2020-7-7 14:10 |

After recording one of the best months yet in May, the cryptocurrency trading industry performed dismally in June. In a month where crypto prices gained some stability, the spot trading volume went down by over 50%. Crypto derivatives didn’t fare any better, setting a new low for monthly volumes in 2020.

A new report by analytics platform CryptoCompare revealed that the lower-tier exchanges had been more adversely affected than their top-tier counterparts. Lower-tier exchanges, which account for the majority of the spot trading volume, lost 53% of their volume month-on-month.

In what was a sub-optimal month for crypto trading, options volumes on CME defied the odds, shooting up by 41% to hit an all-time monthly high.

Spot Volumes PlummetJune saw Bitcoin’s price gain some stability, starting the month off at $9,460 and closing at $9,215. The stability failed to appeal to the traders and consequently, the spot trading volume took a huge hit.

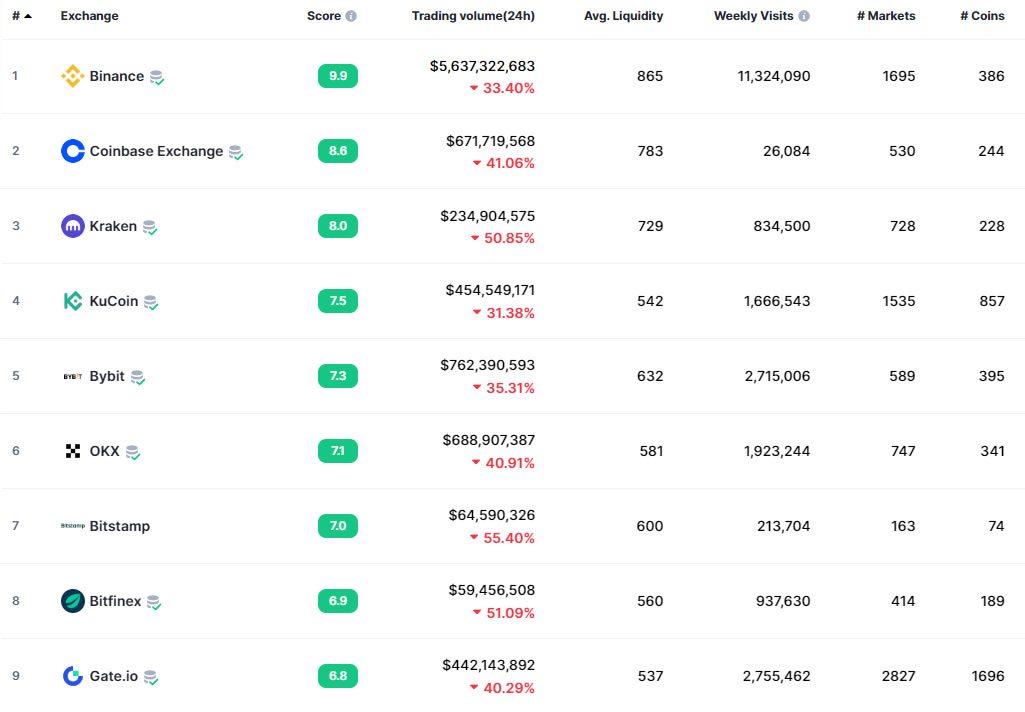

On top-tier exchanges, the trading volume dropped by 36% to $177 billion. These are exchanges that CryptoCompare rates highly based on their legal compliance, data provision, security, the team, market quality, and other such factors. itBit had the highest score at 77.5, with Gemini, Coinbase, Kraken, and Bitstamp rounding up the rest of the top five.

The highest recorded volume on top-tier exchanges was $9.26 billion on June 11.

Binance maintained its position as the largest top-tier exchange with $41.8 billion in trading volume. This was down 19.6% from May when it recorded $57.2 billion. OKEx was second, with the top-two maintaining a significant lead over the other top-tier exchanges.

The lower-tier exchanges were hit even harder, losing 53% of their trading volume month-on-month to facilitate $466 billion worth of trading volume.

Total Spot Volume – Lower Tier Vs. Top-Tier Exchanges Courtesy of CryptoCompareExchanges that rely on traditional taker fees took the lion’s share of the traded volume, accounting for 76% of the volume. Trans-fee mining exchanges accounted for less than 23% of the volume.

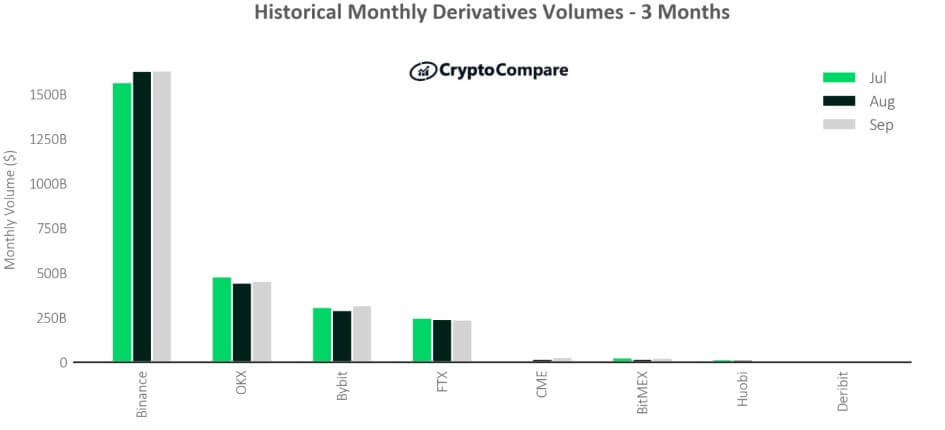

Crypto Derivatives Hit 2020 LowIt’s been a great year for crypto derivatives. As BeInCrypto previously reported, derivatives volume shot up to record their best month ever in May. A previous report by TokenInsight had also revealed that the sector was recording over $20 billion in daily trading volumes.

However, in June, the sector came crashing down. Derivatives volumes dropped off by 35.7% in June to $393 billion, the latest report reveals. This is the lowest monthly volume so far in 2020.

All derivatives trading platforms recorded a drop in trading volume, with BitMEX recording the largest decline. The exchange, which is one of the biggest players in this sector, recorded a 50.3% drop to trade $51.6 billion.

Huobi was down 38.3% to trade $122.4 billion, but it managed to hold on to its position as the largest crypto derivatives platform. OKEx and Binance were the other big players in the market, trading $106.9 billion and $85.9 billion respectively.

For Binance, the drop in trading volume wasn’t the only blow to its derivatives platform. The Brazilian securities regulator ordered the company to cease offering its derivatives products in the South American country. In an order published on Monday, the regulator claimed that Binance doesn’t hold the license to act as a securities intermediary. Failure to abide by the order will attract a daily fee of 1,000 Brazilian reals ($188).

Despite hitting its yearly low, the derivatives market increased its share of the crypto market. With the spot market dropping by 49.3%, derivatives accounted for 37% of the crypto market in June, up from 32% the previous month.

Monthly Spot Vs. Derivatives Volumes Chart Courtesy of CryptoCompareIn more good news for the derivatives industry, European regulators recently approved the first derivatives platform in the region. Crypto Facilities, owned by Kraken, received the license from the U.K’s Financial Conduct Authority, allowing it to target institutional investors.

CME Shows PromiseInstitutional interest in crypto has continued, with the growth of Bitcoin products at the CME being the biggest indicator. In June, total options volumes at the CME hit an all-time monthly high at 8,444 contracts traded. This was up 41% from the May figure where 5,986 options contracts were traded. The highest daily volume stood at 1,061 contracts traded on June 19.

Futures volumes at the CME didn’t fare as well, however. June saw 128,258 contracts traded, 23% below the May figure.

Overall, the trading volume at the CME also dropped by 16.6%. However, this was the lowest drop in the derivatives sector.

The post Crypto Trading Volume Plummeted in June as Prices Stabilized appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Open Trading Network (OTN) на Currencies.ru

|

|