2018-8-28 20:17 |

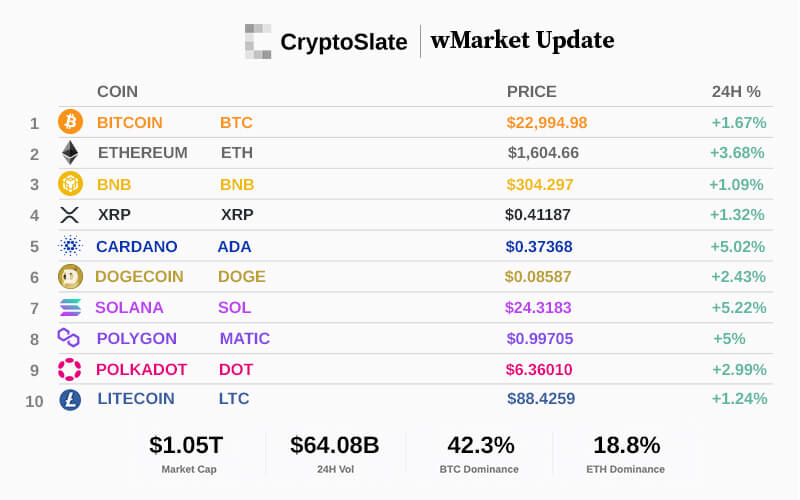

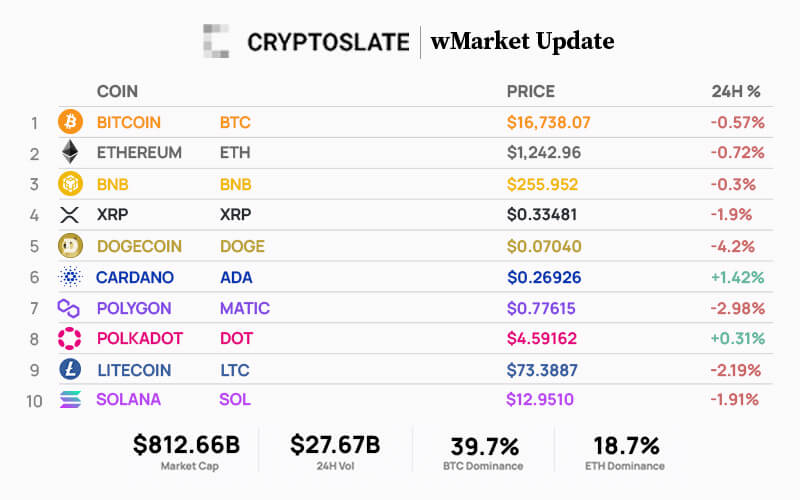

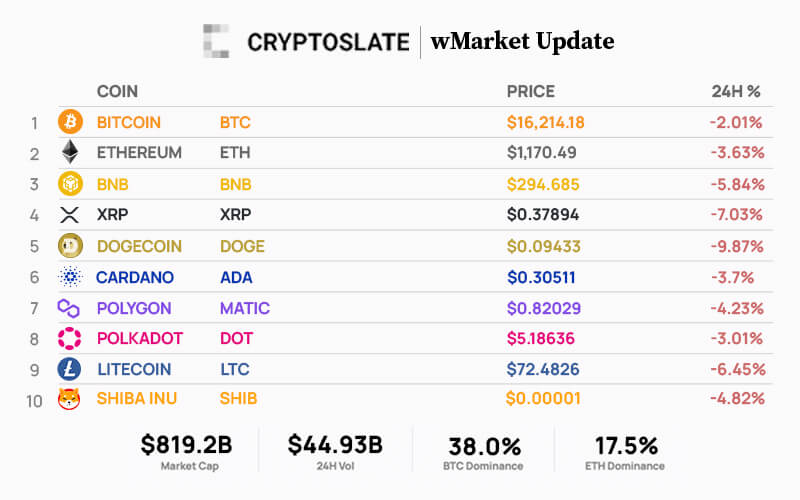

The virtual currency market is still trying to recover from the drop it experienced since the beginning of the year. Since January, the virtual currency market capitalization moved from $800 billion dollars to $200 billion. But, there are several possibilities ahead and significant events that would certainly have a deep impact in the direction of the market.

According to an important report, there are several big players in the crypto space that will be discussing about issues related to the regulation of Initial Coin Offerings (ICOs) in the United States.

Indeed, there are 32 different virtual currency companies that are going to be debating about future regulations in the space. The companies we are talking about are Ripple, Kraken, the CME Group, Coin Center, ICE, and Circle, among others.

Additionally, an important congressman favorable to virtual currencies and ICOs, Warren Davidson, has also been invited to talk.

Indeed, the congressman wants to be the leader of the ICO legislation in the country. For him, the lack of regulation is one of the main reasons why the United States has a risky and unsafe virtual currency market. Other experts agree on the diagnosis saying that the market needs regulations to protect consumers and investors and provide a clear environment for companies to expand.

The meeting will be taking place on September 25, 2018. During the event, different issues related to virtual currencies will be discussed. For example, how is the best way to protect investors? Which responsibilities should regulators take? How to allow companies to expand in a friendly environment?

Moreover, in September the U.S. Securities and Exchange Commission (SEC) will be given by the regulatory agency. At the beginning of August, the cryptocurrency market experienced a short dip due to the fact that the SEC decided to delay the approval of a Bitcoin ETF.

One of the things the SEC commented about the application was that the ETF was not in line with the Securities Exchange Act. Another reason to delay the ETF was due to reports that the price of Bitcoin was being manipulated.

Another report that was signed by Eduardo Aleman, revealed that the SEC scheduled for September 30 the final date to take a decision on the Bitcoin ETF proposal.

The report reads as follows:

“The Commission finds that it is appropriate to designate a longer period within which to take action on the proposed rule change so that it has sufficient time to consider the proposed rule change.”

September will be a very active and important month for virtual currencies. US regulators will decide about the future of the space and the SEC will be talking about the ETF presented by the Winklevoss twins. Is September going to be the month that will change the direction of the market?

origin »Bitcoin price in Telegram @btc_price_every_hour

Universal Currency (UNIT) на Currencies.ru

|

|