2023-3-27 14:45 |

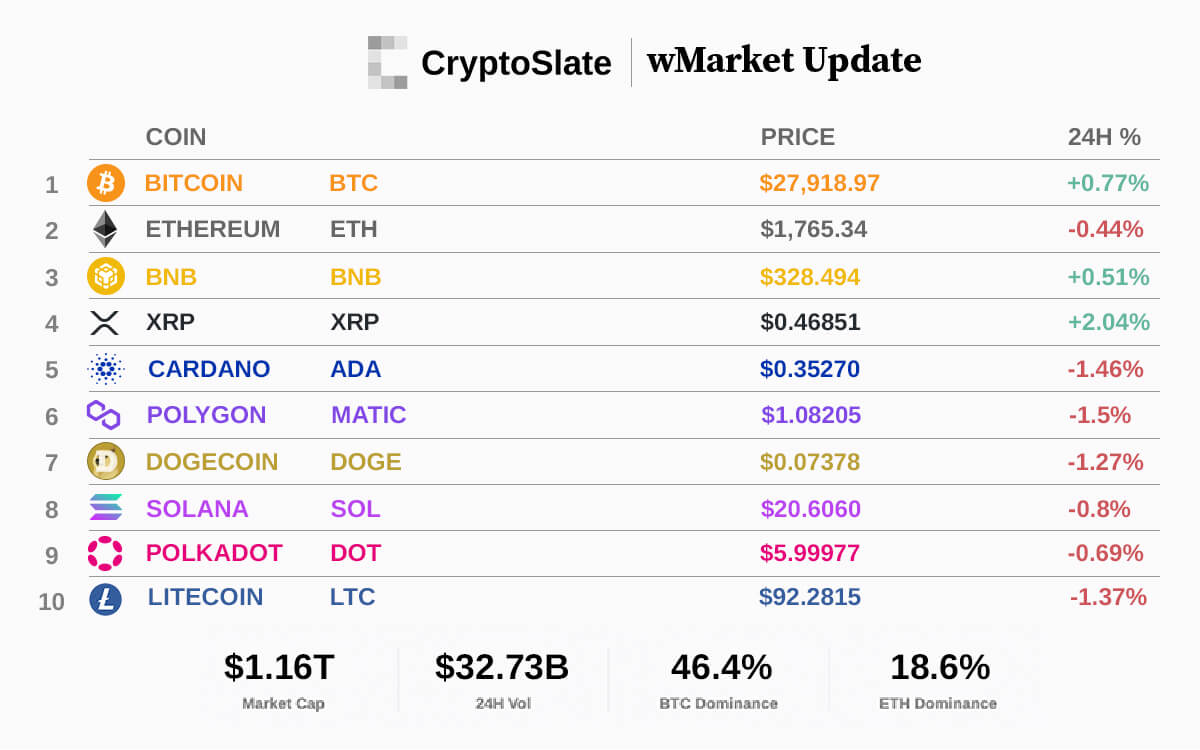

The cryptocurrency market cap saw net inflows of around $10 billion over the last 24 hours and currently stands at $1.16 trillion — up 0.16%.

During the reporting period, Bitcoin’s market cap increased by 0.88% to $540.81 billion — while Ethereum’s market cap decreased by 0.32% to $216.37 billion.

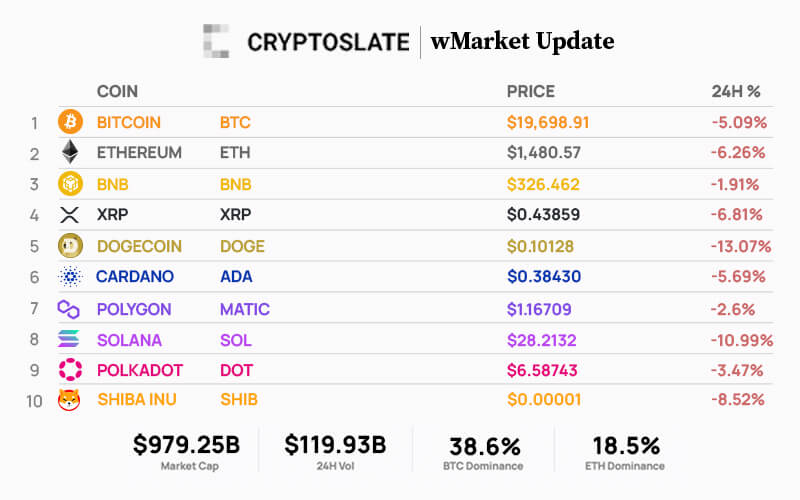

Except for Bitcoin, BNB, and XRP, other top 10 cryptocurrencies recorded losses during the reporting period. XRP saw the highest gain of 2.04%, while Polygon and Cardano posted the highest loss of 1.5% and 1.46%, respectively.

Source: CryptoSlateIn the last 24 hours, the market cap of Tether (USDT) increased to $79.04 billion. Meanwhile, the market caps of USD Coin (USDC) and Binance USD fell to $33.84 billion and $8.01 billion, respectively.

BitcoinIn the last 24 hours, Bitcoin increased by 0.77% to trade at $27,918 as of 07:00 ET. Its market dominance grew to 46.4% from 46.3%.

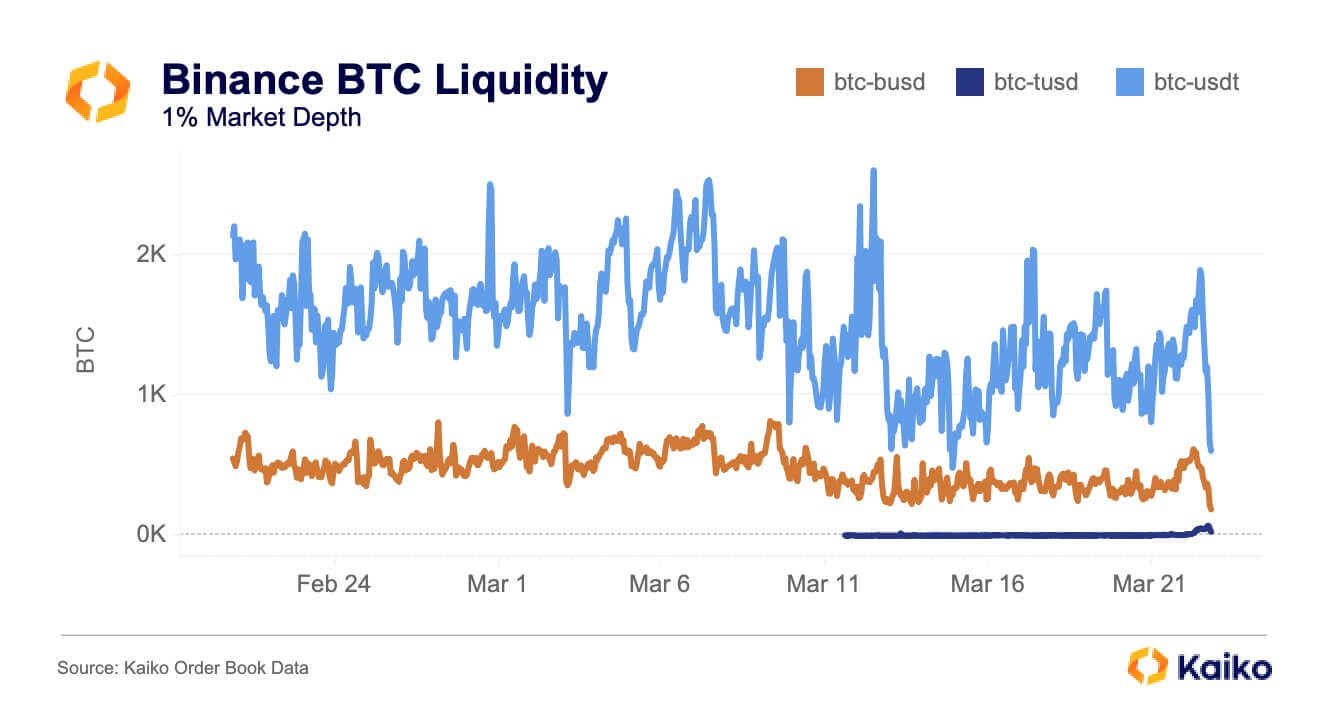

Over the weekend, BTC mostly traded above $27,000, peaking at $28,178 on March 26 before correcting to its current levels. The flagship digital asset has seen increased concerns being raised about its liquidity levels.

Source: Tradingview EthereumOver the last 24 hours, Ethereum fell 0.44% to trade at $1,765 as of 07:00 ET. Its market dominance fell to 18.6% from 18.7%.

During the reporting period, Ethereum topped out at $1,797 before trending down. With the Shanghai upgrade set to happen soon, investors have continued to ape into the digital asset.

Source: Tradingview Top 5 Gainers RadicleRAD is the day’s biggest gainer, rising 36.71% over the reporting period to $2.59 as of press time. The project is holding a vote to clarify the role of its foundation within the broader Radicle ecosystem. Its market cap stood at $126.83 million.

inSureSURE surged 22.55% to $0.00812 during the reporting period. The token is up 220% over the past month. Its market cap stood at $217.65 million.

JOEJOE is up 17.27% to $0.48082 as of press time. The token is up 90.8% over the past month. Its market cap stood at $161.77 million.

KaspaKAS gained 12.71% to trade at $0.01920 at the time of writing. Earlier today, the token reached a new all-time high of $0.01964. Its market cap stood at $336.86 million.

UMAUMA rose 9.61% to $2.22167. Its market cap stood at $153.18 million.

Top 5 Losers RSK Infrastructure FrameworkRIF is the day’s biggest loser, falling 11.3% to trade at $0.14219 at the time of writing. It was unclear why the token was experiencing a sell-off. Its market cap stood at $135.56 million.

GitcoinGTC declined 10.42% to $2.14454 over the reporting period. The project has been up 16% over the last seven days. Its market cap stood at $128.49 million.

MetisDAOMETIS fell 7.05% to $24.5154 at the time of press. Its market cap stood at $109.11 million.

HEXHEX decreased 6.29% to $0.08654. The project’s founder Richard Heart said the PulseChain could launch at any time without warning. Its market stood at $15.01 billion.

BeldexBDX plunged 6.04% to $0.05853. The token had risen by over 58% in the last 30 days. Its market cap stood at $235.24 million.

The post CryptoSlate wMarket Update: Bitcoin meets resistance at $28,000 as liquidity concerns rise appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|