2020-3-5 13:00 |

Bitcoin is now worth $161 billion, with strong infrastructure established by the world’s largest financial institutions and conglomerates in the likes of Fidelity, CME, and Square. 9 years, ago, the market capitalization of BTC was valued at less than $21 million.

Bitcoin HODLers are not “lucky”The Bitcoin market tends to undergo a cycle of the bear market-accumulation-build phase-bull market every two to three years.

Due to its nature as an emerging asset, both bear and bull market trends often last longer than the expectations of investors.

During a bear market, a long-lasting correction typically comes to an end when market sentiment switches to the extreme when the majority of investors begin to wear off and the market shakes off weak hands.

In crypto, investors that hold Bitcoin through bear and bull cycles with a long-term investment thesis are called HODLers. After every major bull cycle, HODLers are frequently described as “lucky” investors that happen to purchase BTC at a low price.

But, a discussion about BTC in 2009 on a well-known forum shows the firm long-term belief in Bitcoin by HODLers.

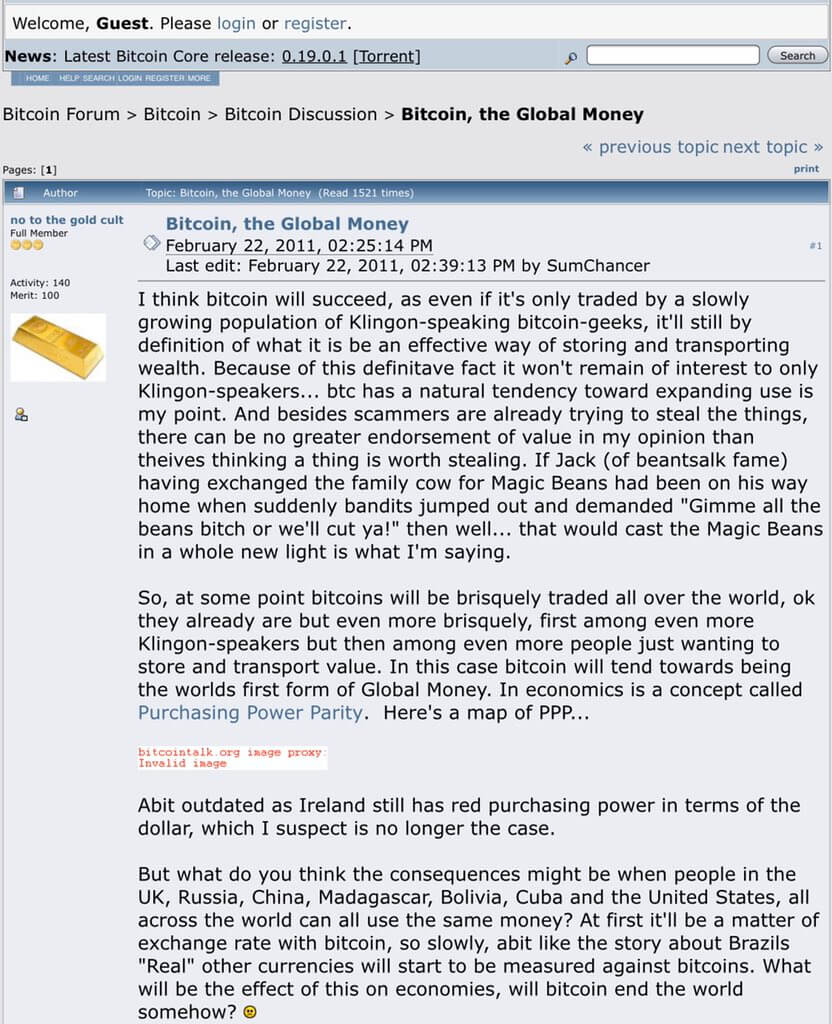

On a thread entitled “Bitcoin, the Global Money” opened on February 22, 2011, one investor said:

“I think bitcoin will succeed, as even if it’s only traded by a slowly growing population of Klingon-speaking bitcoin-geeks, it’ll still by definition of what it is to be an effective way of storing and transporting wealth.”

The investor noted that while BTC may start out as a new currency for small group of users, over time, it will eventually serve more people.

“So, at some point, bitcoins will be brisquely traded all over the world, ok they already are but even more brisquely, first among even more Klingon-speakers but then among even more people just wanting to store and transport value,” the investor explained.

Bitcoin thread on a popular forum in 2011 (source: Nathaniel Whittemore Twitter)As time passed, more companies have started to get involved in BTC and the crypto industry in general.

Fidelity, CME, and Square are running platforms that facilitate BTC trades and purchases, Samsung is running a Bitcoin mining venture, and some of the biggest banks in the world are closely studying the technology behind BTC.

For the early-stage believers in BTC and the technology behind it, which was not easy, it paid off well. Since 2011, the Bitcoin price has increased from $1 to $20,000 at its peak. At the current price of $8,857, it is up 8857 times for early investors.

Is more growth to come?Highly-regarded executives and investors in the crypto industry like Xapo CEO Wences Casares believe that the Bitcoin price will eventually be worth $1 million in ten years time.

Casares explained that as the mainstream adoption of Bitcoin increases in the long run, its fixed supply would make BTC far more valuable.

He said:

“I have noticed over time that the price of Bitcoin fluctuates around ~ $7,000 x how many people own bitcoins. So if that constant maintains and if 3 billion people ever own Bitcoin it would be worth ~ $21 trillion (~ $7,000 x 3 billion) or $1 million per Bitcoin.”

The market cap of Bitcoin is still merely two percent of the entire market cap of gold. BTC has a long way to go to be considered as a proper safe-haven asset, but when it reaches that point, industry executives believe BTC’s value will follow.

The post Early adopters called Bitcoin the “future of money” 9 years ago; it’s up 10,000x since appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|