2020-10-26 15:16 |

Since surging last week to hit $13,000, Bitcoin has been keeping around this level.

More importantly, over the weekend, Bitcoin made its first close above $13,000 since the end of the last bull market.

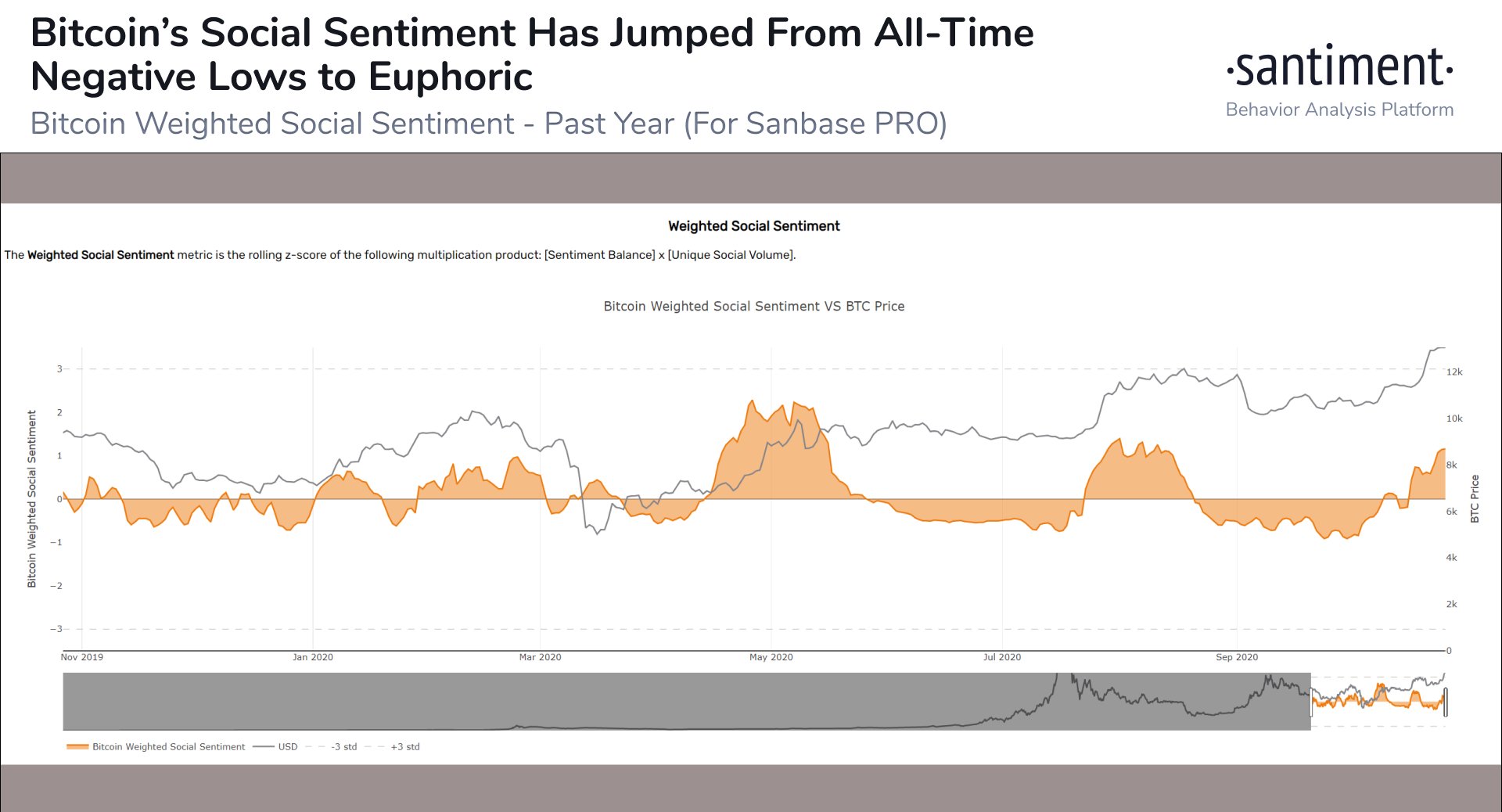

And with this recent rally, the social sentiment of Crypto Twitter has done “one of the biggest 180 turns in its decade-long history,” as per Santiment. From its all-time negative levels earlier this month, the ratio of positive vs. negative commentary has now “shifted to borderline euphoric levels.”

Source: SantimentThe crypto fear and greed index is also showcasing “greed” sentiments, having a reading of 75, up from 45 last month reflecting “fear”.

“We're in a bull market”Adding to all the bullishness in the market is exchanges’ BTC balance which has been on a continuous decline since March, even whales aren’t selling which says the macro view of the leading digital asset remains bullish.

“Exchange netflow is mostly in the negative region since October 2019. Netflow was mostly positive in 2018 (and especially high during the 3k capitulation) when people were actively selling their coins. We're in a different paradigm now that the BTC have exchanged hands,” said trader Crypto Squeeze.

Moreover, about 136k BTC are currently locked on Ethereum through WBTC and RenBTC, further putting pressure on bitcoin’s sell-side liquidity crisis.

“We're in a bull market. Trade if you must but make sure you HODL your precious BTC.”

If you were not here during 2013 or 2017 bull markets: current #bitcoin price rise is just a small taste of what's next (weekly RSI in 70-90 range). We haven't even started! pic.twitter.com/8YxjkQr6CE

— PlanB (@100trillionUSD) October 25, 2020

“Institutions are net record long”While the PayPal news last week helped push Bitcoin’s price higher, adding about $19 billion to its market cap over the following two days, it is mostly seen as helpful for sentiment, PR, and making PayPal look progressive.

Still, institutional interest is rising, for one, the latest CME Bitcoin futures COT report shows leveraged funds are net record short and institutions are net record long. Just this month, the open interest on CME Bitcoin futures has increased by 127%.

“With market rallying, basis trades are increasingly attractive for hedge funds, currently yielding 10%+,” noted Skew.

So Much Better, Still More to ComeAs we reported, Grayscale raised a record $1 billion for its investment products in the third quarter. Since December 2017, Grayscale Bitcoin Trust (GBTC) has attracted more than $2.8 billion, $2 billion of it has been in 2020 alone.

According to Bloomberg, this is better than “about 97% of exchange-traded funds currently listed in the U.S.” However, analyst Ceteris Paribus noted that “Big factor here is that ETF's allow outflows, GBTC does not.”

Meanwhile, Fidelity is receiving interest from “a wide range of institutional investors, including family offices, RIAs, hedge funds, pensions, foundations, and other institutional investors.”

And with the chances of the approval of a Bitcoin ETF next year high, more institutions would start paying attention to the market

Bitcoin (BTC) Live Price 1 BTC/USD =12,841.7319 change ~ -1.26Coin Market Cap

237.92 Billion24 Hour Volume

27.12 Billion24 Hour Change

-1.26 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD");The post Crypto Market Sentiments Do A 180; From Fear to 'Borderline Euphoric' Following Bitcoin Rally first appeared on BitcoinExchangeGuide.

origin »Bitcoin (BTC) íà Currencies.ru

|

|