2023-3-3 16:14 |

Coinspeaker

Crypto Market Tanks amid Worries of Silvergate Bank’s Insolvency

Four months after the collapse of the crypto exchange FTX, yet another crisis-like situation has gripped the crypto market with fear and unrest amid the developments around Silvergate Capital (NYSE: SI). Earlier today, the broader cryptocurrency market shredded more than 4.5% eroding over $60 billion of investors’ wealth.

In the last 24 hours, the world’s largest cryptocurrency Bitcoin is down by 4.54% and is trading at the $22,358 level with a market cap of $431 billion. With today’s price correction, Bitcoin has touched a new two-week low.

Along with Bitcoin, altcoins too started bleeding in a somewhat similar magnitude. Bitcoin competitor Ethereum (ETH) has corrected by 4.76% and is currently trading at a price of $1,565 and a market cap of $191 billion.

Similarly, other altcoins have tanked anywhere between 5-10% in this recent market correction triggered by the news around Silvergate Bank. A day before, the crypto-focused bank announced that it would be delaying its filing with the US SEC as it faces a crisis of confidence in the market.

Silvergate Bank said that they were suffering major operational challenges after the collapse of FTX. The bank faced heavy withdrawals from its crypto customers over the last few months. As a result, the bank has been selling securities in large numbers to meet these obligations.

On Thursday, March 2, the stock price of Silvergate Capital (NYSE: SI) tanked a massive 57% with JPMorgan downgrading it to “underweight” from “neutral”. Many in the crypto space are skeptical about the bank’s future and worried about its survival.

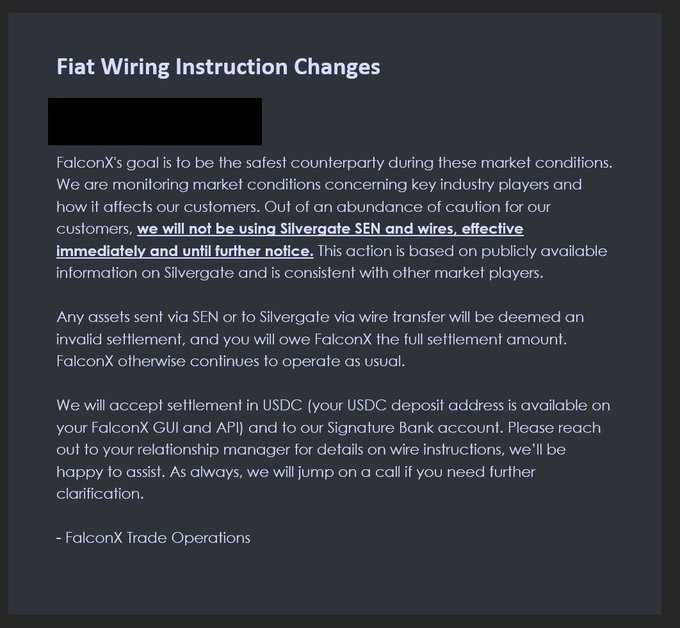

Some crypto partners like Coinbase have also abandoned Silvergate Bank and moved their work to its rival Signature Bank.

Crypto Investors Boost Stablecoin Reserves amid Silvergate CrisisAs the crypto market faces jitters around the Silvergate news, investors are shoring up the holdings of their stablecoins. During the early morning hours of Friday, the two most popular stablecoins USDT and USDC saw an uptick in their activity.

As per the pricing data from CoinGecko, the 24-hour trading volume for USDT earlier on March 3 was $43.2 billion, against $39.9 billion on the previous day. Similarly, the USDC volumes also jumped to $4 billion from $3.4 billion previously.

Markus Thielen, head of research at Matrixport told Bloomberg:

“We have seen an increase in stablecoin activity as a sign that crypto firms are using crypto rails to move money around”.

The data from CryptoQuant shows that stablecoin reserves on the exchanges have also been increasing, Earlier on March 3, reserves of stablecoins jumped by 120 million tokens.

nextCrypto Market Tanks amid Worries of Silvergate Bank’s Insolvency

origin »Bitcoin price in Telegram @btc_price_every_hour

Market.space (MASP) на Currencies.ru

|

|