2022-8-17 21:00 |

A surge in stolen funds from decentralized finance (DeFi) protocols has sent losses from cryptocurrency hacks soaring nearly 60% in the first seven months of the year.

Between January and July 2022, stolen funds from cryptocurrency hacking amounted to $1.9 billion, up from $1.2 billion during the same period last year, according to a blog post from Chainalysis.

The blockchain analysis firm indicated that the trend would be unlikely to reverse in the near term, as a $190 million hacking of cross-chain bridge Nomad and a $5 million hacking of several Solana wallets have already occurred in the first week of August.

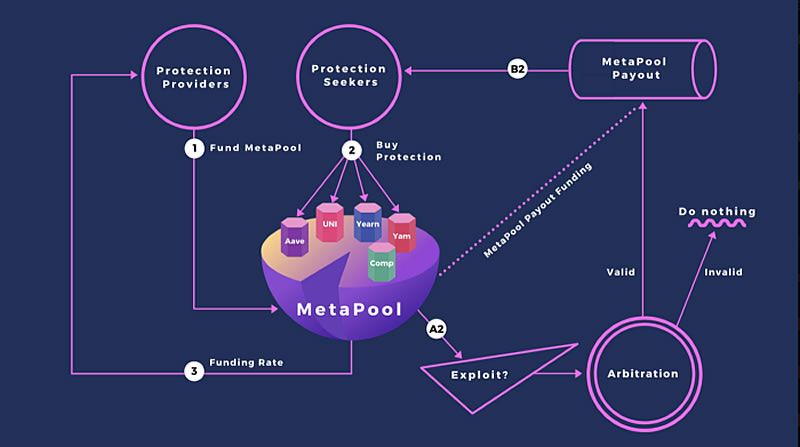

“DeFi protocols are uniquely vulnerable to hacking, as their open source code can be studied ad nauseam by cybercriminals looking for exploits and it’s possible that protocols’ incentives to reach the market and grow quickly lead to lapses in security best practices,” Chainalysis said in the blog.

Chainalysis attributes much of the illicit activity to “bad actors” associated with North Korea, such as the infamous Lazarus Group. According to its estimates, North Korea-affiliated groups have stolen approximately $1 billion of cryptocurrency from DeFi protocols so far this year.

Crypto scamsMeanwhile, cryptocurrency scams independent of DeFi saw a sharp 65% dropoff over July, as digital asset prices declined. Year to July total scam revenue this year only reached $1.6 billion, compared to $4.46 billion for the same period last year.

“Scams are down primarily because of the crypto downturn, but also because of the many law enforcement wins taken against scammers and the product solutions that exchanges can use to fight scamming,” said Kim Grauer, Chainalysis’ director of research.

According to its research, scam-related proceeds have fallen in tandem with the price of Bitcoin, since the beginning of the year. In addition to the shrinking bounty from the scams, the cumulative number of individual transfers to scams also sank to its lowest in four years.

“Those numbers suggest that fewer people than ever are falling for cryptocurrency scams,” Chainalysis said in the report. “One reason for this could be that with asset prices falling, cryptocurrency scams — which typically present themselves as passive crypto investing opportunities with enormous promised returns — are less enticing to potential victims.”

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

The post DeFi Responsible for 60% Rise in Crypto Hacks, Says Chainalysis appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) на Currencies.ru

|

|