2020-11-14 15:30 |

Since February 2020, we have seen a steady growth of the blockchain space and, most significantly, decentralized finance. While DeFi isn’t entirely new, the network’s growth has been more aggressive this year than it has ever been. The distribution of COMP governance token and the introduction of yield farming protocols around June this year has made DeFi the most engaging conversation in the blockchain space, no doubt.

DeFi Yield Protocol (DYP)Decentralized finance has only grown this much because of the control and ease it offers users. By allowing users to utilize traditional banking and financing services like lending, borrowing, and saving, an overwhelming sense of trust has been birthed over the past few months. Even more captivating is that many users now earn more than 100% of their capital, mostly by offering liquidity through yield farming protocols.

Over the past couple of months, we have also seen a contrast between different DeFi protocols and what might set a precedent for the DeFi ecosystem’s longevity as a whole. The DeFi yield protocol (DYP) is a unique protocol that allows virtually any user to provide liquidity, earn DYP tokens as yield while maintaining the token price. Unlike some DeFi user interface, the DYP interface is quite simplified, accommodating new and expert yield farmers.

What Makes the DYP Staking Pool Unique?DYP developers, together with a blockchain company, developed the unique DYP staking. The DYP staking allows users to stake dAPP through the Ethereum smart contract that is front-end integrated with Metamask and Trustwallet. By studying some flaws of the DeFi ecosystem, DYP aims to tackle them head on and give users the best experience in open finance.

One of the many arguments against the operability of defi revolves around “whales” controlling the network. One of such examples is the infamous Sushi dump where the anonymous founder dumped all of his Sushi tokens for ethereum. To prevent a whale attack, DYP developed an anti-manipulation feature that automatically converts all pool rewards from DYP to ETH at 00:00 UTC everyday. The system then distributes the rewards to liquidity providers. This manipulation feature ensures that the pool’s liquidity is fair to every participant.

Besides preventing whales through the anti-manipulating feature, the smart contract also maintains the DYP token price. If the DYP price fluctuates beyond 2.5% in value, rather than swapping all 276,480 DYP tokens for ETH at 00:00 UTC, the smart contract only swaps as many DYP tokens to ETH that doesn’t affect the price of the token. The leftover DYP is then distributed in the next day’s rewards. If there are still leftover DYP tokens, the DYP governance votes on whether to distribute them to token holders or burn the tokens from circulation.

The decentralized network is essentially an open space regulated by a smart contract, and the greatest risk in yield farming today is still a smart contract bug. To prevent the risk of a smart contract bug on their network, DYP ensures all their smart contract codes are audited.

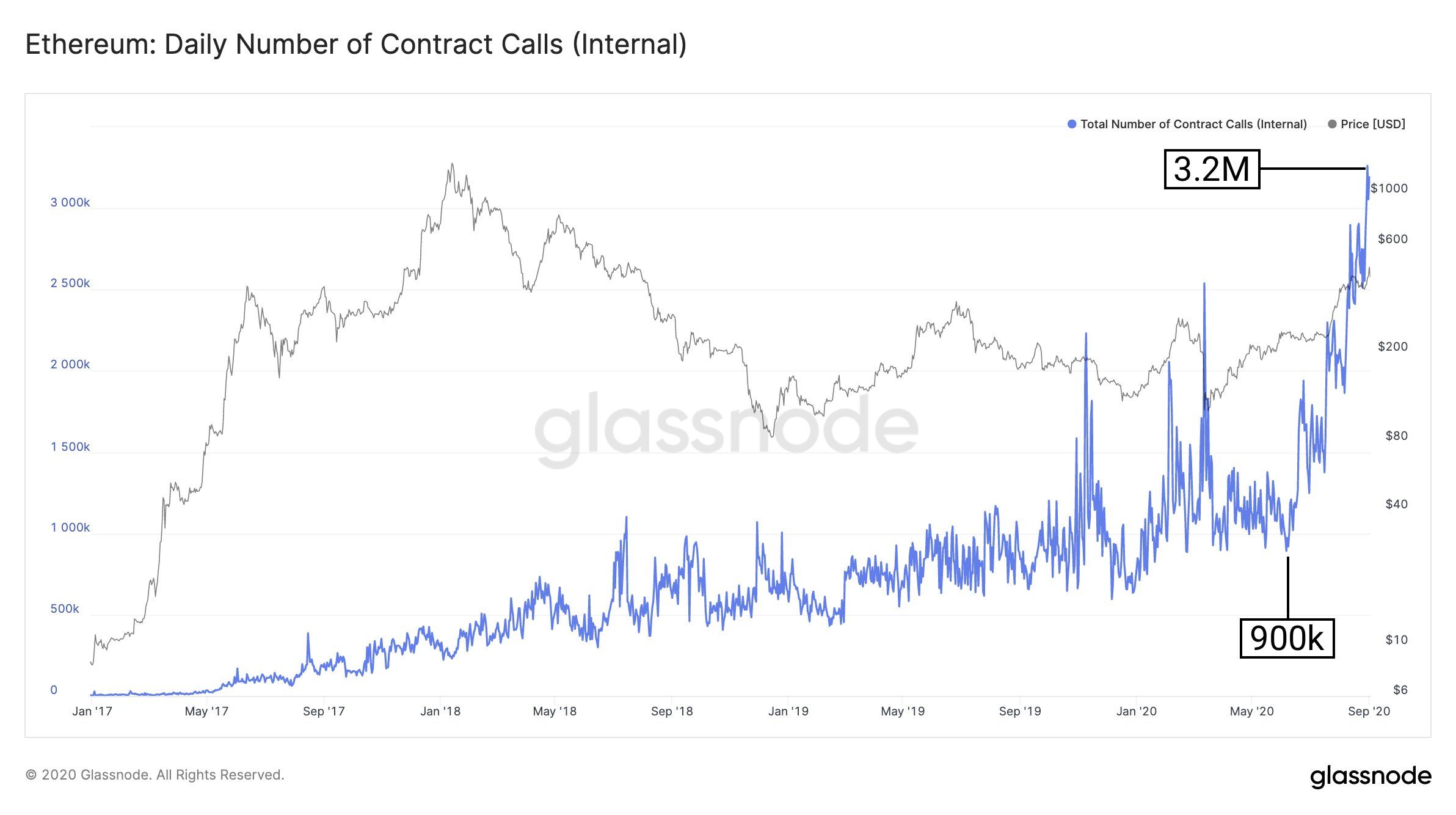

DYP Yield Farming and the Ethereum Mining NetworkAs the Ethereum network continues to increase in size and number, there’s a corresponding need for mining on the network. The DYP team has been committed to Ethereum mining for more than three years and have invested more than $1m on their mining farm. Not only is the team heavily invested in Ethereum mining, but the DYP team has also shown its willingness to allow many more users to participate.

To reward users, every ethereum miner address that interacts with the DYP smart contract will earn a monthly bonus of 10% in DYP of the ETH income earned monthly. Essentially what this means is; if ETH price is $400 and DYP price is $2, if you earn 1ETH monthly, you also get a monthly airdrop of 10% (20 DYP tokens worth $40). To claim the airdrop tokens, users will need to join their Ethereum mining pool with a 0% fee, meaning users will also earn more monthly.

DYP also has an automatic earn vault that moves a participant’s funds around using the best yield farming strategies. The automatic earn vault will distribute 75% of the earnings among the liquidity providers and 25% to buy back DYP tokens. Ultimately this promotes liquidity in the pool and maintains the price of the token.

DYP CrowdsaleWhen the decentralized finance ecosystem seeks a balance while setting a precedent for its mainstream adoption, DYP is actively laying a foundation from its public crowdsale. During the whitelisting and presale round, 570,000 DYP tokens worth 2,821.71 ETH have been sold. For a chance to participate in this unique protocol, join the public crowdsale at https://crowdsale.dyp.finance/.

This is a sponsored post. Learn how to reach our audience here. Read disclaimer below.

The post Defi Yield Protocol Is a Massive Boost for Yield Farmers and the Defi Space appeared first on Bitcoin News.

origin »Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) на Currencies.ru

|

|