2020-4-24 22:40 |

As Bitcoin’s halving draws closer, Bitcoin holders are increasingly adding to their portfolio, in anticipation of the event. The Bitcoin market is consistently receiving hundreds of millions of dollars worth, on a daily basis.

Popular on-chain market analysis service, Glassnode, revealed the increase in a recent tweet. According to the tweet, the “Hodler Net Position Change” has been climbing steadily since late March. Glassnode’s data also shows that investors are now accumulating over 75,000 BTC every day, more than $560 million at press time.

#Bitcoin HODLer Net Position Change has been growing daily since the end of March and is now hitting yearly highs.

Long term investors are increasing their positions – and they're accumulating more $BTC each day.https://t.co/nPqBsr1QTd pic.twitter.com/KRCkEQ3NaD

Glassnode’s graph shows that in the last year, there has been a commendable level of Bitcoin accumulation, for most of the year. However, it also shows that there were times between February and March that accumulation levels plunged quite terribly.

As the market continues to anticipate the Bitcoin halving, there is some chance that the rate of accumulation could climb even higher. Recently, Coinbase CEO Brian Armstrong, revealed that the exchange is seeing an increase in Bitcoin deposits worth exactly $1,200. This suggests some of the people who have received the Federal Government’s $1,200 stimulus package because of the coronavirus pandemic, have dumped it all in the Bitcoin market.

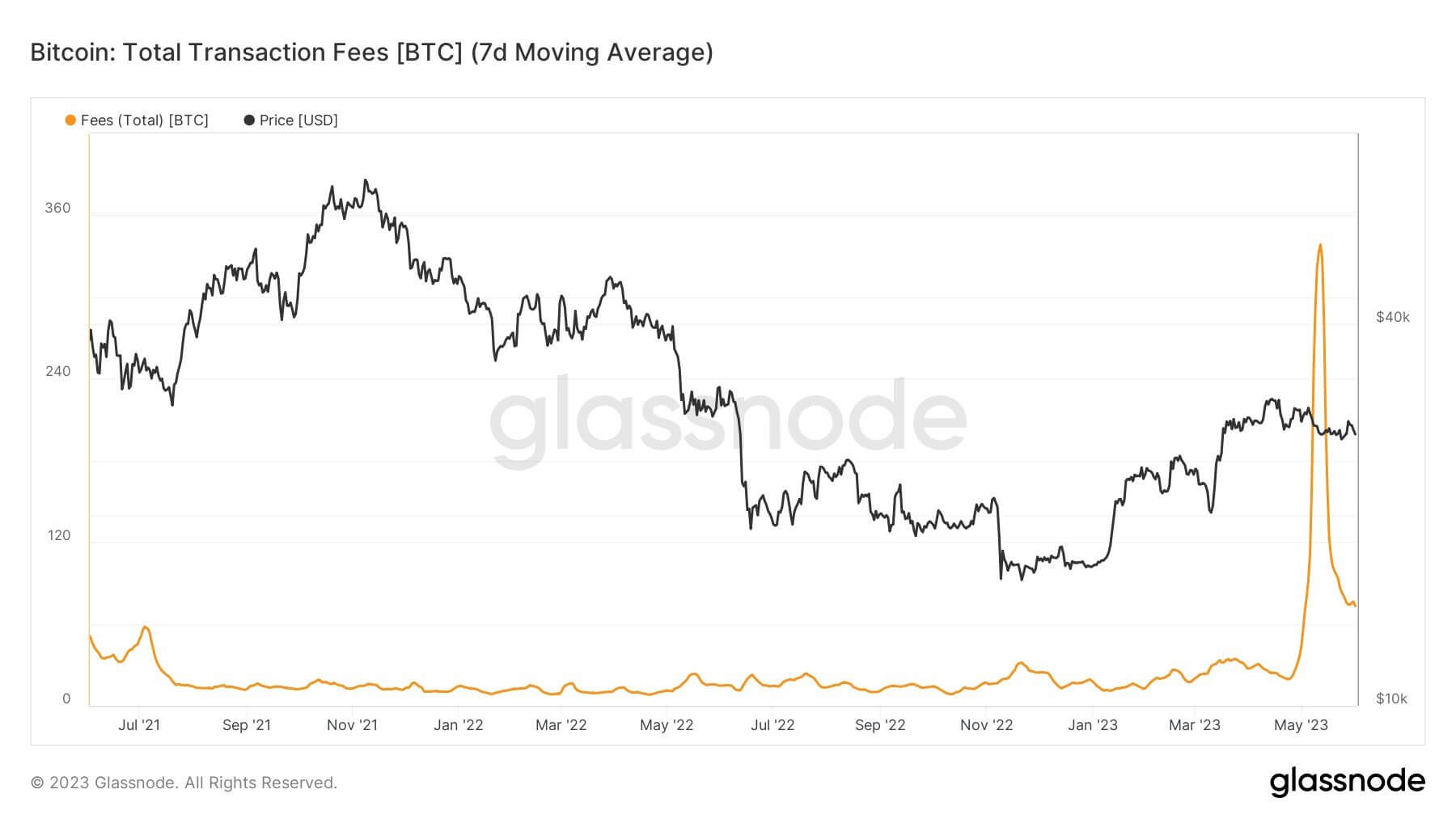

In another tweet, Glassnode revealed that Bitcoin’s average fee in the last 24 hours has increased significantly. The monitoring resource said the fees jumped 58.8% from $0.48 to $0.76. This led to another revelation that the total amount of Bitcoin fees paid has also jumped. In the same period, total fees paid rose 50.7%, from $6,349.52 to $9,568.14.

While the upcoming halving is the easy explanation for the spike in activity on the Bitcoin network, the pandemic could also be considered. Many members of the crypto community believe that the heavy currency printing being used to support the economy could easily reduce the value of fiats.

Some have a grimmer outlook and foresee possible hyperinflation. This fear could be driving people into alternative assets, specifically Bitcoin.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|