2018-7-28 01:30 |

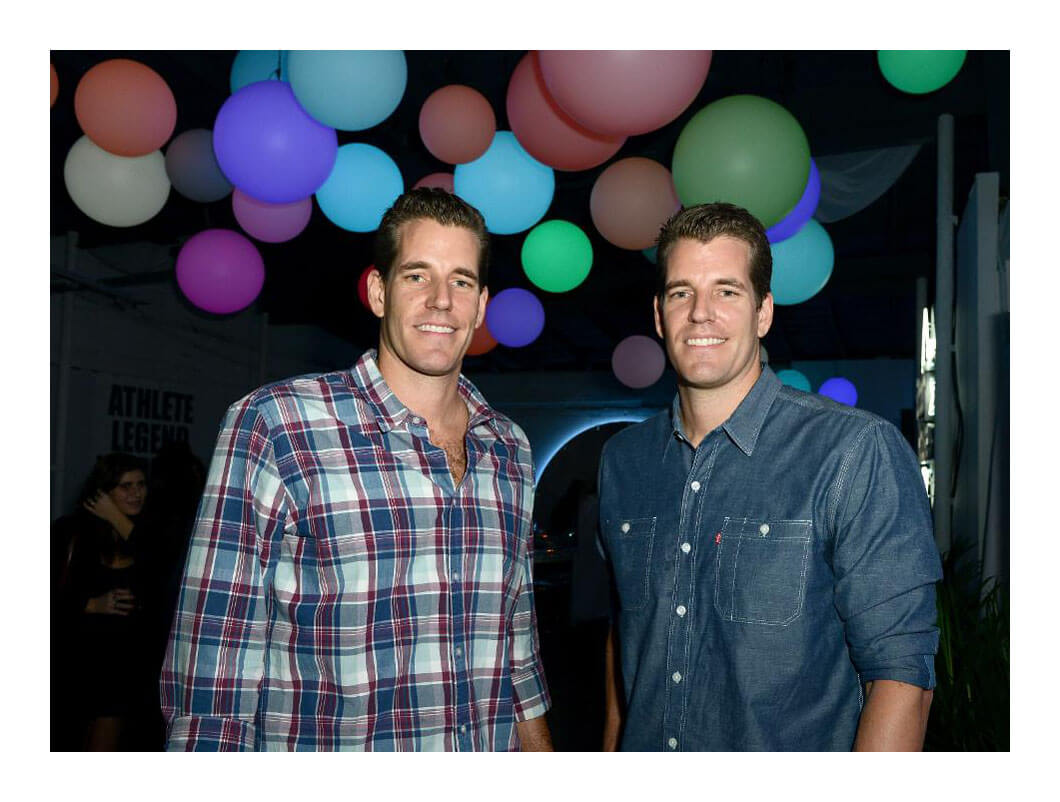

The Winklevoss twins made the second attempt to bring the first Bitcoin exchange-traded fund (ETF) to a regulated U.S. exchange. The crypto community was extremely optimistic about this bid; the official approval was expected to be received as soon as next month. But these expectations would not be met. For the second time the Winklevoss brothers got the reject from the United States Securities and Exchange Commission (SEC). CoinSpeaker gave a detailed analysis of the Commission’s reject. Nevertheless, the deny leaves room for positive as the vote was not unanimous and was followed by the official dissent of one of the commissioners.

The application for Bitcoin ETF was denied in 3-1 vote. The only voice in favor of the Winklevoss twins’ initiative belongs to Hester Maria Peirce, experienced lawyer specializing in financial market regulation. Not only she voted for the approval of listing and trading shares of the Winklevoss Bitcoin Trust on Bats BZX Exchange, Inc, but took her chance to explain her position and published a detailed dissent on the essence of the decision.

The first part of the dissent is focused on one of the most controversial issues associated with the decision of the SEC – the consistency of the proposed changes with the Securities Exchange Act of 1934 and other relating documents. The Commission named the high susceptibility to fraud and other market manipulations as one of the main reasons of the denial. Peirce points attention to the fact that the examination of the issue was one-sided: “The disapproval order focuses on the characteristics of the spot market for bitcoin, rather than on the ability of BZX—pursuant to its own rules—to surveil trading of and to deter manipulation in the ETP shares listed and traded on BZX”.

The decision of the Commission is not only over-focused on the Bitcoin spot market – it influences the overall development of the crypto community. The approval of SEC is an important checkmark for investors. Peirce pointed out that the SEC focused on the market instead of the product seeking for approval. This approach may distort the picture of the crypto market, so it must be avoided: “The Commission’s mission historically has been, and should continue to be, to ensure that investors have the information they need to make intelligent investment decisions and that the rules of the exchange are designed to provide transparency and prevent manipulation as market participants interact with each other.”

According to Peirce, the BZX exchange’s rules governing the trading of the exchange-traded product (ETP) shares are consistent with Exchange Act. The transparent and decentralized nature of Bitcoin prevents manipulations on its own, and the rules of the BZX exchange are designed to eliminate the risks of fraud. But the consistency with the Exchange act is not the only issue highlighted in Peirce’s dissent.

The Commission emphasized such issues as the price disparities across Bitcoin markets. Peirce makes a strong point saying that the establishment of Bitcoin ETFs would lead to “more price arbitrage and thus better connections among markets.” This fact is an illustration of the influence of the SEC’s decision. The case is not solely about the Winklevoss Bitcoin Trust, the denial inhibits the natural institutionalization of the crypto market.

In the dissent Peirce is making some overarching statements. The disapproval order is a big disappointment for the Winklevoss brothers as well as for a big part of the crypto community. But the real influence is more substantial. To quote Peirce, “the disapproval order demonstrates a skeptical view of innovation, which may have an adverse effect on investor protection, efficiency, competition, and capital formation well beyond this particular product.”

The overall tone of Peirce’s dissent is respectful and logical. She draws attention to the important issues and provides strong arguments in favor of her position. For all the supporters of Bitcoin ETF, the idea expressed in the conclusion of the dissent is worth taking note of: “An ETP based on bitcoin would offer investors indirect exposure to bitcoin through a product that trades on a regulated securities market and in a manner that eliminates some of the frictions and worries of buying and holding bitcoin directly.”

The SEC did not shut the door on Bitcoin and other cryptocurrencies. The Winklevoss twins may take their time to convince more members of the Commission on the reliability of Bitcoin ETF. The next big discussion on the issue is associated with CBOE’s VanEck/SolidX Bitcoin ETF. Unfortunately, the case could drag on for half a year: legal expert Jake Chervinsky posted on Twitter that “the SEC can, and probably will, delay its decision on the VanEck/SolidX commodity-backed Bitcoin ETF until ~March 4th, 2019.” But the approval is worth waiting.

The post Debate Continues: SEC Official Considers Winklevoss Bitcoin ETF Rejection a Mistake appeared first on CoinSpeaker.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|