2018-8-14 12:50 |

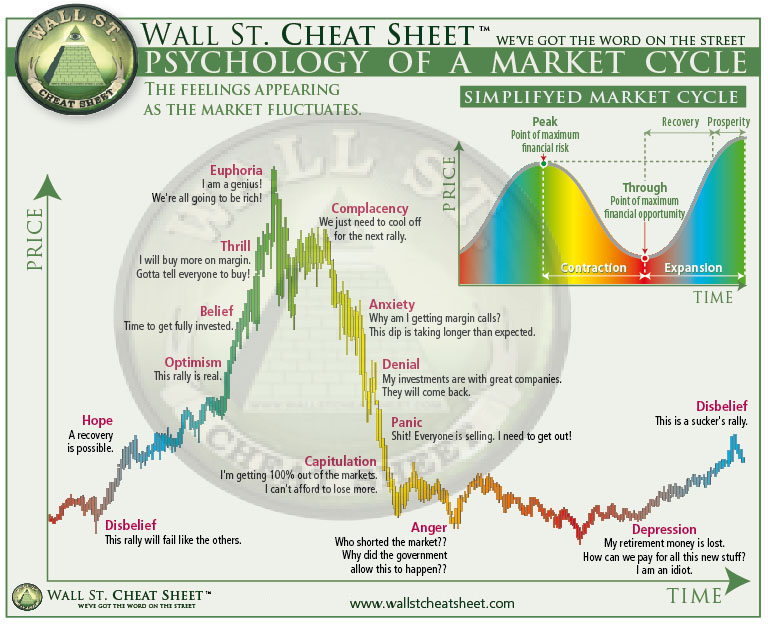

EOS is a bear market. The current bearishness has a high probability of continuation – a characteristics of a persistent trending market. Long positions would not be rational until it is clear there is a change in the outlook on the market.

EOSUSD Long-term Trend: BearishResistance levels: $6, $7, $8

Support levels: $3, $2, $1

EOSUSD bearish trend extended further to the south in the daily chart, and broke the last week support level at $5. The pair is approaching another support level of $4. The current price action shows the possibility of price going further downwards, aiming at the support level of $3. The Stochastic Oscillator Period 14 is below the level 10 and still points to the downside, which indicates that the market is oversold. There may be a bullish effort along the way, but it is going to be temporary.

EOSUSD Price Medium-term Trend: BearishLast week, the crypto was bearish. The price broke to the downside after consolidating around the resistance level at $6, the 10-day EMA is below the 50-day EMA (far apart from each other). The price broke the market level at $5 which exposed it to the strong support level at $4. More selling pressure in the market could led to further downwards movement.

Presently, the price is retracing towards the level of $5, touching the 10-day EMA. In case EOS price goes up to the resistance level at $6 with the price action formation of bullish engulfing candle that may signal a bullish signal, which would propel the market towards the north.

There is currently some form of consolidation in the market, which denotes a “pause” before the market resumes its movement, and it would most probably be in favor of bears. Nonetheless, the more the market goes bearish, the more the chances of a strong bullish reversal.

The post EOS Price Analysis: Trends of August 14 – 20, 2018 appeared first on CoinSpeaker.

origin »Bitcoin price in Telegram @btc_price_every_hour

EOS (EOS) на Currencies.ru

|

|