2022-9-6 19:15 |

Bitcoin was created after the last big recession in 2009, but this time around the rules of the game have changed.

In a post-truth world U.S. economists are now unable to agree on whether a U.S. recession is likely or not, has started or has not, or even how to define a recession.

The Federal Reserve (Fed) continues to pursue a policy of aggressive fiscal tightening to combat high inflation, currently at 8.5%, suggesting that a sustained economic contraction is ever more likely.

If such a scenario should pass, or has passed, what does it mean for crypto and Bitcoin?

What or which recession?Until recently a recession referred to two consecutive quarters of falling Gross Domestic Product (GDP). With the U.S. economy on track for two consecutive quarters of falling GDP, a White House blog asked, “How Do Economists Determine Whether the Economy Is in a Recession?”

Answer: by any other measure than two consecutive quarters of falling GDP.

According to the White House, a recession should instead be identified by taking a “holistic look at the data,” including the labor market, spending, production and incomes. In the U.S. the National Bureau of Economic Research (NBER) performs that research, with “no fixed rules or thresholds” to determine what they are assessing.

With the word recession eroded into meaninglessness, U.S. economists are free to debate any position they like based on whatever meaning they choose.

Choose your recession wiselyOver the past few months a parade of economists and industry leaders have talked to broadcasters and media outlets to offer their analysis on whether a recession is likely or not. In a CNBC retrospective analysis, the broadcaster summed up just some of the contradictory opinions they had recently received.

Steve Hanke, a professor of applied economics at Johns Hopkins University, firmly believes the U.S. is headed for a major decline. “We’re going to have one whopper of a recession in 2023,” he told the broadcaster.

Nobel Prize-winning economist Richard Thaler could not disagree more. According to Thaler, the U.S. isn’t entering “anything that resembles a recession.”

Stephen Roach, of Yale University, told CNBC believes a recession is incoming, but it won’t be as bad as in the early 1980s.

To clear up any potential confusion, Steen Jakobsen told viewers that the U.S. is not heading for a recession in nominal terms, even if it is in real terms.

Meanwhile, Liz Ann Sonders at Charles Schwab says a recession is more likely than a soft landing.

A crash course in soft landingsA soft landing is the term the Federal Reserve (Fed) uses to describe a scenario in which inflation can be brought down without causing a recession. Increasingly the notion seems like a fair weather fantasy with no basis in reality.

In an Aug 26 speech in Jackson Hole, Wyoming, Jerome Powell seemed to indicate that their soft landing was abandoned. The Fed would now pursue sustained “below-trend growth,” widely understood to mean a “growth recession.”

For clarity, the Fed will persevere with fiscal tightening measures until the joblessness rate rises, while the government and National Bureau of Economic Research continues to deny there is a recession.

Bitcoin and the r-wordBitcoin was born out of the last recessionary cycle in 2009 following the banking crisis of the previous year. If the U.S. economy can ever be officially described as in recession or in a recession-like environment again, then it would be the first U.S. recession of Bitcoin’s lifetime.

How Bitcoin reacts to this kind of economic environment is understandably a major point of interest for crypto heads, and so far, the signs seem to indicate not well.

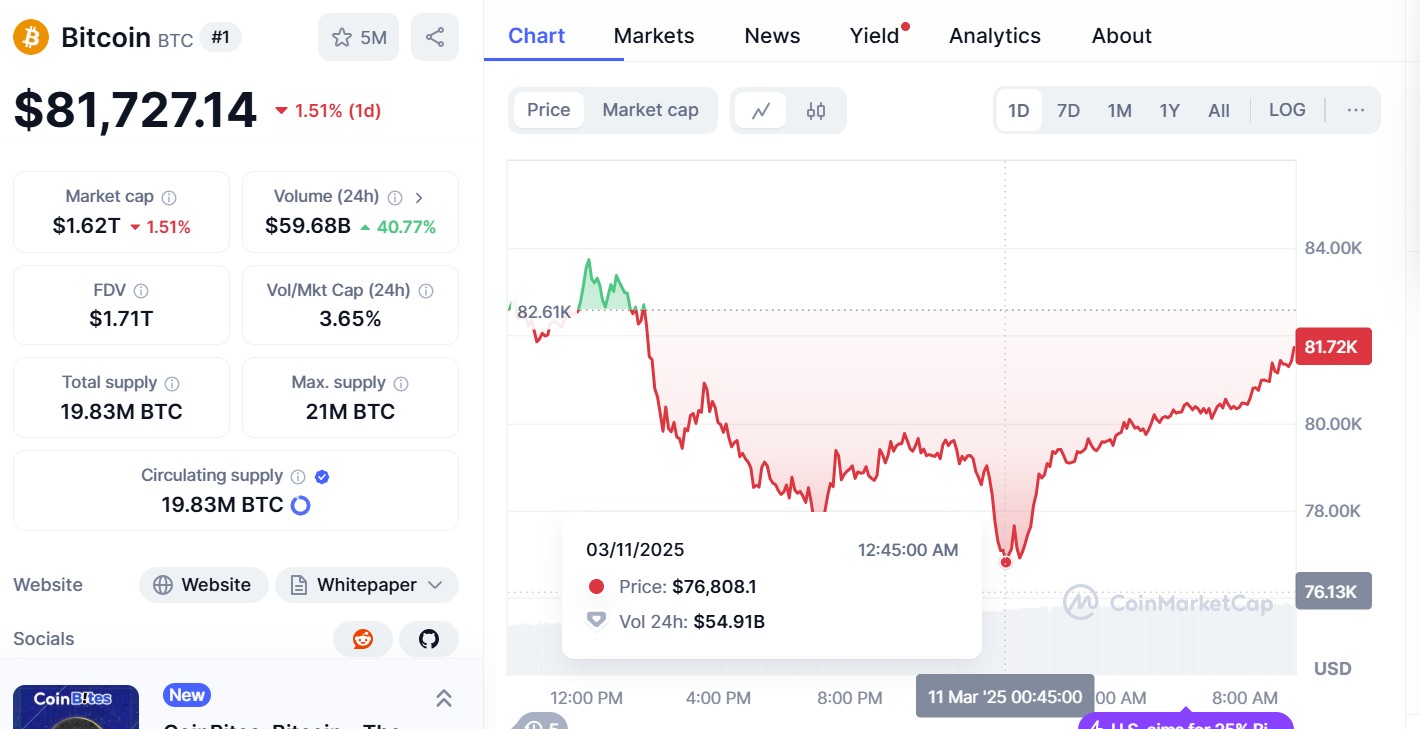

No matter how economists or politicians might choose to define the r-word, Bitcoin prices are either high or low. BTC is currently down 71% from an all-time high of $69,044 in Nov. The cryptocurrency is also down 57% from the start of the year, and 14.8% in the previous 30 days.

It appears that Bitcoin is by no means immune to economic troubles in the economy or traditional markets. Debate on the matter rages on.

Bullish BTC advocates such as Eric Wall argue that the currency is at or around “fire sale” levels, a position that others in the industry have echoed. Earlier last month, Senior Bloomberg Analyst Mike McGlone declared that Bitcoin is trading at a massive discount.

Outside the crypto industry, traders are less optimistic, with 63% of desks expressing bearish sentiments, according to the financial services company Charles Schwab.

The prevailing logic held by many in the cryptosphere is that Bitcoin would perform very well in a high inflationary environment. Recent price activity has seemingly poured cold water over this idea, but according to Steven Lubka, managing director of Private Client Services at Swan Bitcoin, it all depends on how you define the word inflation.

Lubka states that there is more than one type of inflation. One type in which Bitcoin performs very well and another in which it doesn’t. Right now, we are in the latter inflationary environment.

So how do you define inflation? That is another rabbit-hole entirely.

The post Economists Split on US Recession, so What Now Bitcoin? appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|