2024-11-11 00:30 |

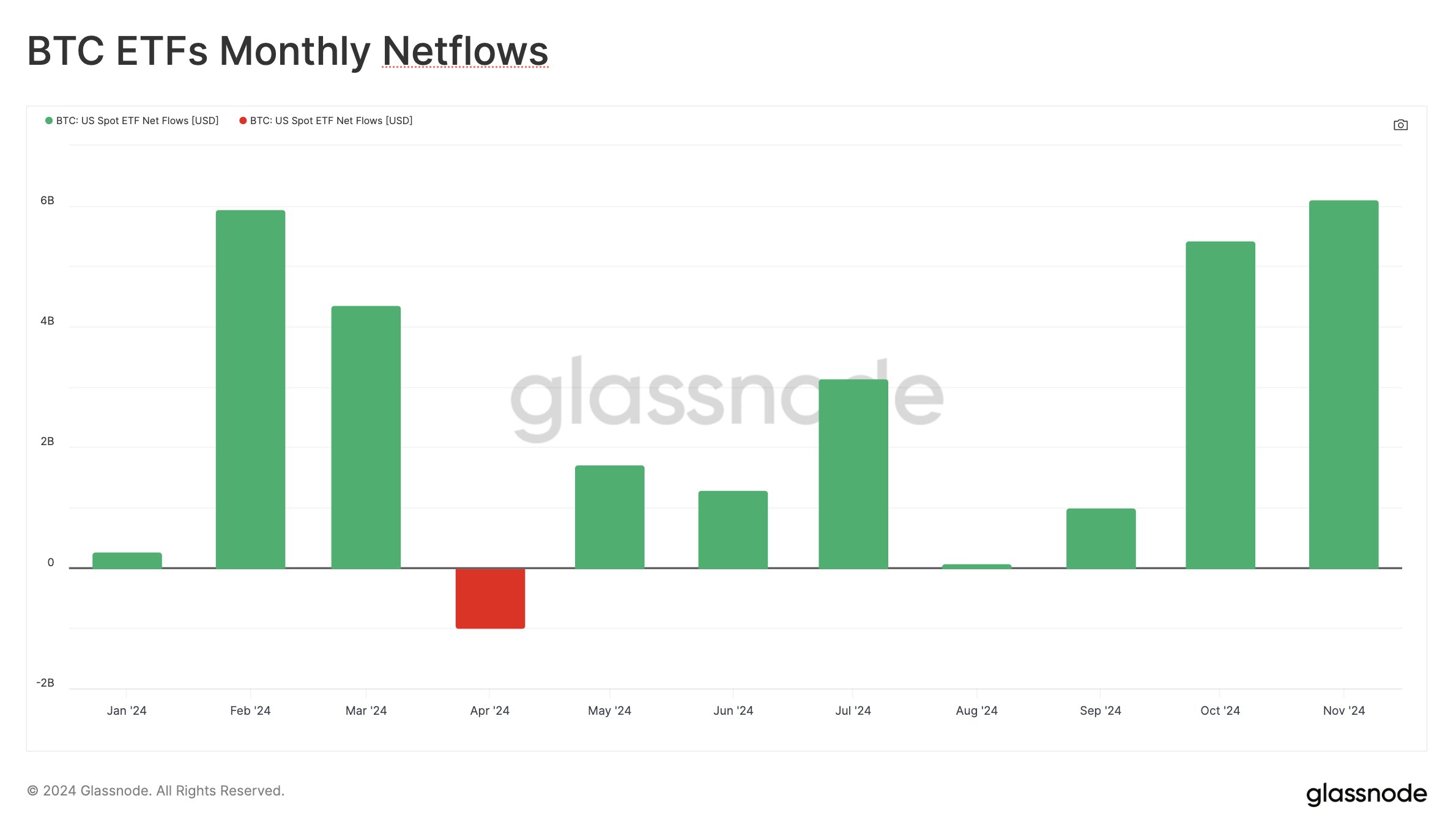

Bitcoin is currently rewriting its all-time high, thanks primarily to the results of the recently concluded US elections and increasing inflows into Bitcoin ETFs. Days before the election, Bitcoin struggled to hold the $70k level, briefly hitting $73k.

Immediately after the elections, Bitcoin unleashed another mini-run, hitting $77,262 and briefly topping $79k for the first time. With favorable market and political conditions, many traders and analysts are looking at more upside for Bitcoin.

But there are a few contrarian opinions in the market right now, saying that the asset is up for a correction. Ki Young Ju, CryptoQuant’s CEO, offers a shocking prediction for Bitcoin: the world’s top digital asset will trade below $60k by year-end.

Just one day left. For me, it’s $58,974. Hope I’m wrong. https://t.co/ALUa0nvlMT

— Ki Young Ju (@ki_young_ju) November 9, 2024

CEO Makes Shocking Bitcoin Price PredictionAccording to a Twitter/X post by Ki Young Ju, the market is up for some major disappointment. After Bitcoin hit $77k, he expects that there will be a trend reversal in the next few weeks, with Bitcoin ending the year at $58,897.

Ki Young Ju’s bold prediction contrasts with the growing chorus of analysts saying that Bitcoin’s continuous surge is expected until next year.

Still, Young Ju offered a disclaimer, saying he could be wrong. The CEO’s post on Bitcoin came when the asset traded at the $77k, briefly topping $79k.

Market Can Expect A 24% Drop In The Asset’s PriceYoung Ju’s Bitcoin price prediction represents a massive 24% price drop. Before making the prediction, he also asked his followers on Twitter/X to guess the possible Bitcoin price at year-end.

The post added that he’d give 0.01 BTC or roughly $7,600 at the current price to anyone who can offer the closest guess. However, only paid users of CryptoQuant can participate.

The CryptoQuant CEO’s post immediately garnered hundreds of posts and re-shares, with conflicting predictions for Bitcoin. The diversity in users’ answers is expected since predicting the asset’s price by year-end is often challenging.

Based on CoinGlass data, the top crypto notched reds in five months and red in the other five over the last decade. Bitcoin is traditionally volatile every year-end, and it’s often influenced by “the Santa Claus rally.”

Market Data And Results Of US Elections Currently Dictating Bitcoin’s PriceKi Young Ju’s prediction on social media has gained traction and received hundreds of replies. Although the CEO offered a contrarian opinion, many in the industry still look at the asset’s upside due to favorable market and macroeconomic conditions. Some analysts say that the results of the US elections and the recent Federal Reserve rate cut sparked Bitcoin’s rally.

Bitcoin’s current price action pushes many traders and investors to seek profitable opportunities. Some traders share Ki Young Ju’s sentiment and are bracing for a correction, while others are focused on the asset’s fundamentals. The CEO’s position only reflects the asset’s volatility and uncertainty, even in favorable market conditions.

Featured image from Midjourney, chart from TradingView

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|