2022-3-1 23:54 |

Price uncertainties usually characterize the cryptocurrency market. This can be worsened by factors such as war and inflation, therefore there is a need for a way to protect investments even at such times.

Degis is an Avalanche-based protocol built to protect crypto investors’ assets from any kind of risk. This is the first all-in-one protection protocol built on Avalanche or any other project, and its aim is to bring a universal crypto protection platform that will shape decentralized protection of the ecosystem.

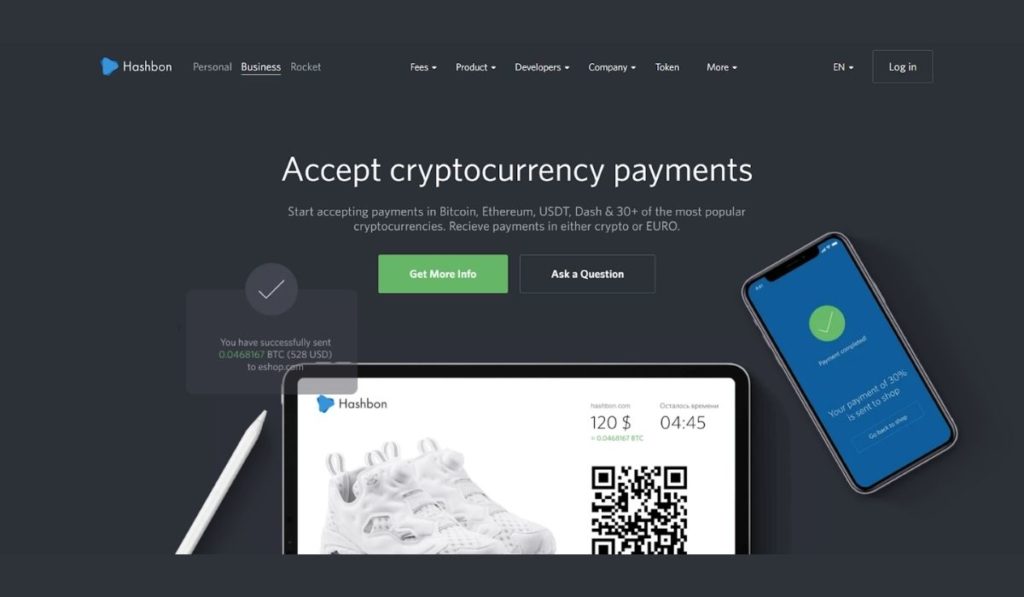

The protocol offers a better alternative to traditional insurance which involves lengthy processes both for registering and claiming insurance benefits when the need arises. Degis intends to harness blockchain technology to better administer insurance via smart contracts and bring digital asset protection to investors in every part of the world.

There are three areas where Degis is focusing on in its crypto-insurance project. These are wider cover areas, capital liquidity aggregation, and instant payouts. The benefits of subscribing to this protocol include protection from token price volatilities, impermanent loss, wallet risks, and even smart-contract insurance.

The protocol hopes to make DeFi insurance better through a better user experience, by protecting investments and paying incentives via earn to play. Anyone buying or selling insurance will be incentivized with Degis tokens.

Naughty Price for controlling token volatility

Naughty Price is a next-generation product that covers token price volatility risks by deploying protection pools. This is different from most other insurance protocols that focus on covering smart contract flaws and protocol hacks. By covering token price fluctuation, Naughty Price is reaching a much wider market than the other protocols.

How Naughty Price works

There are three main players in the Naughty Price system, namely creators, providers, and buyers/sellers. Providers deposit USDC into the policy pool to provide liquidity. In return, they get LP tokens as a reward which they can stake for mining the DEG (Degis token).

Creators deposit USDC into the right policy pool and are rewarded with the same amount of naughty tokens. They may choose to sell the Naughty Tokens to the left policy pool before expiration. After the expiry date, the price payout is determined only by the price of the token. Left policy pools, which are AMM-based capital aggregation pools, allow buyers and sellers to trade Naughty Tokens and USDC respectively.

As providers deposit USDC into the right policy pool, the protocol then mints a fractional amount of naughty tokens based on the exchange rate between the tokens and USDC at the time. providers can redeem their capital based on the exchange ratio between the two, using the Uniswap AMM mechanism as a reference.

DEG Token

The Degis protocol is powered by the DEG tokens. These are ERC-20 tokens that can be staked into the treasury for protection pool premium sharing. Holders of the tokens can also stake to create veDEG tokens to attend initial protection boosting. There are a total of 100 million DEG in supply as the native token for the protocol.

origin »Bitcoin price in Telegram @btc_price_every_hour

Market.space (MASP) на Currencies.ru

|

|