2021-4-14 20:53 |

Don-key finance has announced the completion of a funding round led by private investors with $2.2 million. Some of the private investors who took part in the funding round include Spark Digital Capital, AU21, Genesis Block Ventures, Solidity Ventures, Black Edge Capital, MoonWhale, and Morningstar Ventures.

The company anticipates using the funds to bootstrap its social yield farming platform and help its users boost their earnings. Notably, Don-Key uses a similar analogy as eToro in social trading by helping novice investors copy from some of the experienced traders.

“Don-key is all about maximizing the upside by making it easier for humble investors and farmers to generate consistent yield, whatever their ability level,” the company noted in a press release.

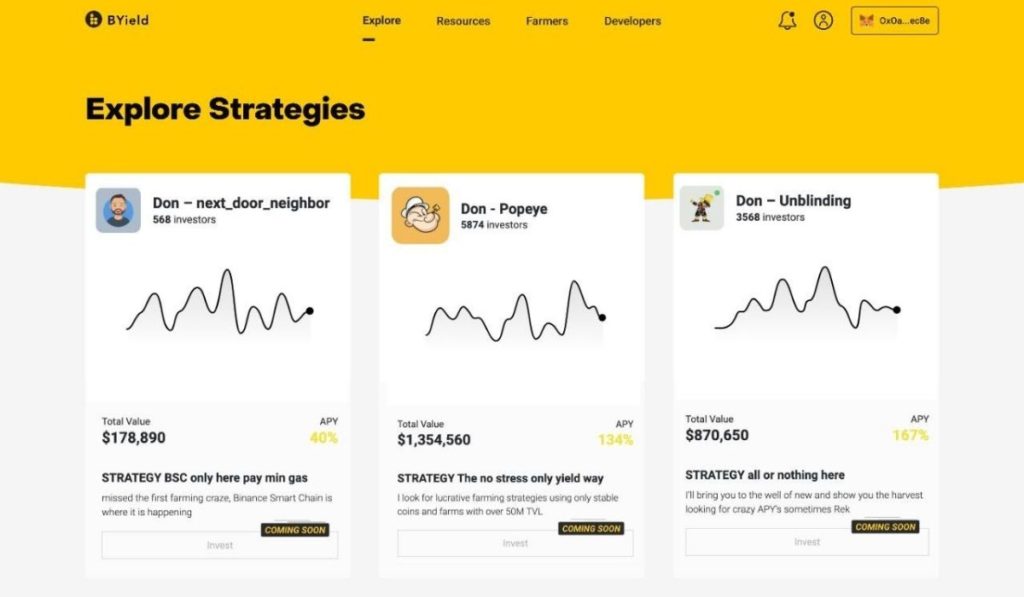

Don-key envisions bringing together the yield farmers and the liquidity providers on its platform. One of the key features of the Don-key finance platform will be copy farming, whereby users can learn and auto-invest in the latest farming opportunities. Copy farming will be enabled by following top farmers and also browsing the platform’s leaderboard.

The other notable key aspect of the Don-key finance platform will be strategy builder. Under this aspect, users can easily access drag and drop interfaces to maximize on different scenarios.

Through the new Don-key finance platform, users can track farmers’ reputations based on proven APY results and historical track records. Moreover, investors’ reputation will enable top participants to unlock extra levels and access the highest alpha opportunities.

The company has also set aside some funds to incentivize top farmers and liquidity providers. “DON tokens are airdropped to all farmers based on monthly trading results and take into account: ROI, Risk level, asset exposer, and more. the better you are, the more you get,”.

Don-key users can redeem their DON tokens anytime or hold them to gain value over time. As a result, the company can attract more investors and experienced farmers to its platform over time.

Yield farming has tremendously grown in the decentralized financial ecosystem over the past few months. However, due to a lack of proper customer education, its adoption has not yet reached the peak. Crypto projects are using yield farming to attract more customers to their platform as the competition grows in the global crypto industry.

origin »Bitcoin price in Telegram @btc_price_every_hour

Joint Ventures (JOINT) на Currencies.ru

|

|