price of Ethereum since February. Source: TradingView.comAccording to Ryan Sean Adams, the founder of Mythos Capital, the DeFi space has not seen new entrants yet.

Adams hinted that most of the DeFi usage comes from long-time cryptocurrency users. When new users enter the DeFi market, it could fuel newfound demand for ETH.

Why it is optimistic for Ethereum in the longer termSince July 1, the total value locked in DeFi protocols rose from less than $2 billion to $8.42 billion.

The sharp increase in DeFi activity coincided with an ETH rally, causing the cryptocurrency to surge.

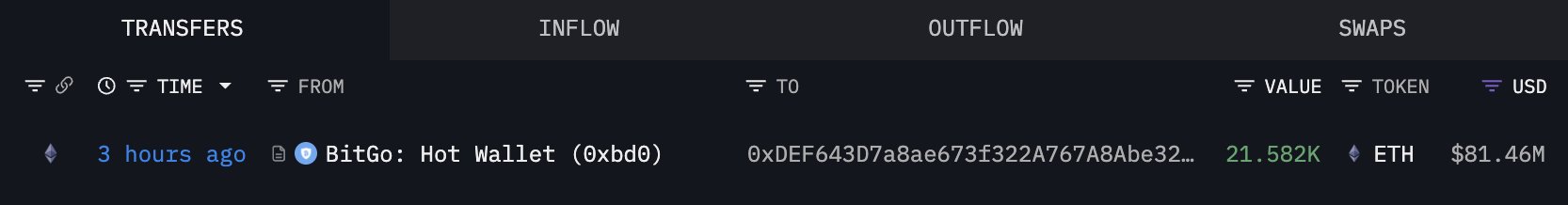

6.888 million ETH locked in DeFi. Source: Ryan Sean Adams, Defipulse.comOn the Ethereum blockchain network, users rely on ETH to process transactions or smart contracts. The fees on Ethereum, often called “gas” have spiked after the DeFi market started to become more crowded.

The confluence of the growing demand for gas and the clogging Ethereum network likely fueled the upsurge of ETH.

In the months ahead, Adams said he is “waiting for a spark.” When “fresh blood” enters the market, it could further buoy ETH. He stated:

“Almost 7% of ETH supply is locked in DeFi But ETH price isn’t rising… why? My theory: this lockup, all the recent DeFi activity, it’s all crypto natives, ppl already long ETH, no fresh blood We haven’t seen the wave of new entrants yet. This is kindling. Waiting for a spark.”

There are two roadblocks to the mainstream adoption of DeFi.

First, the high fees make it difficult for new users to navigate. Users would have to calculate gas costs, raise to premium rates on non-custodial wallets like Metamask, which complicates the process.

Second, DeFi protocols are challenging to use for new users, as there are no third parties users could depend on.

Over time, analysts expect the user experience of DeFi to become simpler, enabling an increase in new users.

Supply crisisWhen the number of ETH on DeFi surpassed 5 million, Ethereumprice.org founder “0xNick” said a supply crisis is forming. He said:

“ETH leveraged in #DeFi has passed 5,000,000 or ~4.50% of total circulating supply. It’s quite clear there’s a supply-side liquidity crisis forming here. yETH and Phase 0 will compound this.”

Whether the heightened level of selling pressure on both Ethereum and Bitcoin would hinder the momentum of DeFi remains uncertain.

The majority of yield on DeFi protocols came from new governance tokens. In a steep ETH sell-off, the possibility of a governance token dump intensifies, which could reduce yield in the near term.

The post ETH plunged, but 7% of Ethereum supply in DeFi is a mid-term bull sign appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|