2018-7-20 18:46 |

As the weekend approaches, altcoins are overly vibrant with DASH leading the recovery. So far, DASH is up 21 percent week over week and likely to break above $270 cementing our buy proposals. In the mean time, XRP, EOS and BCH are stuck in a consolidation and yet to breach key resistance lines.

Let’s have a look at these charts:

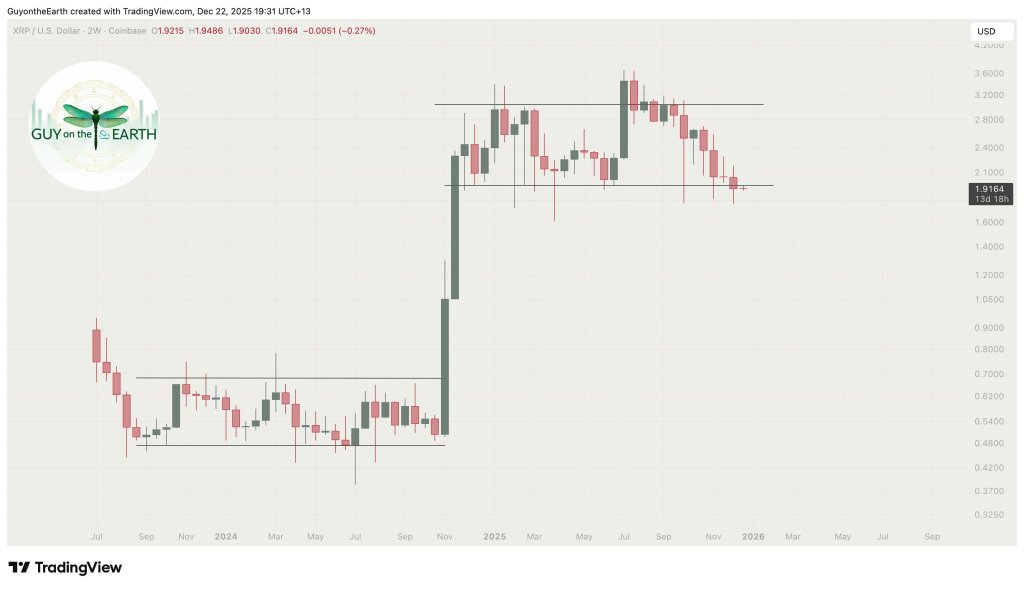

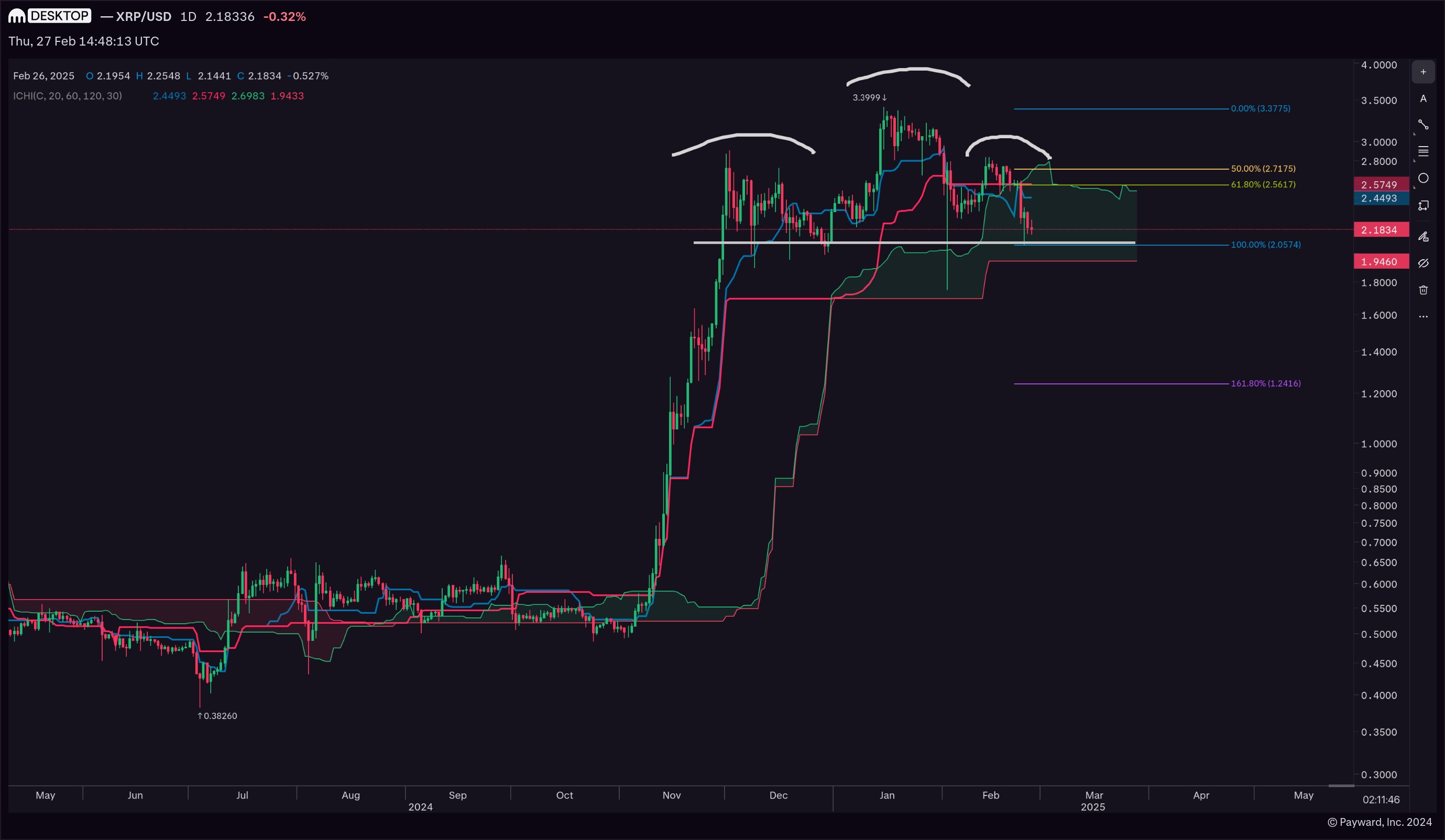

XRP Technical Analysis Click here to see the full size XRP Daily Chart by Trading ViewOf all the top 10 coins in the liquidity list, XRP is perhaps the only that is under regulatory cross hairs. For survival, commentators say, SEC must spell out the category where XRP falls and whether it is a utility or a security. Undoubtedly, if US regulators say XRP is a security that must comply with SEC rules and regulation, then that would be the end of XRP. In fact Asheesh Birla thinks the coin’s valuation would dip to oblivion.

Back to price action and it’s a gloomy picture. As XRP continues to oscillate within an energy sapping 10 cent range with lower and upper limits at 45 cents and 55 cents, traders must pause. Overly, the main trend is bearish and at the moment, we are in a limbo.

For buyers to edge higher and sync with the overall bullish sentiment, then we must see break above 55 cents in line with our XRP buy strategy. That will allow buyers to aim at 70 cents as first targets. On the flip side, any synchrony with bears driving prices below 45 cents mean 15 cents would be ideal bear target.

EOS Technical Analysis Click here to see the full size EOS Daily Chart by Trading ViewDan Larimer and Block One’s EOSIO blockchain is proving to be force to reckon despite recent upheavals. RAM continues to be a contention but behind RAM and talks of Block Producers, it’s through put is surging.

Congrats to the #EOS community on becoming the fastest growing, highest performing (2000+ TPS w/ 500ms block times), most efficient (1% inflation and no fees), and most aligned blockchain ecosystem in the world… in just 6 weeks https://t.co/R0OR0hIqU4

— BrendanBlumer (@BrendanBlumer) July 18, 2018

At one point, EOSIO through put was better than Visa printing 2822 TPS triggering celebrations within the community. Nevertheless, critics think the developer community should come with permanent solutions to tame RAM, a network resource. Side chains and expansion of total RAM TB are some proposals to fix that.

In the charts, we maintain a neutral to bullish stand thanks to gains on Mon-Tue. Even though EOS is still in consolidation and below $9, our minor trigger line and July highs, odds are EOS bulls will break above it today or over the weekend. In any case, any close above $9 means we shall begin loading EOS longs with stops at $8 and targets at $15 or June highs.

Stellar Lumens (XLM) Technical Analysis Click here to see the full size Stellar Lumens Daily Chart by Trading ViewOn a weekly basis, XLM is the crypto’s top performer adding 52 percent. Even without looking at the chart, 52 percent week over week gains means there is a bullish break out somewhere.

In the daily chart, we can see that XLM bulls broke above 22 cents, triggering buys and hitting our first targets at 30 cents or June 2018 highs.

Now, the reaction we are seeing is normal and provides an opportunity for traders to load up anywhere between 22 cents and 25 cents. Ideal first target would be 50 cents with safe stops at 22 cents.

Bitcoin Cash (BCH) Technical Analysis Click here to see the full size Bitcoin Cash Daily Chart by Trading ViewThe supremacy war rages on but unfortunately, ordinary investors and guys who use BCH don’t care about details. All they want is to settle and move on with their lives.

If synergy existed between BTC and BCH developers then the better but at the moment, BCH is concentrating more on off chain solutions as colored coins and others. At the same time Bitmain is proposing smart contract capabilities, the Omni Layer Protocol concept like those in use by Tether but once they elaborate, we shall get a better understanding on their idea.

On the chart, it’s a stand still for Bulls and so far, BCH is yet to move above $850 resistance line. Nevertheless, buyers are definitely in charge even though BCH price action is confined within a $250 trade range with lower limits at $600.

In any case, we remain neutral and risk on traders better wait for break outs above $850 before loading up on dips with targets at $1,300. Remember, any drop below $600-in line with our previous analysis-would automatically usher in sellers.

DASH Technical Analysis Click here to see the full size DASH Daily Chart by Trading ViewCoins often have to prove that their network is scalable and the best way to demonstrate that is solid results. DASH carried out their stress test processing double Bitcoin transactions and the results were astounding: fees remained constant and performance didn’t dip. In other news, those willing to trade DASH can now open individual accounts at Evolve Markets.

$Dash Stress Test Processes Double Bitcoin’s On-Chain Transactions Without Issuehttps://t.co/Br1prkpckH#Blockchain #Cryptocurrency #FinTech #Technology #BTC #Bitcoin #Dash #Payments #Litecoin #LTC pic.twitter.com/sbM1DhzgFP

— Dash Force News (@DashForceNews) July 19, 2018

Today’s and tomorrow’s candlestick would either make or break our bullish stand. From previous DASH analysis, we stated that DASH is trading within a bear break out all thanks to June 10 bear candlestick dropping prices below $270.

For buyers to cancel that preview then we must see DASH prices closing above $270-previous support now resistance. Thereafter, we shall begin taking longs with every dip with targets at $330 and later $500.

Disclaimer: Views and opinions expressed are those of the author and aren’t investment advice. Trading of any form involves risk and so do your due diligence before making a trading decision.

origin »Bitcoin price in Telegram @btc_price_every_hour

Dash (DASH) íà Currencies.ru

|

|