2023-2-23 01:17 |

The biggest news in the cryptoverse for Feb. 22 saw EMURGO launch a social network for the Cardano community. Meanwhile, the FTC said that it is investigating Voyager Digital and objected to the company’s pending deal with Binance.US. Elsewhere, Sam Bankman-Fried could hire a tech expert to consult on his bail conditions.

CryptoSlate Top Stories EMURGO launches Cardano Spot social networkBlockchain company EMURGO has announced the beta launch of Cardano Spot – a social network for enthusiasts to discuss the ecosystem.

The Managing Director of EMURGO Media Sebastian Zilliacus said the closed beta was released at the end of 2022. Project development has since moved on to the open beta stage, taking into account community feedback, and is now ready for onboarding projects.

FTC objects to Binance.US-Voyager deal; reveals investigation into bankrupt firmThe US Federal Trade Commission (FTC) said it was investigating bankrupt lender Voyager Digital and its executives, according to a Feb. 22 court filing.

The FTC said it was investigating “certain acts and practices” of Voyager that constituted “deceptive and unfair marketing of cryptocurrency to the public.”

Due to this reason, the regulator has objected to Binance.US’ planned acquisition of Voyager’s asset, arguing that the sale could “interfere with causes of action by a governmental unit like the FTC.”

FTC argued that the proposed plan would “discharge” Voyager and its employees from claims linked to possible fraud.

SBF to hire tech expert to consult on trial after breaching bail conditions – private citizens urge arrestSam Bankman-Fried’s lawyers said Feb. 21 that the defense has acquiesced to the court’s request to hire an independent technical expert to consult on bail conditions and is currently looking for a suitable candidate, according to a court filing.

The move comes after the FTX founder breached his bail conditions by using encrypted messaging apps and a VPN during January and February. Prosecutors filed a written complaint on the matter, while the defense argued that VPN usage was benign.

Binance to burn $2B idle BUSD on Feb. 22Binance announced that it would burn $2 billion worth of idle Binance USD (BUSD) on BNB Chain “later today” on Feb. 22 at 12:07 UTC.

The same amount of BUSD held as a collateral on the Ethereum (ETH) chain will be released after the burn.

The BUSD marketcap recorded a 15% drop and saw its 14-month low at $13.7 billion on Feb. 17. Binance CEO Changpeng Zhao (CZ) noticed the drop and stated that the “landscape is shifting.”

Blur reveals additional 300M token airdrop to loyal usersNon-fungible token (NFT) marketplace Blur said it would distribute additional 300 million tokens to loyal users during the second season of its airdrop.

Blur previously airdropped 300 million tokens to its early users on Feb. 14.

The marketplace said the “Season 2” of its airdrop would incentivize loyalty amongst its users.

Immutable reportedly lays off 11% of staff after $56M lossThe Sydney Morning Herald reported that Australia’s crypto gaming firm, Immutable, will lay off 11% of its staff on Feb. 22.

Immutable’s CEO, James Ferguson, reportedly blamed the decision on the company’s need to maximize its reserves and prioritize essential projects.

Impacted workers would be offered an average of 10 weeks’ redundancy pay, the ability to keep more shares in the company, laptops, counseling, coaching, and outplacement services. The report added that impacted staff in the United States would have their company-provided healthcare extended.

BIS chief says past events ‘cast doubt’ on stablecoins’ ability to function as moneyThe general manager of the Bank for International Settlement, Agustin Carstens, said events in the past year “have cast serious doubts on the ability of stablecoins to function as money.”

In a Feb. 22 speech, the bank chief argued that what sustains fiat currency is not novel technologies but “the institutional arrangements and social conventions behind it.”

According to Carstens, stablecoins do not enjoy the credibility of sovereign fiat currencies, and the lack of regulatory clarity impacts them.

Deutsche Bank completes trial of Project DAMA tokenization platformDeutsche Bank and Memento Blockchain have completed a proof of concept tokenization platform called Project DAMA (Digital Asset Management Access), which aims to simplify launching and accessing digital funds.

The project will initially be tested in Singapore due to its crypto-friendly disposition, as well as its status as a globally leading hub for fund and asset managers. Additionally, the bank said the country is proactive approach to regulating new technology and financial services.

Esports org RRQ to embrace NFT membership for fans with Zilliqa partnershipIndonesian esports organization Rex Regum Qeon (RRQ) is partnering with Zilliqa to create an NFT membership program for fans, according to a Zilliqa statement.

The organization has had impressive results over multiple different games in the past years, with success in PUBG championships such as PUBG Mobile League, Dunia Games WIB, PUBG Mobile Star, and Fighting League.

Research Highlight The on-chain metric that could signal a bear market reversalRealized price is a metric often used to determine market movements in bear and bull markets. Defined as the value of all Bitcoins at the price they were bought divided by the number of circulating coins, realized price effectively shows the cost-basis of the network.

Dividing the network into cohorts can help us reflect the aggregate cost basis for each major group owning Bitcoin. Long-term holders (LTHs) and short-term holders (STHs) are the two primary cohorts driving the market — LTHs are all addresses that held BTC for longer than 155 days, while STHs are addresses that held onto BTC for less than 155 days.

The LTH-STH cost basis ratio is the ratio between the realized price for long-term and short-term holders. Given the historically different behaviors LTHs and STHs exhibit, the ratio between their realized prices can illustrate how the market dynamic is shifting.

For example, an uptrend in the LTH-STH cost basis ratio is seen when STHs realize more losses than LTHs. This shows that short-term holders are selling their BTC to LTHs, indicating a bear market accumulation phase led by LTHs.

A downtrend in the ratio shows that LTHs are spending their coins faster than STHs. This indicates a bull market distribution phase, where LTHs sell their BTC for profit, which STHs buy up.

An LTH-STH cost basis ratio higher than 1 indicates that the cost basis for LTHs is higher than the cost basis for STHs. This has historically correlated with late-stage bear market capitulations that turned into bull runs.

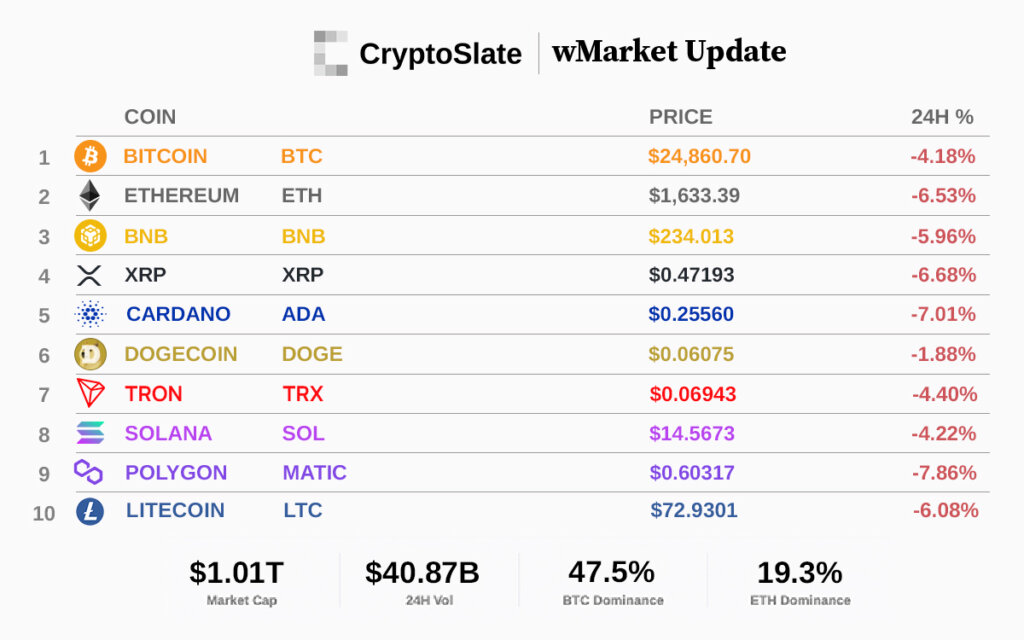

Crypto MarketIn the last 24 hours, Bitcoin (BTC) fell -1.96% to trade at $23,828.98, while Ethereum (ETH) was down -1.81% at $1,617.79.

Biggest Gainers (24h) FLOKI (FLOKI): 30.48% RSK Infrastructure Framework (RIF): 25.88% Synapse (SYN): 20.55% Biggest Losers (24h) BinaryX (BNX): -43.82% Conflux Network (CFX): -12.18% Flare (FLR): -11.97%The post CryptoSlate Wrapped Daily: Cardano social network enters beta; FTC investigates Voyager appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Santiment Network Token (SAN) íà Currencies.ru

|

|