2023-3-30 14:45 |

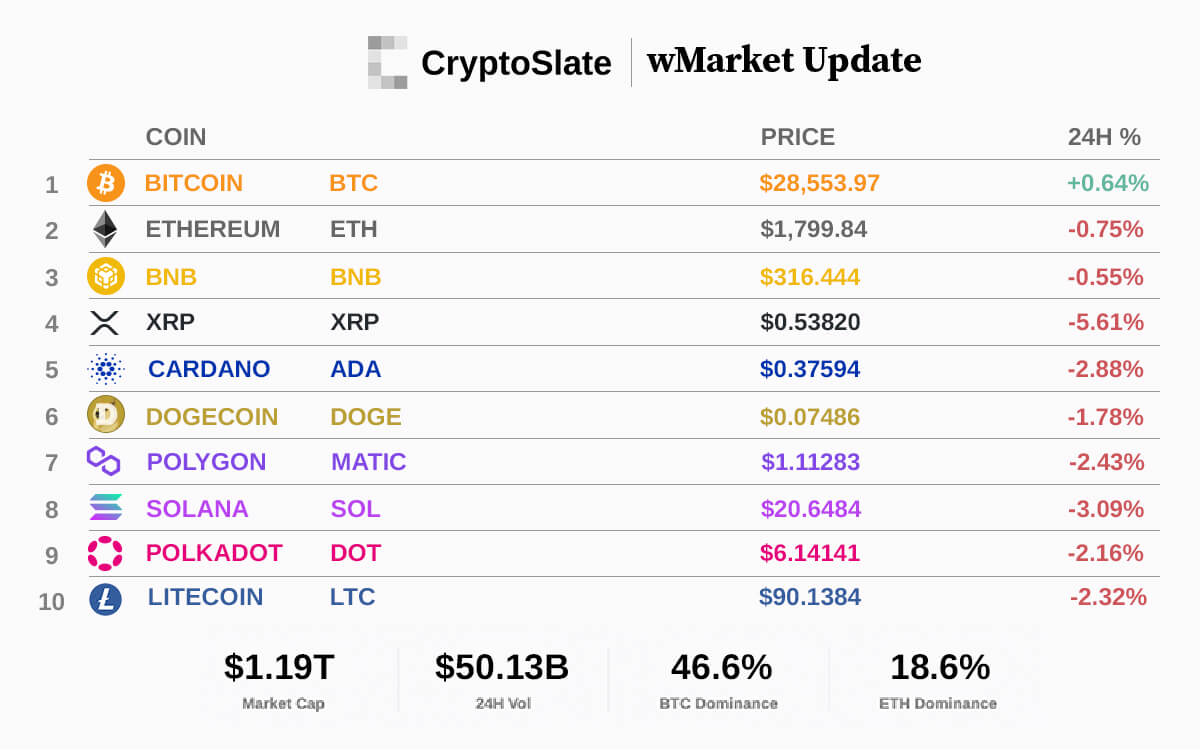

The cryptocurrency market cap saw net inflows of around $4 billion over the last 24 hours and currently stands at $1.19 trillion — up 0.12%.

During the reporting period, Bitcoin market cap increased by 1.06% to $552.87 billion, while Ethereum’s market cap fell by 0.26% to $220.59 billion.

All top 10 crypto assets performed poorly in the last 24 hours except for BTC. XRP and Solana posted the highest loss of 5.61% and 3.09%, respectively. Others like Polygon, Polkadot, and Litecoin lost over 2% each.

BNB and ETH posted minor losses of less than 1%, respectively.

Source: CryptoSlateIn the last 24 hours, the market cap of Tether (USDT) increased to $79.63 billion. Meanwhile, the market caps of USD Coin (USDC) and Binance USD fell to $33.25 billion and $7.66 billion, respectively.

BitcoinIn the last 24 hours, Bitcoin jumped by 0.64% to trade at $28,553 as of 07:00 ET. Its market dominance increased to 46.6% from 46.3%.

During the reporting period, BTC touched a new high for 2023, with its rally above $29,000 during early trading hours.

Meanwhile, CryptoSlate’s Insight reported that over $4 billion in notional BTC options would expire on March 31.

Source: Tradingview EthereumOver the last 24 hours, Ethereum declined 0.75% to trade at $1,799 as of 07:00 ET. Its market dominance dropped to 18.6% from 18.7%.

During the reporting period, ETH peaked at $1,827 and bottomed at $1776. Blockchain analytical firm Santiment reported that the ETH supply on exchanges has dropped to an all-time low of 10.31%.

Source: Tradingview Top 5 Gainers SolarSXP is the day’s biggest gainer, rising 46.28% over the reporting period to $0.47581 as of press time. The project has been up 49% over the last 30 days. Its market cap stood at $266.22 million.

1Inch1INCH surged 12.81% to $0.57528 during the reporting period. The project’s fusion mode now offers better rates in most cases and zero gas fees in some instances. Its market cap stood at $480.24 million.

TelcoinTEL gained 12.53% to trade at $0.00240 at the time of writing. The token is down 15% over the past month. Its market cap stood at $159.35 million.

DeroDERO is up 12.28% to $8.32294 as of press time. The privacy-focused project is rallying following the increased regulatory scrutiny on the U.S. banking system. Its market cap stood at $111.63 million.

GensoKishi MetaverseMV rose 9.58% to $0.15183. Over the past week, the metaverse-related token has increased by 45%. Its market cap stood at $259.53 million.

Top 5 Losers CoreCORE is the day’s biggest loser, falling 11.29% to trade at $1.73821 at the time of writing. The project has been experiencing a massive sell-off over the last 30 days, down 43.22%. Its market cap stood at $133.48 million.

renBTCRENBTC declined 10.63% to $30,604 over the reporting period. The project has been up 35% over the last 30 days. Its market cap stood at $109.56 million.

OMG NetworkOMG decreased 10.19% to $1.60578. It was unclear why the token was experiencing a sell-off. Its market stood at $225.2 million.

FlareFLR is on the top losers list for the second consecutive day. It is down 8.79% to $0.03759 as of press time. Its market cap stood at $451.04 million.

Mask NetworkMASK plunged 8.01% to $6.39216. The project has shed part of the 25% gains it made on March 29. Its market cap stood at $486.76 million.

The post CryptoSlate wMarket Update: Bitcoin $29,000 rally short-lived as top 10 assets plunge appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|