2024-5-28 00:33 |

Kaiko Research said on May 27 that spot Ethereum ETF approvals are a positive sign for the digital asset’s long-term growth despite potential short-term headwinds.

According to Kaiko’s report, the approval has removed much of the regulatory uncertainty around Ethereum’s classification as an asset class.

Will Cai, Head of Indices at Kaiko, said the approval means the SEC is implicitly treating ETH as a commodity rather than a security. He added:

“[The approvals have] significant and likely positive ramifications on how all similar tokens will be regulated in the US …”

Contrary to earlier expectations, the SEC approved the ETFs’ 19b-4 filings on May 23. The agency must still approve S-1 orders. Spot Ethereum ETFs are expected to launch in the coming weeks or months.

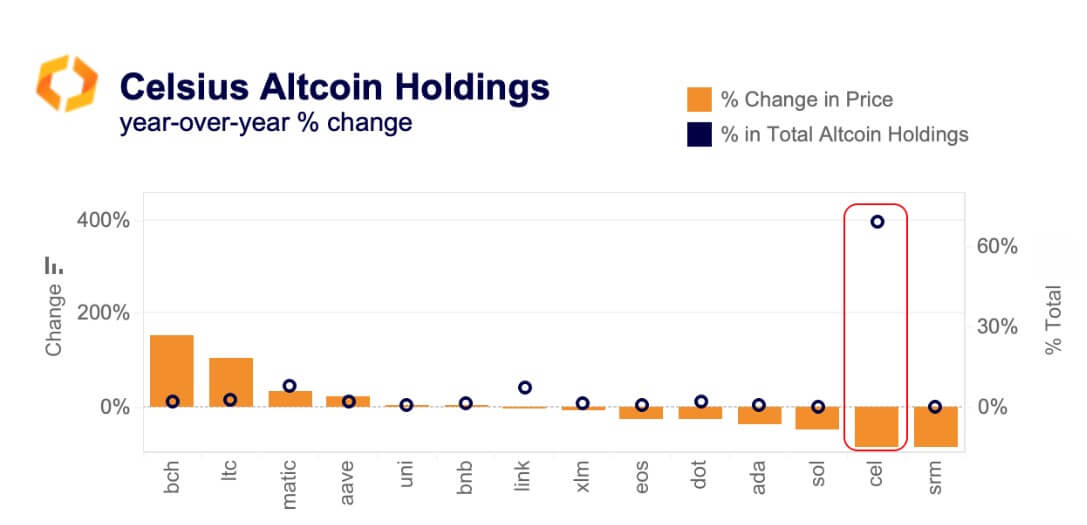

Grayscale may see outflowsDespite its optimism around regulatory changes, Kaiko believes that Grayscale’s ETHE fund will likely experience outflows, which could put selling pressure on ETH as the new funds begin trading.

It wrote:

“The overall market impact of ETHE’s redemptions is still uncertain.”

Grayscale’s ETHE currently has $11 billion in assets under management (AUM). Kaiko anticipates the fund will experience $110 million of average daily outflows after it begins trading as an ETF.

By comparison, Grayscale’s Bitcoin fund, GBTC, saw outflows amounting to $6.5 billion or 23% of its AUM during its first month of trading as an ETF.

Furthermore, other ETFs’ inflows offset or exceeded GBTC outflows by the end of January.

Hong Kong ETFsKaiko also drew attention to Hong Kong’s ETH ETFs. The company said the foreign funds’ “lackluster” launches point to further uncertainty on how ETHE redemptions will impact the market.

Based on separate data from Farside, Hong Kong’s spot ETH ETFs have seen $4.4 million in net outflows since their launch in early May.

Finally, Kaiko commented on centralized exchange data. ETH’s market depth is close to $226 million, or about 42% below its pre-FTX average levels. ETH is only 40% concentrated on US exchanges, down from 50% in early 2023.

The post ETF approvals will boost Ethereum’s long-term growth despite short-term headwinds – Kaiko Research appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|