2022-8-17 19:30 |

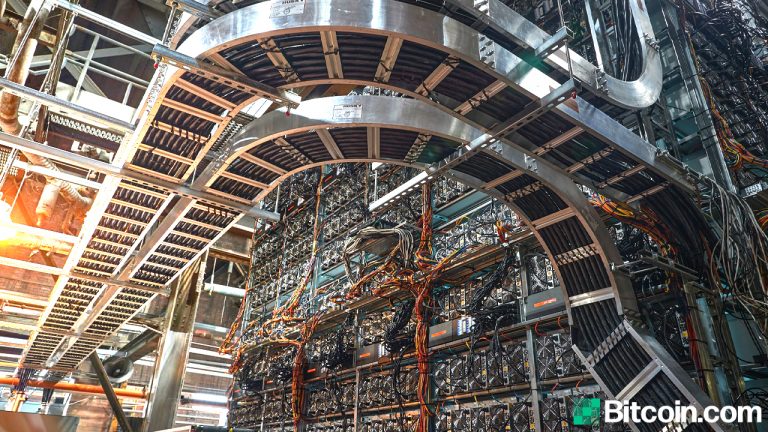

A series of impairment charges contributed to a $1 billion second quarter loss for the largest publicly-traded Bitcoin mining companies in the United States.

In the three months ending June 30, Core Scientific, Riot Blockchain, Marathon Digital Holdings, booked net losses of $862 million,$366 million, and $192 million, respectively, according to recent quarterly earnings reports.

The 60% drop in the price of Bitcoin over the past quarter also compelled other significant miners, such as Bitfarms and Greenidge Generation Holdings, to write down the value of their holdings.

The downturn has forced miners to pivot from hoarding their mined Bitcoin to selling significant portions to cover operational costs and repay ballooning debt.

Mining firms dump holdingsFor instance, Bitfarms sold nearly half of its Bitcoin holdings to pay down $100 million in debt last month, while Core Scientific parted with nearly 80% of its coins to cover operational costs and further fund expansion.

“Public miners are still dumping their Bitcoin holdings at a higher rate than their production rate,” said Arcane Crypto analyst Jaran Mellerud. “Public miners sold 6,200 coins in July, making July the second-highest BTC selling month in 2022.”

According to Mellerud, the top public miners unloaded 14,600 coins in June against a production margin of 3,900.

Forestalling foreclosureIn addition to selling off the fruit of their labors, miners have also had to sell other capital and raise more debt in order to remain solvent. For example, Marathon was able to secure another $100 million loan with Silvergate Capital Corp, while refinancing an existing $100 million line of credit in July.

Meanwhile, Core Scientific arranged a $100 million common stock purchase agreement with B. Riley Principal Capital II.

In order to eliminate over half its debt, while adding some liquidity, Stronghold Digital Mining made an arrangement with lender New York Digital Investment Group and WhiteHawk Capital.

All of Stronghold’s $67.4 million outstanding debt from an original agreement was eliminated with the return of around 26,200 Bitcoin mining machines to NYDIG.

Commitment from WhiteHawk to restructure and expand its current equipment financing agreements should also reduce near-term payments, and introduce an additional $20 million of borrowing capacity.

The post Crypto Mining Companies Sell off Coins and Gear to Recoup Losses appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Speed Mining Service (SMS) на Currencies.ru

|

|