2021-4-9 21:02 |

Decentralized finance (DeFi) protocol Badger DAO has partnered with Fireblocks to expose institutional Bitcoin to the DeFi ecosystem.

BadgerDAO Bringing BTC To DeFiBadgerDAO disclosed in a blog post that it would be integrating with Fireblocks, a digital asset storage for institutional investors.

With this partnership, BadgerDAO aims to enable over 200 institutional Fireblocks clients to securely store Badger assets on their DeFi platform and put their Bitcoin to work through the Badger protocol.

Commenting on the partnership and integration benefits, BadgerDAO founder Chris Spadafora said that the integration wants to make Badger's vaults and products more accessible to institutional investors, not just retail DeFi investors.

“Our intention is to further help onboard institutional Bitcoin holders to DeFi. With Badger smart contracts being easily integrated by anyone/company without our permission, we anticipate many more centralized businesses servicing the institutional market to be powered by Badger.”

Once Fireblocks integrate with its flagship product, the Sett vaults, anyone with the Fireblocks app or browser extension would be able to deposit tokenized Bitcoin such as wBTC directly into any of the automated yield-producing vaults.

The protocol claims to have over $1 billion worth of tokenized Bitcoin in its vaults from automated yield aggregation strategies. The collaboration will also enable Institutional clients to securely hold their Badger tokens and interest-bearing assets on the Fireblocks platform.

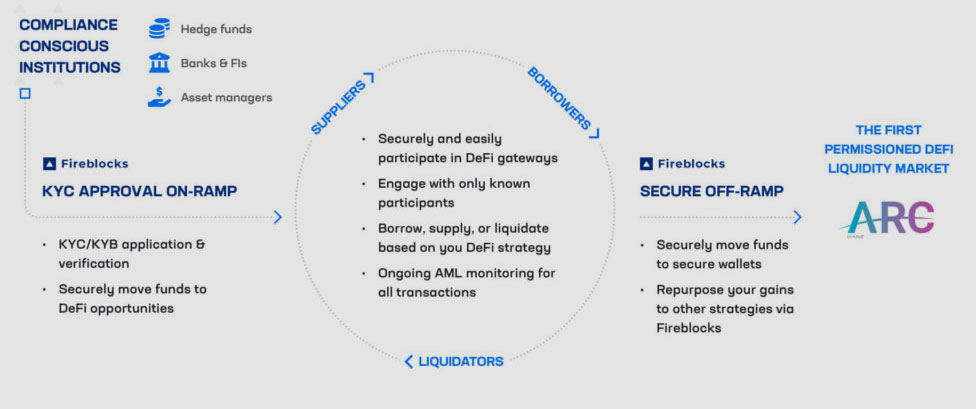

Fireblocks is a platform that offers a secure infrastructure for moving, storing, and issuing digital assets for institutional clients. The company, which recently secured $133 million in a Series C funding round, counts institutions like BNY Mellon, Galaxy Digital, Genesis, and others as clients.

BadgerDAO's Stablecoin, CLAWSLaunched in 2020, BadgerDAO is popular for its Badger token and Sett vaults product. The Sett vault helps users deposit different types of tokenized Bitcoin, such as wBTC, renBTC, or tBTC, to generate an automated yield.

The Bitcoin-focused DeFi platform also recently launched its stablecoin called CLAWS. In an announcement in February, BadgerDAO explained what its new offering will do and why the crypto space needs another stablecoin. It also noted that CLAWS was more of a “yield dollar” similar to those offered by the UMA protocol.

A yield dollar is a collateralized asset with an expiration date. They are minted when a user provides collateral and at some LTV (Loan-to-Value) ratio.

The post DeFi Protocol BadgerDAO Partners With Crypto Custody Firm Fireblocks first appeared on BitcoinExchangeGuide. origin »Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) на Currencies.ru

|

|