2020-8-4 21:31 |

dYdX, a decentralized exchange (DEX), announced the launch of Ethereum perpetual swaps on its platform with trading going live August 4, 2020. The ETH-USD Inverse Perpetual Contract Market will allow the users to margin trade up to 10x leverage on their EH collateral and bet on the future price of ETH.

Speaking on the launch of the perpetual contracts, the founder of dYdX, Antonio Juliano said,

“The main reason people like trading these contracts is because people can trade them with pretty high leverage.”

However, the risk of trading high leverage is evident in the crypto market with the volatile swings causing massive liquidations on these contracts. These markets are dominated by institutions and professional retail traders hence trade with caution.

With ETH volatility continuing to rise, this is a great time to start trading an Ethereum Perpetual Contract. Our smart contracts are secure, open-source, and audited by @OpenZeppelin. To read more about the new Perpetual, head to our blog: https://t.co/kllNQJCUzY

— dYdX (@dydxprotocol) August 4, 2020

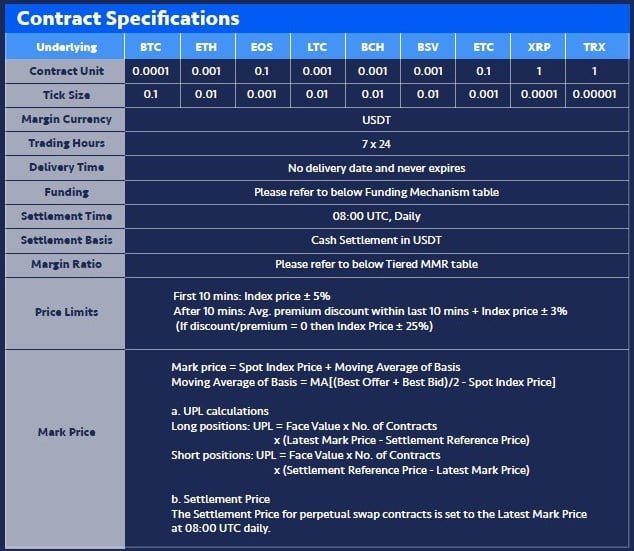

The ETH-USD swaps will be quoted in USD and settled in the base currency similar to the first launched perpetual swap settled in Bitcoin (BTC).The minimum order size is set at $200 with orders less than $1500 only available as market or fill-or-kill orders.

According to Juliano, the dYdX swaps will offer a simpler way to get leverage on trades than most of the DEXes in the market with its liquidity better than an average DEX. However, the derivatives market is lagging behind the spot market in crypto, a factor that Juliano believes is caused by the large presence of retail traders in the space. He said,

“The crypto market is very dominated in terms of volume by retail traders, particularly international crypto traders.”

The decentralized finance, DeFi, app has gradually grown its products since starting as a margin trading platform on Ethereum, to offering several synthetic assets such as derivatives. This has seen the platform grow its total locked value of assets from $13 million at the start of the year and currently places 14th on the DeFi Pulse market ranking with $38 million locked in assets’ value locked on the platform.

origin »Bitcoin price in Telegram @btc_price_every_hour

Sharpe Platform Token (SHP) на Currencies.ru

|

|