2018-11-14 22:42 |

The dreaded Bitcoin Cash (BCH) fork is upon us. However, some Asian investors seem to be certain that the upcoming fork will be good for them and betting that the sum of the parts will benefit them. Because of this, they are buying a lot of BCH now.

This Thursday, November 15, the fork will happen. If you have one BCH, you will have two different “Bitcoin Cash” tokens afterwards, ABC and Satoshi Vision (SV). The gamble from these investor is that they believe that the two tokens together will be more expensive than what BCH is now.

James Quinn, the head of markets at Kenetic Capital, spoke to Coindesk about the phenomenon. According to the expert, many people are using this new opportunity to make some money and even some institutions are seeing this as a great chance to profit. He says that while hard forks are unique to cryptos and are still very new, some more traditional investors are interested.

They can use their knowledge about how the market works to focus on understanding how this new world also works and getting a good profit with it. According to him, there are many similarities between this process and something that these investors are more accustomed to like special dividends and stock splits.

As a result from all of this, he affirms that Kenetic, which is based in Hong Kong, is seeing a high increase in the buy of BCH assets which are selling like crazy.

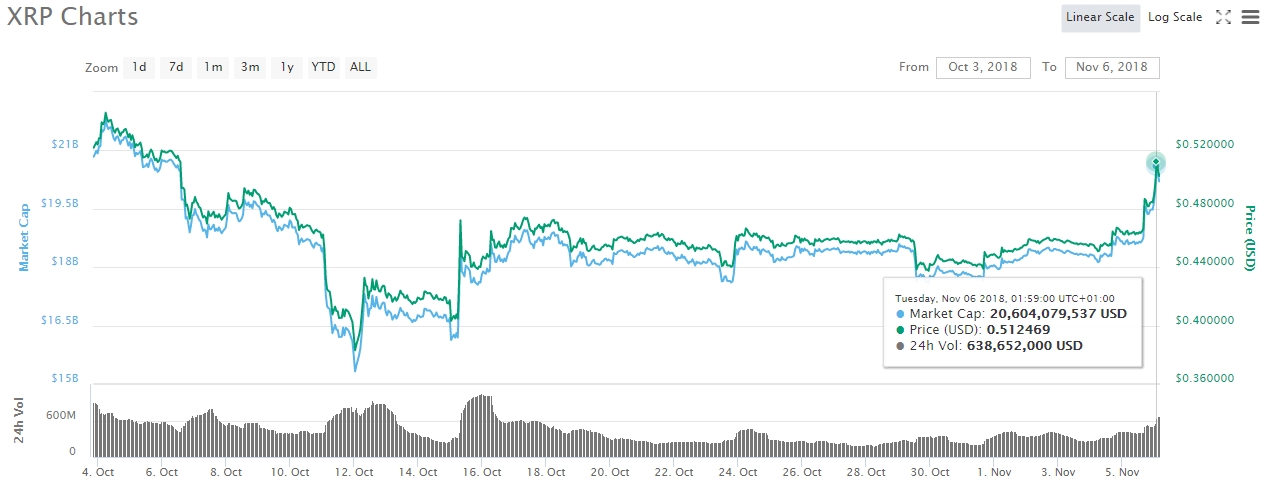

Data from CoinMarketCap shows that the trade volume of BCH is increasingly going up since early November. In November 4, for instance, it was about $1.4 billion USD daily while it was only $228 million USD in November.

While the sales have somewhat declined at the time of this report, they are still considerably higher than they were in October, which proves that the trend is, indeed, very real.

While many exchanges did not publish any specific data about the sale of BCH tokens, OKEx has affirmed that the trading of BCH went up tenfold and that traders are largely very excited about the fork and the possibility to make money with it.

Another aspect that can be seen is that people are not scared of the fork. Institutional investors, which tend to be more wary of risky investments, are in for the trade, which means that they believe that Bitcoin Cash will survive in the future and that one (or both) of the tokens will get out of the fork stronger.

A representative from Huobi has also tried to explain the situation. He affirmed to Coindesk that “it’s about getting free candies”. People are happy because they will double their assets. There is some risk involved because they are not sure whether the prices will go down, but they are betting that they will not.

The First Real Hard ForkWhen you look at the recent past of Bitcoin Cash (which was created via a hard fork from the original Bitcoin Core in August 2017), the company is having a hard fork roughly each six months. However, the previous one was very uneventful while this one has the potential to basically rip the whole BCH community apart and create a new set of problems for the investors.

The main issue now is that the two sides are actually very powerful. In one side, we have Bitcoin ABC, which will keep the structure of the block size at 32 MB and the other initiative, called Satoshi Vision (SV), is being led by Craig Wright, a very polarizing figure that has already claimed that he is Satoshi Nakamoto, for instance, and plan to increase block size up to 128 MB.

ABC is backed by Bitmain while Bitcoin SV is largely backed by nChain and CoinGeek. While it looks like ABC will be more popular and Wright has been making very weird declarations lately (like saying he is Satoshi) that are not helping him, it would be foolish to discard Bitcoin SV so soon.

There Are Very Real RisksDespite how hyped the market seems to be about the upcoming fork, there are some clear risks involved in trading BCH now and buying a lot of it. Quinn has affirmed that there is the chance that some big investors are just enjoying the market now and that they will pull out before the fork.

Less cautious investors might wait too much and end up losing money because they are hyped. It’s just like a pump and dump scheme of sorts. Because there is going to be an event, you pump the asset until it gets very high and then some smart investors just sell off their assets while their price is still at the peak.

Some institutional investors might be wanting to surf on this rise and will not actually invest until the fork happens, which might even affect the price of the tokens soon after the fork. It’s hard to know before it happens, though.

When Bitcoin Cash detached from Bitcoin Core, investors also made a bet, but it is important to remember that times were different back then and that the bear market is on now.

People investing in these assets now need to know that they are facing real risks and that things might not be so great as they were back then.

origin »Bitcoin price in Telegram @btc_price_every_hour

Cashcoin (CASH) на Currencies.ru

|

|