2026-2-3 16:37 |

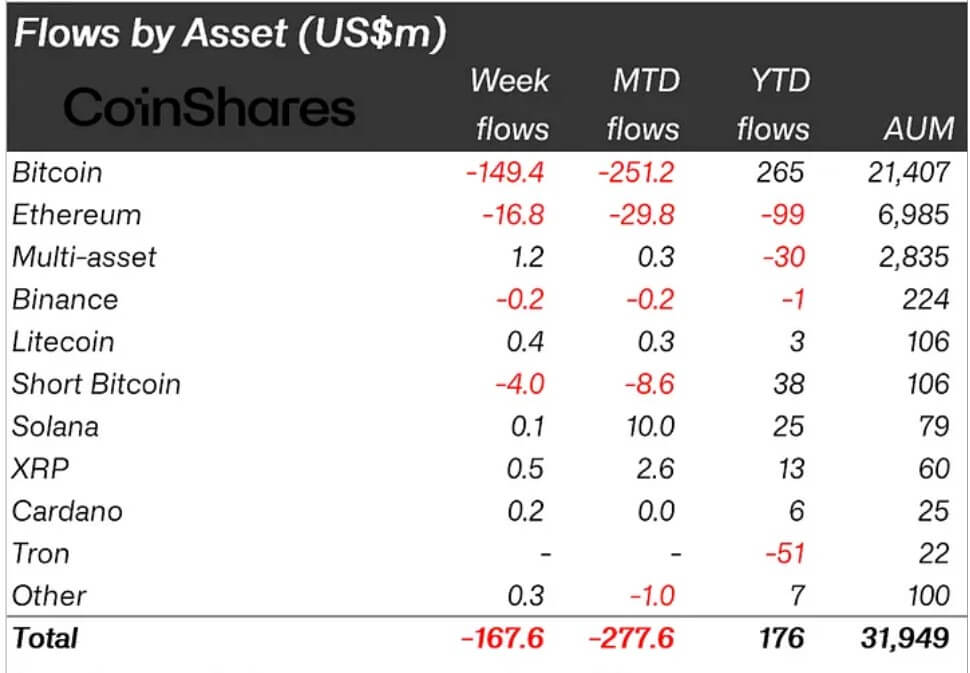

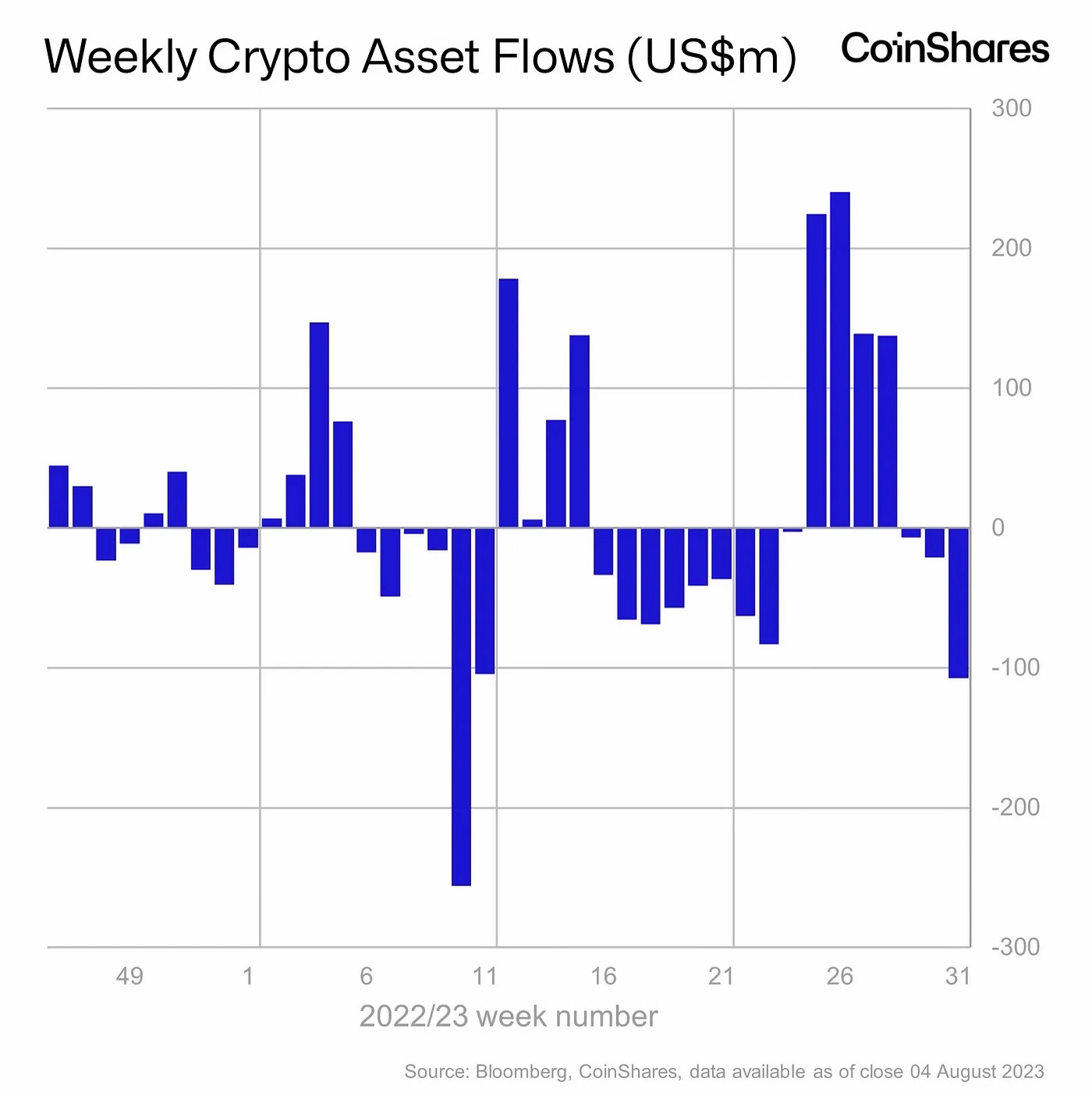

Crypto investment products recorded another heavy week of outflows, according to CoinShares’ latest weekly report dated Feb. 2. These funds recorded $1.7 billion in withdrawals last week and pushed year to date net outflows to $1 billion.

CoinShares revealed that assets under management (AUM) for crypto investment products have dropped by $73 billion from their peak in October 2025.

Outflows were mostly concentrated in the United States, which accounted for $1.65 billion of the total. Most major asset classes posted negative flows during the week, led by Bitcoin products.

Bitcoin ETFs see Major WithdrawalsCoinShares data shows Bitcoin BTC $78 537 24h volatility: 2.3% Market cap: $1.57 T Vol. 24h: $84.39 B investment vehicles recorded $1.32 billion in outflows last week. During this time, US-based spot Bitcoin ETFs were the primary source of selling, with $1.48 billion in outflows.

At the time of writing, Bitcoin is trading below the average cost basis of US spot Bitcoin ETFs. Data shows that US Bitcoin ETF products hold around 1.28 million BTC with a total AUM of about $113 billion.

This implies an average buying price of $87,830 per Bitcoin. BTC prices have moved well below that level following a recent sharp selloff.

Altcoins Weaken as Macro Pressure BuildsThe broader digital asset market also declined as the total crypto market cap shrank by $400 billion over the past week.

Ethereum ETH $2 337 24h volatility: 3.5% Market cap: $282.23 B Vol. 24h: $49.92 B products faced $308 million in outflows last week, according to CoinShares. Assets that had attracted strong interest earlier in the cycle, including XRP XRP $1.62 24h volatility: 1.9% Market cap: $98.48 B Vol. 24h: $4.91 B and Solana SOL $104.3 24h volatility: 3.5% Market cap: $59.11 B Vol. 24h: $7.81 B , also faced struggles. XRP products saw $43.7 million in outflows, while Solana products lost $31.7 million.

One area that recorded inflows against the broader trend was short Bitcoin products with $14.5 million in inflows. Their AUM is up 8.1% year to date amid rising demand for downside exposure.

Meanwhile, the Crypto Fear and Greed Index dropped into extreme fear as the new week started.

Raoul Pal, founder and CEO of Global Macro Investor, recently argued that the ongoing selloff is due to a shortage of US liquidity rather than a structural market issue.

https://t.co/M5mLAi3XLA

— Raoul Pal (@RaoulGMI) February 1, 2026

Pal pointed to temporary liquidity drains related to two government shutdowns and ongoing problems in US funding markets.

Some market participants now expect fewer and slower interest rate cuts under new Fed chair Kevin Warsh, given his firm stance on inflation and quantitative easing.

nextThe post Crypto Products Recorded Net Outflow of $1.7B Last Week appeared first on Coinspeaker.

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|