2024-8-20 21:30 |

Between August 18 and 19, Dogecoin (DOGE) saw an astonishing spike in its stock-to-flow ratio. This sudden increase marks a notable shift for the meme coin, whose price has struggled to produce gains for some time.

At press time, DOGE changes hands at $0.099, representing a 40% decrease over the last 90 days. But the coin could be on the cusp of a major price rally. Here is how.

Dogecoin Seems Bull Run ReadyThe stock-to-flow ratio is a model in the market that measures the scarcity of a cryptocurrency. For instance, if the ratio drops, it means that there is high inflation around the coin, and the price risks dropping.

According to Santiment, Dogecoin’s stock-to-flow ratio jumped to 69.25 — an all-time high for the metric. This unusual spike is a positive signal for DOGE’s price, as it hints at a supply squeeze for the cryptocurrency.

In crypto, a supply squeeze occurs when demand for a coin increases during a scarcity period. Therefore, based on the laws tied to the metric, the DOGE price may encounter a notable rally in the coming weeks.

Read more: Dogecoin vs. Bitcoin: An Ultimate Comparison

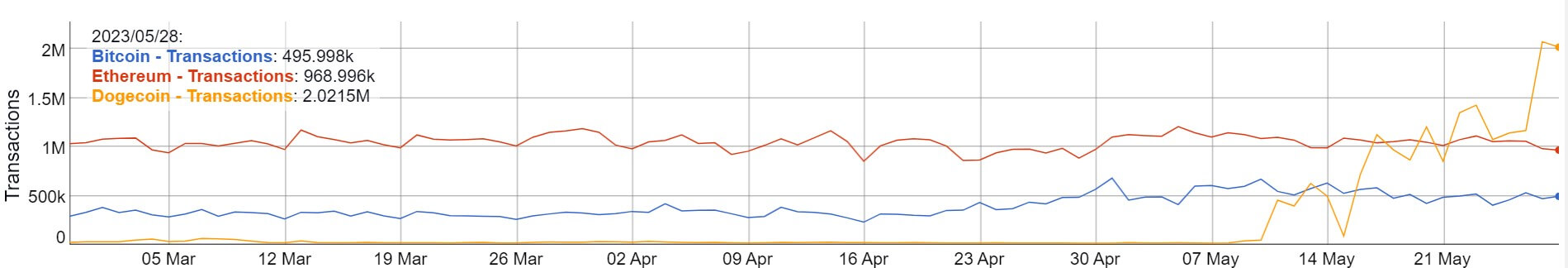

Dogecoin Stock-to-Flow Ratio. Source: SantimentBeyond this surge, both active and new addresses on Dogecoin’s network have risen since last week. Active addresses reflect the number of users completing transactions, indicating increased blockchain usage and a bullish outlook. A decline would signal a bearish trend.

New addresses track participants making their first transaction, with growth suggesting rising adoption and demand. Conversely, a drop would indicate waning interest.

Dogecoin Daily Active Addresses. Source: IntoTheBlockTherefore, the jump in the active and new addresses on DOGE reinforces the forecast that the coin price may soon exit the long-standing bearish trend.

DOGE Price Prediction: Big Gains AheadTo analyze Dogecoin’s next move, BeInCrypto examines the Global In/Out of Money (GIOM) indicator. This tool shows whether addresses are in profit, at a loss, or breaking even based on their acquisition cost versus the current price.

Addresses with a higher cost basis than the current price are out of the money, while those with a lower cost basis are in the money. The GIOM helps identify key support and resistance levels; more addresses in profit create support, while those at a loss contribute to resistance.

Currently, over 1 million addresses purchased 11 billion DOGE at a maximum price of $0.098.

Read more: Dogecoin (DOGE) Price Prediction 2024/2025/2030

Dogecoin Global In/Out of Money. Source: IntoTheBlockThis figure is higher than the number that accumulated between $0.12 and $0.15. Therefore, if buying pressure increases, DOGE may break above the resistance around these points.

If successful, the price may climb to $0.15, representing an approximately 50% increase. However, failing to clear this resistance or facing rejection could invalidate the bullish outlook. In such a scenario, DOGE’s price might drop to $0.088, indicating potential downside if momentum shifts.

The post Dogecoin (DOGE) Sudden Supply Squeeze Hints at 50% Price Increase appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Supply Shock (M1) на Currencies.ru

|

|