2020-2-27 01:42 |

The ETC price has been decreasing since reaching a high of 140,000 satoshis on February 6. However, it is very close to reaching a significant support area and is trading inside a bullish reversal pattern.

Ethereum Classic (ETC) Price Highlights The price is trading inside a descending wedge. A golden cross has transpired. There is support at 70,000 satoshis. There is resistance at 115,000 & 140,000 satoshis.Full-time trader @AltcoinSherpa outlined an ETC price chart that shows the price consolidating near an important long-term support level at 90,000 satoshis. He believes that the ETC price will increase and gives a target of 112,000 satoshis for the future movement.

$ETC #EthereumClassic $ALTS: Price still consolidating in this current region, no real dump yet. This 1W lvl at 97k sats is strong support for now. 50D EMA is acting as a resistance lvl for now, would not want to see 88-91k sats lost. pic.twitter.com/BeqwWTTQPr

— Altcoin Sherpa (@AltcoinSherpa) February 25, 2020

Will the ETC price reverse and head towards the target or will it break down instead? Continue reading below if you want to find out.

Important ResistanceThe main resistance area is found at 140,000 satoshis. It acted as support throughout 2017 and 2018 before it turned to resistance in November 2018. Afterward, it rejected the price several times, most recently in February 2019.

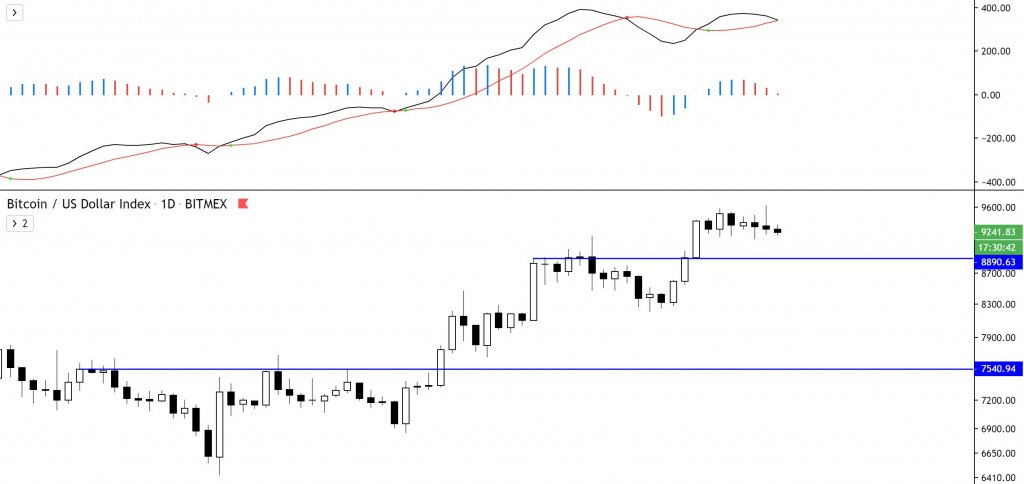

The weekly RSI is approaching the 50-line. As long as it is above it, we can say that the price is in an upward trend. So, in order for the price to remain in such a trend and eventually make another attempt at breaking out, the RSI has to bounce at the 50-line and begin moving upwards.

Let’s take a look at the daily chart and see if a reversal area is close.

Descending WedgeThe daily chart reveals that the shorter-term price movement can be considered bullish.

First, the price is possibly following an ascending support line, beginning on December 17, 2019. Also, it could be trading inside a descending wedge. It is interesting that the end of the wedge coincides with this possible ascending support line, making it an extremely suitable place to initiate a reversal.

The bullishness is aided by the golden cross, a bullish cross between the 50- and 200-day moving averages (MA).

If the price breaks down from this formation, it is likely to find support at 70,000 satoshis, right above the 200-day MA.

ETC Possible BreakoutThe short-term term chart reveals a clearer picture of the descending wedge, which is projected to end on March 7 at the latest.

Furthermore, we can see some bullish divergence developing in the RSI, which was rejected by the 50-line several times. If the RSI continues with its trend, it will likely move above 50 as soon as the price breaks out.

Since the wedge is a bullish formation, we expect a breakout from the wedge soon.

To conclude, the ETC price has been decreasing since February 14, trading inside a descending wedge. We believe it will break out from this pattern and head towards 115,000 satoshis.

The post ETC Could Soon Break out From Its Bullish Pattern appeared first on BeInCrypto.

origin »Ethereum Classic (ETC) на Currencies.ru

|

|