2020-7-30 17:25 |

Aave, the Ethereum based DeFi protocol, has released a tokenomics upgrade proposal dubbed ‘Aavenomics’ that will define its shift to a more decentralized governance ecosystem.

The firm announced this milestone on July 29 via a medium blog, noting that it is another exciting phase for Aave. Aave’s founder and CEO, Stani Kulechov, has since confirmed that the new governance tokens have been under development since we began the year.

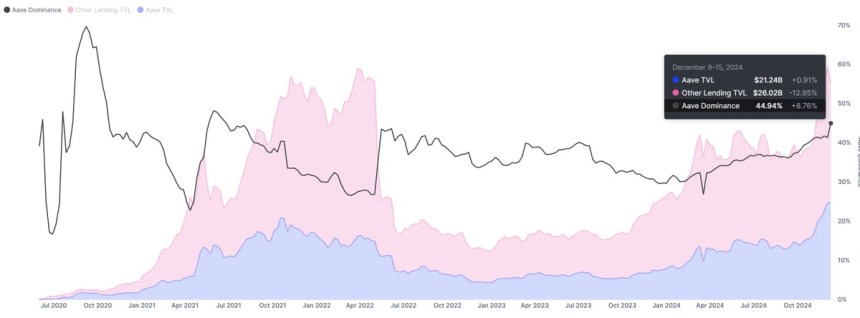

The protocol is set to join the likes of Compound and Synthetic, which already launched its governance tokens. Notably, the debut of Compound’s token saw the DeFi market rally to new ATH’s as this protocol overtook Maker in terms of total value locked (TVL). This position, however, has not held given Maker regained its position as the leading DeFi protocol; over $1 billion are currently locked within its ecosystem.

Aave’s Governance TokenCurrently, Aave’s DeFi platform uses LEND as its native token, but these are now set to be swapped for the upcoming governance token, AAVE. These governance tokens will supposedly introduce a financial services ecosystem that is pegged on a future proof framework and distributed governance to enhance safety and sustainability.

The LEND token supply, which is currently 1.3 billion, will be reduced to a bare 16 million AAVE tokens once the Aavenomics proposal is fully integrated. Thirteen million of these AAVE tokens will be redeemed by token holders, while the remaining 3 million will be allocated to Aave Ecosystem reserve. Going by these stats, Aave set the conversion rate for LEND against the new governance token at 100:1 to achieve the target numbers.

To initiate the swap, a governance vote will be conducted via the existing LEND token holders. Once approved, the underlying smart contracts will then facilitate the swap in a move that will see Aave achieve more decentralization in its governance.

The 3 million tokens allocated to Aave’s Ecosystem reserve will be used to incentivize development, hence safety and economic incentives in the rewards pool. Their allocation will be heavily dependent on Aave’s community, a decision they can now voice via a governance token.

Aave’s DeFi FootprintAt the moment, Aave is the fourth DeFi in terms of TVL with a significant $445 million in locked digital assets, up 14.6% in the last 24 hours. The project launched in 2017, and went by ‘EthLend‘ at the time; this name was, however, changed in September 2018 to what is now ‘Aave.’

Some highlights by this ETH financial service protocol include its $18 million ICO funding. This was later topped up by other funding rounds that have seen Aave gather over $3 million from the sale of LEND tokens after 2017.

origin »Bitcoin price in Telegram @btc_price_every_hour

Aave (LEND) на Currencies.ru

|

|