2020-8-8 16:48 |

The Nasdaq Composite Index (IXIC) broke its all-time high on Thursday, closing over 11,000 for the first time ever.

The main driver for the push into uncharted territory appears to be an improvement in unemployment data.

Party like it's 1999: Nasdaq closes >11,000 for the first time ever. pic.twitter.com/N3wzFbL6WS

— Holger Zschaepitz (@Schuldensuehner) August 6, 2020

Unemployment and claims dropped to the lowest level since April.

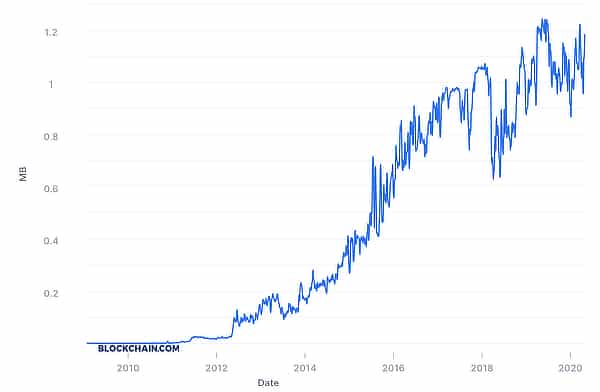

Bolstered by Tech StocksThe rise was led chiefly by tech stocks: Facebook, Amazon, Apple, Netflix, Microsoft, and Google (FAANMG). Tech giants are now worth more than $7 trillion, greater than the combined total market capitalization of the financial, energy, industrial, and material sectors.

Source: TwitterThe Nasdaq has outstripped all other equity markets in percentage growth. This is no surprise, given the growth of the industry at large.

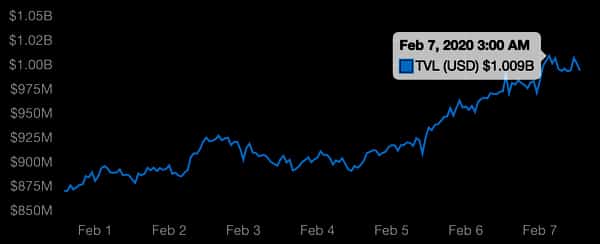

Mixed SignalsInterestingly, gold is also following the Nasdaq into new all-time highs. However, investor flows into gold, silver, bitcoin, and other store-of-value (SOV) assets present a mixed signal.

When both equities and SOV assets rise, investors can become easily confused. Generally, stock rallies go hand in hand with investor flows out of safe-haven positions. The current unusual correlation suggests that tech stocks may be substantially overvalued.

Some analysts believe that the long term indicators are nevertheless positive. According to Ryan Detrick, chief investment strategist for LPL Financial:

Yes, technology is probably extended in the near-term, but when you look at how strong earnings and guidance have been from the group, you realize there’s a reason the Nasdaq is at 11,000 and why eventual continued strength is quite likely.

Is the Nasdaq in a Bubble?It’s difficult to tell, at least until some of the air has been let out. The current rally closely mirrors the run-up that took place in 1999 during the dot.com bubble.

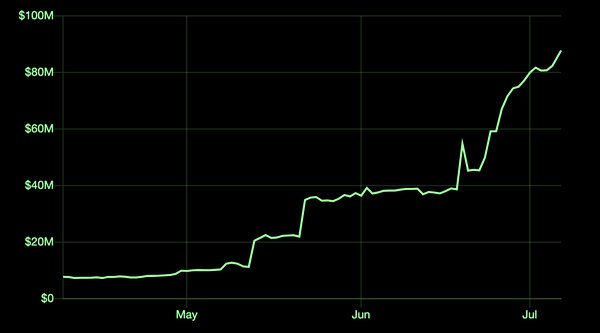

Substantial liquidity, caused by the Federal Reserve’s (Fed) borrow-and-buy policy with T-bills, could be a major culprit. Generally thought of as a stop-gap measure, the Fed has committed to purchasing $80 billion in notes per month.

The purchases have been coupled with further commitments for another $112 billion in issuance this quarter. Together, these indicators have driven yields to record lows.

Funds have therefore shifted into both equities and SOV assets, seeking a hedge against inflation, as well as yields from dividends. The jobless claims stoked hopes that companies are making their way out of the Covid-19 crisis.

However, despite hopes of stability, difficulties will arise when inflation rates are calculated. If inflation rises, equity investments could lose value, and money would likely flood out of these positions into SOV assets, thus creating the burst that many analysts have long called for.

The post Dotcom 2.0? Nasdaq Closes Above 11,000 for the First Time Ever appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Chronobank (TIME) на Currencies.ru

|

|